Table of Contents

ToggleIn our previous topics, we have covered all the basic concepts of financial planning, investing in equity, the debt market, and debt funds. It’s time to learn advanced techniques and strategies to leverage our investment life.

The ultimate aim of investments is to be rewarded by managing the risk involved in it. If you don’t take any risk in life, you are not the right person to look for rewards. Let us learn together about the aspects of how an investor should allocate his funds toward his assets.

Asset Allocation – Definition

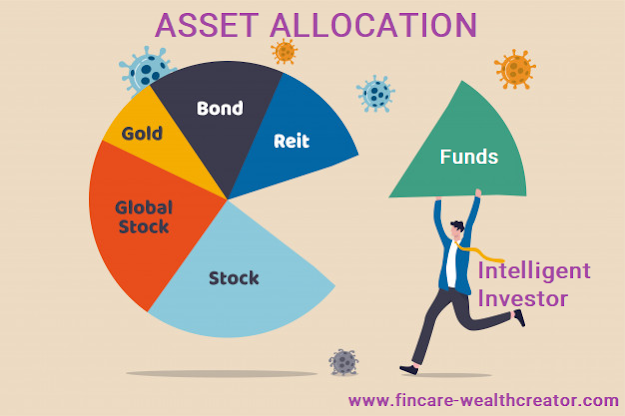

The strategical process by which an investor plans their investments into various instruments like Equity shares, Mutual funds, Bonds, NCDs, Fixed income, and Cash components to minimize the total risk involved in it, and also to get desired the interest rate on investments is known as asset allocation.

This cannot be achieved in a day, over an Excel sheet or a calculator. It is a daily activity to analyze and understand our goals and processes.

It is determined or viewed by a few attributes as follows:

- Proper Goal Setting with Timeline.

- Age and Risk calibration.

- Choose the Investment plan wisely.

- Proper Diversification of Investments.

- Rebalancing your portfolio.

Proper Goal Setting with Timeline:

An Intelligent investor must have his plans and goals specific and up to the point. A goal just stays as writing in a paper until it’s been predefined with a deadline. A proper goal with a timeline will make an investor clear on his investment objectives like, when to increase investment when to rebalance the investment, and what the interest rate is looking at every instrument they invest.

If you plan to accumulate 1 crore by the next 25 years, you can invest Rs. 6000 per month as SIP. So the expected interest rate is 12% Per annum. So the allocation of your assets can be dependable of giving an average of 12% return.

If we allocate 20% of an amount in stocks with 20% interest, 40% of the funds in Mutual funds with a return of 14%, 30% of the fund in a Debt market with a 9% return, and 10% of funds in Fixed deposit with a 6% return.

This is how we have to allocate our assets in an averaging concept where the risk can be minimized and the rewards can be averaged. Thus, we can achieve our desired return as per our goal in the next 25 years.

Age and Risk Calibration:

Age plays a predominant role in the life of an Investor. If we start investing at a young age, we have to invest almost half the amount to achieve the same corpus, that a person starts investing in the later period of his life.

A person with the age of 20 can invest only Rs. 2000 per month to achieve a sum of 1 crore at the age of 50, at a rate of 14% per year. Another person starts at his later age of around 35, and he has to invest almost Rs. 16000 per month to achieve at age 50 with the same 14% of interest to make 1 crore of his corpus.

The difference between both of them is,

1. The first person started early, so he had a long runway to accumulate the corpus with a minimum amount

2. In the case of the second person, he started a little late as he had a short-run fall. So, he had to invest 8 times the amount than the first person, anyhow his investment time is half of the first person.

3. When you provide 30 year time period for your investment, you can overcome the fluctuation of the market. For 15 years, it’s still a risky one.

So, age plays a major role in the strategy of asset allocation. At an early age, the risk can be more on equity and less on debt funds, as the years pass, the time when you invest an amount is also required for survival. At that point, you can’t take more risks and have to accumulate in low-risk instruments like debt or fixed-income tools.

Choose the investment Plan Wisely:

This means not only the analysis of taking the best stock or mutual fund but also about self-preparation of,

- What type of stocks or funds do you look for?

- What is the interest rate you are looking for?

- Duration of investment.

- How much percent, the funds would occupy in your asset allocation?

Why we look at these four parameters is, that most people use to transfer from one fund to another every year. This proves their inability to calculate their assets towards their dream. Also, people don’t believe in their analysis and go towards the performing stock and performing mutual funds.

Process of investing wisely:

– Choose a stock, or mutual fund whether it is equity or bond, and look at its fact sheet and historical behavior.

– Expect a minimum return from those investments. If a mutual fund is at 16% P.A., expect a 12% return, freeze your return there.

– Be clear with the objective of investments over those instruments and the tenure you planned, don’t change your investments often.

– If you still need more gain out of your investment, use the technique of rebalancing.

Diversification of Portfolio:

This is an important strategy that our team personally uses in investment techniques.

– Plan all your dreams and goals with the help of equity and debt mutual funds.

– All your emergency funds and marriage funds that you have saved in the 5-year saving timeline have to be allotted in debt funds only.

– Investing in equity shares is considered to be an investment, which will be transferred to our future generation and they can hold for years, it will be a great asset for our generation in our name.

– If the plans are more than 10 years old, invest in an index and blue-chip funds with low expense ratio, and move along with beating the index market.

– Retirement plans can be invested through NPS if you are going to invest till age 60. If you plan early retirement, then park the amount in an index fund and be happy.

So, you should have diversification in your portfolio, every investment in your portfolio has to be pointed out towards an investment. Diversification will make you handle the risk and reward smoothly.

Rebalancing your Portfolio:

This is one of the finest concepts that most people are doing. People who have greater knowledge of the market always move with the strategy of “buy at bearish and rebalance at bullish”.

The process by which, we transfer the amount gained in the equity over a growth phase of the market to debt funds to preserve the gain and also have a double growth of assets while equity is falling. This is known as Rebalancing.

This concept is not suitable for everyone. Those who can understand the market better can handle the emotion in a better way. Also people who know how to book the profit and stimulate or preserve it can do rebalancing.

By rebalancing, the reward will be more when compared to the average return and your portfolio can yield a great return with your asset allocation.

Conclusion:

- Asset Allocation is one of the important strategies in all investor’s investment journeys.

- Without a proper goal and timeline, you can’t be an investor. You will become a speculator.

- Plan wisely on your investments like stocks, mutual funds, fixed income instruments, gold, etc.

- Never shuffle your assets from one fund to another as it is performing.

- Plan your assets according to your age and run on an investment journey.

- Allocate the funds in the directives of the investment goals.

- Rebalancing should be done with the control of emotions, risk analysis, and market knowledge to grow the gain further.