Table of Contents

ToggleAxis mid cap fund and DSP mid cap fund are actively managed midcap funds. The mid cap stocks are the top 100-250 companies of the Indian share market categorized regarding market capital.

Here we will be compared with the Index Nifty Midcap 100 and the category average. Nifty Midcap 100 has performed a phenomenal 12.85%.

These two funds have performed better than the benchmark index and the category too. Axis fund has done 17.27% and DSP fund has done 16.49% since inception. More than comparing with index and category, we will discuss on

- Overview of Funds

- Performance comparison

- Risk and Reward Analysis

- Insight for Investors

Axis Mid Cap Fund vs DSP Mid Cap Fund – Overview

|

| Comparison between Axis Mid Cap fund and DSP Mid Cap fund with Nifty Midcap 100 from Jan’2013 to Sep’2020 |

The two funds were launched in January 2013. So, these are 7 years and 8 months of duration funds.

Both the funds can be started with min Rs. 500 per month as a systematic investment plan.

The current expense ratios are 0.61% for the Axis fund and 0.99% for the DSP fund. DSP mid cap fund’s expense ratio is similar to the category expense ratio average.

The fund size is Rs. 5867 Cr and Rs. 7425 Cr for Axis and DSP funds respectively.

The total securities are 56 and 46 for axis and DSP funds respectively. The equity shares are 94.4% and 98%

The current P/E ratio is 30.35 and 22.42 respectively for Axis Fund and DSP Fund. The P/B ratio is around 4.57 and 3.62 for axis and DSP respectively.

The top 10 holdings are 30.2% and 33.1% for Axis and DSP.

Axis Mid Cap Fund and DSP Mid Cap Fund – Performance:

|

| Comparison between Axis Mid Cap fund and DSP Mid Cap fund with Nifty Midcap 100 from Jan’2013 to Sep’2020 |

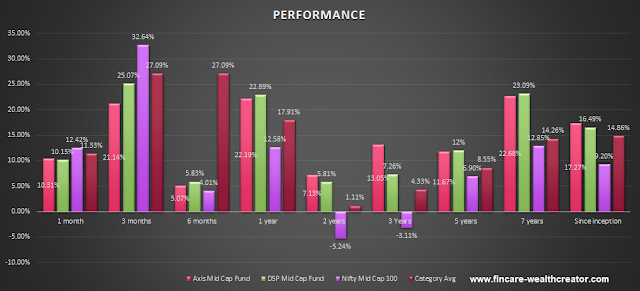

The above image has demonstrated the comparison of the performance of both the funds, nifty midcap 100, and category average.

· The performance clearly shows that even the category average is higher than the Index.

· Even the tracker the graph has shown a great difference in the performance,

· In terms of axis mid cap fund and DSP mid cap fund has shown similar performance over 1, 2, 3, 5, and 7 years, and since inception.

· The difference between these two funds is merely the same, they are statically similar to comparison.

· The 7 years comparison is 22.68% with axis midcap and 23.09% with DSP midcap. The difference is only 0.41%

· The comparison of two funds since inception is 17.27% with axis fund and 16.49% with DSP midcap. The difference in the performance is 0.78%.

· The category average is 14.86% and the index performance is 12.85%.

So, these two funds are good to invest in terms of performance. The main objective of every active fund manager is to beat the index. These two fund managers would have good sleep every day.

There are only a few mid cap funds that have beaten the index with low risk compared to the category.

During the COVID-19 crash, the nifty midcap 100 has fallen 37% and had a recovery of almost 54%. The Nifty midcap 100 stocks have rallied more than nifty 50 and Nifty next 50.

The majority of mid cap and small cap funds have performed almost 75% after the COVID-19 crash.

Axis Mid Cap Fund and DSP Mid Cap Fund – Risk Analysis:

Investors should not only focus on the performance, the most needed is to check the risk appetite.

· Low volatility compared to index

· Risk-adjusted reward compared to index

Here we have shown the 5 years risk analysis of both funds.

In these two funds,

The Axis fund has shown lower volatility than the DSP fund.

· Standard Deviation – 17.88 vs 20.19

· Beta – 0.76 vs 0.91

DSP fund has shown a high risk-adjusted reward

· Alpha – 3.21 vs 2.61

· Sharp Ratio – 0.22 vs 0.21

As a conclusion of volatility and risk adjusted return,

· Axis mid cap fund has a high return and low risk compared to nifty midcap 100 and category average.

· DSP mid cap fund has a high return and average risk compared to nifty midcap 100 and category average.

Axis Mid Cap Fund and DSP Mid Cap Fund – Investor’s Insight:

As an investor, it is hard to see these kinds of funds that have shown more than 20% per annum return in the last 7 years.

These two funds have shown a light show to the investor’s eye. The real fact behind is you should have invested 7 years ago.

To invest in the current situation, the returns may not be the same as the market is highly priced.

Once, the GDP of Q1’2020 has reported a contraction of -23.9%, it will eventually make the market correct.

Even before the GDP announcement, the nifty midcap 100 fell 4% in a single day.

So, investors should wait until the market corrects its earnings. This will make you earn a huge profit in the coming years with these two funds.

Both the funds are well managed by fund managers and the volatility is lesser than the category average. Also, has a better risk adjusted return.