Table of Contents

ToggleInvesting in blue-chip stocks is a dream for investors. Here we are going to discuss the performance calibration between the Axis bluechip fund and the ICICI bluechip fund.

Bluechip funds are defined as investing in blue-chip companies. Blue-chip companies have a strong fundamental in revenue, growth of earnings per share, ROE, ROCE, and low debt.

The companies pay out regular dividends to their investors. The only concern of a few blue-chip companies will be overvalued.

Axis Bluechip Fund has performed with a CAGR of 15.48% per annum from inception. ICICI blue chip has performed about 12.17% per annum. There is almost a 3% difference in performance.

There are only a few actively managed large-cap funds, which have outperformed the Nifty 50 Index. These two funds have been outstanding from Nifty 50 for the last 1,2,3,5 years and from inception.

What is the meaning of Bluechip Fund?

The term ‘Bluechip’ itself is borrowed from poker, where the blue chips hold the highest value. In the investment world, it symbolizes companies that are highly valued for their quality and stability.

and the term “Bluechip Fund” means an investment option where your money goes into the stocks of big, well-known companies that are known for being strong and stable. These are the kind of companies that have been around for a long time and are trusted by many. Investing in a Bluechip Fund is like choosing a safe and steady path for your money to grow over time.

Axis Bluechip Fund and ICICI Bluechip Funds: Overview

Both funds were launched in 2012 December. Both the funds have demonstrated performance over the benchmark index. To understand the essence of blue-chip funds, you might want to explore our detailed article on Best Large Cap Mutual Funds.

Both Axis and ICICI blue chip funds have the majority of equity exposure and few cash instruments.

ICICI bluechip funds can be started by investing Rs. 100 minimum as SIP (Systematic Investment Plan). The ICICI bluechip fund expense ratio is about 1.1%, which is comparatively higher when compared to the Axis blue chip fund.

Axis bluechip fund can be started by investing Rs. 500 minimum as SIP. The Axis Bluechip Fund expense ratio is only 0.51%, which is half of the ICICI Bluechip Fund. The total holding of Axis and ICICI funds are 33 and 70 securities respectively.

The current P/B ratio of the Axis bluechip fund is 4.87 and ICICI bluechip fund is 2.24

The current P/E ratio of the Axis blue chip fund is 32.63 and ICICI blue chip fund is 20.46. ICICI fund has an attractive P/E ratio absolutely due to more diversification.

The equity shares of Axis and ICICI funds are 95.8% and 89.7%. The top 20 holding is almost 87% and 70% in Axis and ICICI respectively.

Axis Bluechip Fund and ICICI Bluechip Funds – Performance:

The above graph has been seen in terms of NAV. The Rs. 10 in August 2013 has grown into 22.67, 20.11, and 16.43 in Axis fund, ICICI fund, and NIFTY 50 respectively.

In the last 7 years which is from the time of inception. Axis fund, ICICI fund, and NIFTY 50 have shown an annualized return of 14.18%, 12.17%, and 8.45% respectively.

Please find the year-on-year performance of both the funds when compared to the benchmark NIFTY 50 Index.

In an overall year-by-year performance comparison, Axis Bluechip Fund has shown consistent domination over ICICI fund and Nifty 50.

In the last 6 and lesser month performance, ICICI fund, and Nifty 50 have performed more than Axis fund.

The performance of the Axis fund is majorly due to lesser holding, only 33 securities. In which they have focused more on the stocks that will be leading the Index.

As the market grows. The fund also grows in the long run. While the index falls, the fund’s NAV tends to fall.

The reason behind ICICI’s performance in the last 6 months is certainly diversification. Huge diversification will not yield extraordinary results in the long run. Of course currently, as the market increased, overall every stock has grown at an average of 60%.

Since the P/E ratio of ICICI blue chip is at 20.46, the fund will produce a steady and decent return in the upcoming years.

For an in-depth understanding of the Nifty 50 and its performance, our article on Nifty 50 Index and Nifty Next 50 Index can provide you with valuable insights.

In the case of Axis bluechip, even though the P/E is higher, the holdings share is completely dependent on the main 10 stocks which carry the growth of the Index. That is the reason, the fund will still tend to grow even after any crash. This fund will outperform the index in the long run between 10 years and 15 years of performance.

AXIS Bluechip is performing much higher than the category. ICICI is performing above average when compared to the category.

Axis Bluechip Fund and ICICI Bluechip Funds – Risk Analysis

It is necessary to analyze both the reward and risk of the fund before investing.

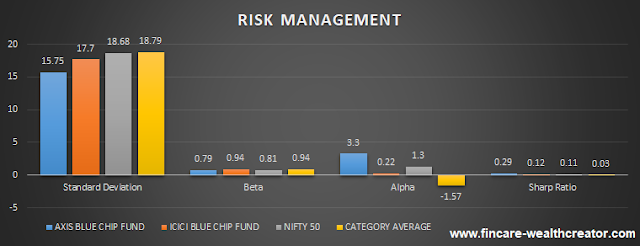

In this case, we will be analyzing a few parameters like Alpha, Beta, Standard Deviation, and Sharp ratio.

In which standard deduction and Beta are used to measure the volatility. The lesser in number compared to the Index and category average is termed to have low volatility.

The sharp ratio and Alpha are used to measure the risk-adjusted return. The higher the value, the higher the risk-adjusted return.

If you’re looking for more information on how to measure and understand these risk factors, our article on Mutual Funds and Risk Ratios might be quite helpful.

Here is the data for risk analysis over the past 5 years.

From the above data,

Axis Bluechip Fund Review:

Volatility: The fund has low volatility when compared to the Nifty 50 Index and the category average.

Risk-Adjusted Return: The fund has shown a better and higher risk-adjusted return compared to the Nifty 50 and category average.

ICICI Bluechip Fund:

Volatility: The fund has comparatively the same volatility when compared to the Nifty 50 Index and category average.

Risk-Adjusted Return: The fund has shown a better-adjusted return compared to the category average and a lower adjusted return than Nifty 50.

The data can be taken from morningstar.in

Conclusion:

- Both these funds have shown a higher return than the Nifty 50 Index. Only a few active funds have surpassed the index.

- Axis bluechip fund has a low expense ratio compared to ICICI blue chip fund.

- The P/B and P/E ratios are attractive in ICICI bluechip funds. But Axis bluechip fund has surpassed all year performance of ICICI fund and Nifty 50.

- Axis bluechip fund has shown lower volatility and high risk-adjusted reward.

- The best about the ICICI fund is even with Rs. 100 every month we can start investing.

- But, it is up to investors to choose any funds that have performed over the index.