Table of Contents

ToggleAarti Drugs shares, an API manufacturing company by its base, which was incorporated in 1984. Recently announced an impressive bonus for their shareholders. The company was trading at Rs. 500 per share before the market crash happened this March 2020.

The company share price has increased robustly to Rs. 2951 currently trading. It has given a return of 600% in just 6 months. It is a small-cap company with a Market Capitalization of Rs. 8679 Cr.

The bonus offered is 3:1, the company provides 3 shares of bonus for every 1 share the investor has before the record date of 1st October 2020. Anyhow, the invested amount for the investors remains the same, the only thing is they will be having 4 shares in place of 1 share.

Many investors and traders find this deal a superficial one. You must have an analysis of the company’s business growth, financial performance, and fundamental analysis.

Let us take you all through the complete fundamentals of the company from the investor’s view.

Aarti Drugs Shares – Business Overview:

The company has reached a trademark of $ 1000 Million through its prime manufacturing of

- Active Pharmaceutical Ingredients.

- Pharma Intermediates.

- Specialty Chemicals.

- Formulations.

The formulation is majorly carried out by their subsidiaries like,

- Pinnacle Life Science Pvt Ltd.

- Suyash Laboratories Ltd.

- Pinnacle Chile SpA.

The company has landed an Rs. 1500 Cr turnover in the year 2019. The major revenue share comes from Active Pharmaceutical Ingredients (API) like

- Metformin – One of the largest producers in the world.

- Fluoroquinolones – One of the largest producers in the world.

- Tinidazole – The largest producer in the world.

- Metronidazole – The largest producer in the world and India.

- Ketoconazole – The largest producer in the world.

- Nimesulide – The largest producer in the world.

The company is completely focused on being the first choice of bulk drugs for vendors across the global market.

The second-largest revenue is scattered by specialty chemicals such as

- Benzene Sulphonyl Chloride.

- Methyl Nicotinate

With these leading product baskets, the company has routed businesses from various parts of global.

- Latin America – 18%

- Europe – 13%

- Africa – 11%

- America – 7%

- Asia – 51%

Key Aspects of Aarti Drugs Shares LTD:

- 12 Manufacturing Sites

- Exporting across more than 100 countries

- More than 34% of revenue is generated from Exports.

- 3,588 Mega Ton monthly capacity in production.

- 34,071 Sq.mt of API plant area.

- More than 50 API molecules have a huge demand across global.

- More than 80 finished products are produced by the company.

- The company is currently with 1536 Employees.

- Have an R&D setup and completely focus on the future development of market needs in API and specialty chemicals.

Business Opportunity as a Pharmaceutical Company:

- America still is focused on the growth of the pharmaceutical industry. Projected to have a global market share of 45.33% by 2033.

- The share of revenue is just 7% in America. So, Aarti Drug has a huge potential in the manufacturing of APIs for American companies. The revenue will increase as a share of voice increases in the American market.

- India the pharmaceutical market is expected to be $100 Billion by 2025. Which, the export business estimates a growth of 9.8% CAGR.

- India is the largest supplier of generic drugs. India supplies more than 50% of the world’s demand for Vaccines.

- 40% of USA supplies and 25% of UK supplies depend on India.

- Since the company has huge manufacturing in API it will be useful for many vaccine productions. It has a huge share of the growth.

- In the current situation, the API and specialty chemical companies in India have a huge demand in manufacturing.

Aarti Drugs – Financial Performance:

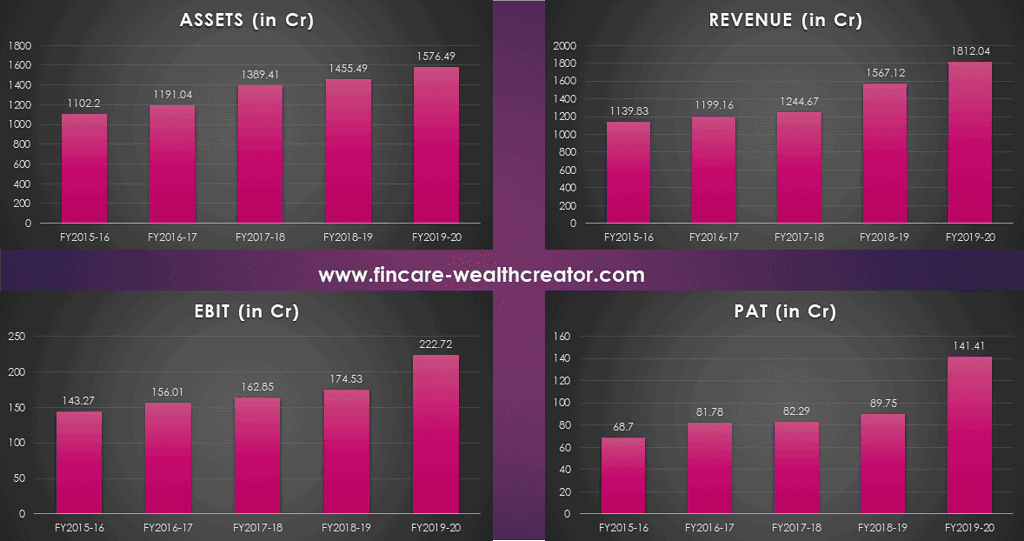

The above image has made it clear, that the company is growing year on year in its revenue and profit.

