Table of Contents

ToggleAngel Broking, is one of the leading full-time and discount independent brokers. Which was established by entrepreneur Dinesh D Thakkar in the year 1987. They are full-time brokers with the National Stock Exchange (NSE), The major advantage compared to other full-time or online brokers are

- More than 30 years of an established brand.

- Well established brand equity.

- Dominated in offline and online platforms with perfect engagement applications.

- Full time, discount, and online broking.

- Zero payment to start a DEMAT account.

- Lower commission rate compared to other brokers.

More than these advantages, it also shares almost 11,000 sub-brokers under them.

The company has decided to become a public company by dispensing a book built issue IPO on 22nd-24th September 2020. The IPO size is 600 Cr, with

- Rs. 300 Cr on Offer for sale.

- Rs. 300 Cr as a fresh sale.

The main adjective of the fresh sale issue of 98.03 lakhs share is to,

- Meet working capital requirements which accounts for Rs. 230 Cr.

- Corporate purpose.

Disclaimer: The article is completely our view and the data shared are from the red herring prospectus of SEBI and the Angel broking website. We are not SEBI registered advisors and we just share the knowledge of our understanding. It is completely in your hands to invest in this IPO.

Angel Broking IPO – Business Overview:

- The main advantage of the company is its founder Mr. Dinesh D. Thakkar. He had made this organization from the starch.

- Started with just 5 lakhs capital to a big organization of 11,000 clients and total assets of Rs. 2995. 68 Cr by Q1’2020-21.

The company has modified itself into technology-oriented financial services in

- Broking and advisory services.

- Margin funding.

- Loans against shares.

- Financial product distributions.

- Where broking services offer a huge share in revenue generation.

- It has customers reach over 18,649 pin codes across India.

- The company manages almost Rs. 13, 354 Cr of the client’s assets.

- Where broking services offer a huge share in revenue generation.

- It has customers reach over 18,649 pin codes across India.

- The company manages almost Rs. 13, 354 Cr of the client’s assets.

- As of June 2020, there were 43, 90, 000 downloads of angel-broking mobile applications.

- There are about 7.7 lakhs of active clients with Angel broking as per the NSE report. As per NSE, it is the 4thlargest full-time broker.

- During the period April-June 2020, there were 12.6 lakhs DEMAT accounts opened. Angel broking was the second platform used to open a DEMAT account.

- They offer the most economical and cheapest brokerage fees.

Angel Broking IPO – Financial Performance

The above image will give you an idea of how the company performed in the last 5 years.

Revenue: The revenue has slipped continuously for the last two years. Instead, the 5-year CAGR is 10.63%, and the 4-year CAGR of revenue is 8.4%.

Despite degrown to -4.4% in the last one year. The company has shown a positive sign by posting Rs. 246.6 Cr in the Q1’202-21. Which is 30.8% higher than last year’s average in a quarter.

EBIT: Same as revenue, EBIT also has seen degrowth in the last two years. Surprisingly, Q12020-21 has shown a 116% growth over the average quarter EBIT of FY2019-20.

PAT: Unlike revenue and EBIT, PAT (Profit after tax) has grown when compared to FY2018-19 with a small margin.

Anyhow, the 2 years’ performance was negative.

Borrowing: Despite revenue not growing year on year, borrowing has significantly come down year on year from Rs. 1137 Cr in FY2017-18 to Rs. 490 Cr in FY2019-20.

This is one of the great positive signs for the company.

Angle Broking IPO – Fundamental Analysis:

Before getting into a fundamental analysis of the company, let us understand the total equity shares the company holds.

Existing shares prior IPO – 7, 19, 95, 003 shares

Fresh sale of shares – 98, 03, 921 shares

So, the Current Shares after IPO – 8, 17, 98, 924 shares.

EPS (Earning Per Share):

EPS before IPO was – 12.05

EPS after IPO – 7.92

3 years of EPS growth was negative.