Revenue is growing at a CAGR of 12.33% in the last 5 years. This is higher than the industry average of 6.62%

Assets have an impressive growth year on year on a CAGR of 9.36% in the last 5 years from Rs. 1102 Cr to Rs. 1576 Cr.

EBIT has a strong growth of CAGR of 18.09% in the last 5 years. When the market is growing at a rate of 9.8%

PAT is growing at a CAGR of 19.78% in the last 5 years. This is higher than the industry average of 2.76%.

The ROE (Return On Equity) is increasing year on year with 23.69% in FY2019-20, which was 17.97% in FY2018-19.

The ROCE (Return Of Capital Employed) has grown at 20.6% in FY2019-20 vs 16.66% in FY2018-19.

The company has marked a strong growth in the market share in the last 5 years, from 0.68% to 0.82%. Anyhow, the market share is less than 1%, and the market demography and dynamics will make the share to be increasing.

As a financial performance, the company is growing at a decent phase. When the revenue has grown by 15.64% over the last year, the share price has grown by 600%. Even if you assume will grow at the rate of 30% from next year, the price climb is 20 times higher than the expected growth.

Fundamental Analysis – Aarti Drugs Shares:

Total Shares: 2.33 Shares

Market Capital: Rs. 6879 Cr.

Face Value: Rs. 10 per share.

Book Value: Rs. 280.44 Cr.

Price to Book value (P/B): 10.54

Earnings per Share (TTM): 87.72

5-year EPS Growth: 13.73%.

Price to Earnings (P/E): 33.64 (Very High)

Industry P/E: 36.74

Interest Coverage Ratio: 6.2 (increased 4.4% than last year)

Debt Equity ratio: 0.59 (decreased 35% from last year)

Current ratio: 1.45 (below the threshold)

Return on Net Worth (RoNW): 22.33 (increased by 27% to last year)

Shareholding Pattern:

- Promoters (61.44%)

- Mutual Funds (4.19%)

- Alternative Investment Funds (0.52%)

- FII (1.07%)

- Financial Institutions (0.11%)

- Retail Investors (28.67%)

- Others (4%)

Intrinsic Value:

The Current EPS (TTM) is at 87.72. The 5-year EPS growth is at 13.73%. The share price is 2 times more volatile than Nifty. So, we should take a margin of safety at a minimum of 20%. In calculating these parameters, the share price should range below Rs. 1432.72.

Excess Liquid Cash Per Share:

Liquid Asset:

· Fixed Asset

§ Investments= 20.88 Cr

· Current Asset

§ Cash & Bank Balance = 3.85 Cr

§ Other Financial Assets = 11.89 Cr

Total Liquid Asset = 36.12 Cr

Total Liabilities = 848.9 Cr

Excess Liquid Cash = -848.9 Cr

Excess Liquid Cash Per Share =-348.83 Rs/Share.

Strength:

· Financial performance and Fundamentals are strong.

· EPS growth of 13.73% for the last 5 years is phenomenal

· Continued a superficial growth in EPS in Q1’2020-21.

· No Promoters shares pledged

· Net profit of the company has been growing continuously for the last 5 years.

· High demand on the global market for the products in which they are leaders.

· EPS (TTM) growth is predominately higher.

· FII has increased its shareholdings.

· Mutual funds and DII have increased their shareholdings.

Weakness:

· High Debt to Equity ratio. However, they are reducing it year on year.

· High P/E ratio. Still, it is lower than the industry average.

· Poor dividend to investors.

· The share price is 107% overvalued from the intrinsic value.

· Lower Current ratio than the industry average and threshold of 2.

· Excess liquid cash per share is -348 Rs, this suggests all their assets are illiquid.

· The stock is highly volatile. 2 times higher than the Index.

Should You Invest for this Price Only for a Bonus?

As we mentioned earlier, the company has decided to provide its investors with 3:1 bonus shares.

Most people think the bonus is a great gift. Indeed it is a gift for existing shareholders and not for those who buy at the time of record date and to sell on the next day.

Since there is no change in value the changes are only in the number of shares. This deal is not going to benefit the traders and investors.

The bonus will surely benefit the investors who bought the shares and hold them for a longer period in terms of dividend benefits.

Also, buying at a price 107% overvalued than the actual value will be a great fault as an investor.

Apart from this, this share is fundamentally strong and performing share. So, calculate and plan for a 15% growth of revenue year on year. The same percentage should reflect on the share price too.