P/E Ratio:

Prior IPO – 25.4

After IPO – 38.62

Industry P/E – 24.1

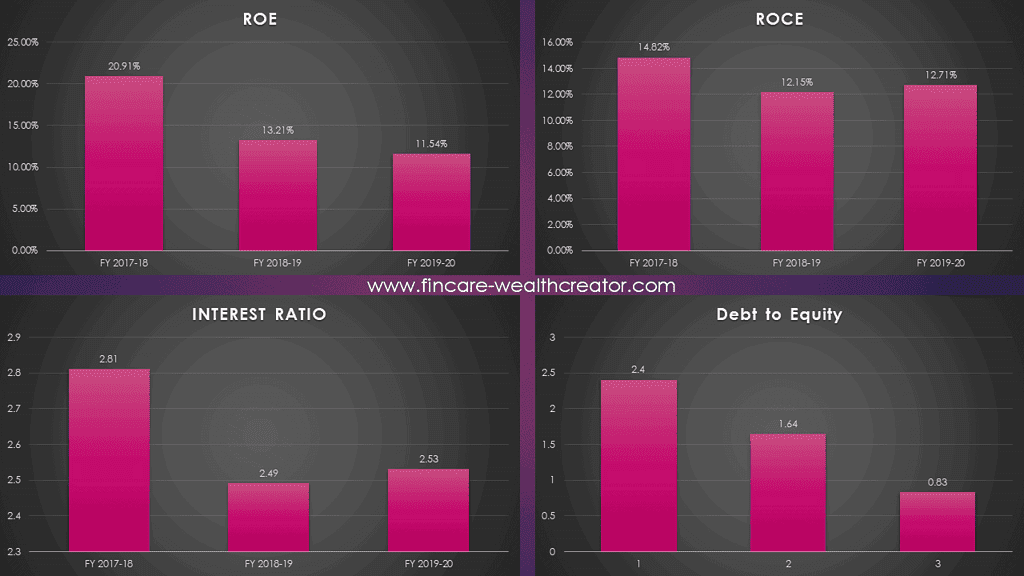

The above image should make you clear on the other aspects of,

- ROE

- ROCE

- Interest coverage ratio

- Debt to Equity ratio

ROE is coming down year on year for the last two years but still provides 11.54% in FY2019-20. ROCE has grown slightly in FY2019-20 when compared to FY2018-19. The current ROCE is 12.71%

The interest coverage ratio has shown great growth over the last year. Still, the 2-year performance is negative. In FY2019-20, it accounted at 2.53

Debt to equity is reducing year on year from 2.40 to 0.83. This is a good sign that the company is focusing on closing its debts and borrowing.

Debt to assets also is coming down to 22.41% (FY2019-20) from 47.82% in FY2017-18.

Excess Liquidable Cash Per Share:

Liquid Assets:

§ Cash and Cash Equivalents – Rs. 486.78 Cr

§ Bank Balance – Rs. 1430.26 Cr

§ Investments – Rs. 82.03 Cr

§ Other Financial Assets – Rs. 12.02 Cr

Total Liquidable Assets – Rs. 2011.89 Cr.

Total Liabilities – Rs. 2365.66 Cr.

Excess liquidable cash = Total liquidable Assets – Total Liabilities

= – Rs. 354 Cr

Excess Liquidable cash per share = – 43.27 Rs.

STRENGTHS:

- High customer base, with more discounts on brokerage.

- Great digital platform with more number of downloads as an application.

- Total years in the market with the 4th largest broker as per NSE.

- The assets and revenue tend to move in growth in Q1’2020-21.

- The borrowing and debt to equity ratios are well coming down. The company is focusing on reducing its debts.

- The PAT and EBIT are growing compared to last year and this year also it will be growing more than 10% as expected.

WEAKNESS:

- 3 years of EPS growth is Negative.

- High P/E compared to the industry.

- Negative growth in revenue of 3 years.

- More competition rising day by day.

Conclusion:

- Please find all the relevant details on financial, business, and fundamental analysis.

- Always, invest in the value of the stock and the company. Check with your financial advisors before investing in an IPO.

- Always equity is subjected to market rise, so be careful in your investments.