Table of Contents

ToggleIn India, exposure to the Bond or Debt market is minimal when compared to other countries. If you’re one of them, then Debt Funds can be the best opportunity to invest in bonds or other fixed-income instruments.

Most investors around the world, plan and create their portfolio as a 50% Equity and 50% Debt market. The reason why many retail investors in India don’t invest in bond marketing is due to the face value of bonds.

A single face value of the bond is some lakhs, which is not affordable for most of us in India. So, people who have an idea to invest in the bond market can prefer debt funds where diversification and liquidity are at a higher mark than bonds.

What are Debt Funds?

Debt funds are a type of mutual fund that is invested in securities like the central, and state government bonds, G- Sec, Corporate bonds, Treasury bills, NCDs, Commercial papers, etc.

As it is a mutual fund, it has a diversification of bonds and different tenures, so the risk associated will be even lesser when compared to the bond market.

It provides us with a fixed income across the years we continue. One of the best places to invest after equity to overcome an inflation threat.

An investor who is away from market volatility can prefer a debt fund as their investment tool. Debt funds in India are better than Fixed Deposits in terms of returns and better than Equity Mutual funds in terms of risk.

How Does Debt Mutual Funds Work?

- CRISIL and CARE provide credit ratings for debt funds, which invest in various securities.

- The credit rating of security indicates the risk of default in the disbursement of returns promised by the holder of the debt instrument.

- Therefore, the fund manager of a debt fund ensures that he invests in high-rated credit instruments.

- In addition, a higher credit rating means that the entity is more likely to pay interest on the debt security regularly and pay back the principal upon maturity.

- A debt fund that invests in high-rated securities is less volatile than a bond/fixed-income fund that invests in low-rated securities.

- Additionally, maturity also depends on the fund manager’s investment strategy and the overall interest rate regime in the economy.

- Investing in long-term securities is encouraged by a falling interest rate regime.

- A rising interest rate regime, on the other hand, encourages him to invest in short-term securities.

Types of Debt Mutual Funds

Different types of Debt Funds are invested in different securities and bonds with changes in the tenure of investments. We shall discuss this in detail.

1. GILT Funds:

- GILT Funds are a type of debt funds that are invested in G-Sec bonds, the highest-rated government bonds.

- It has zero credit and liquidity risk, the only risk involved in the interest rate risk.

- This bond should be held for more than 7 years.

- The average return of a 10-year bond is 9-12% per annum, which is nearly equal to equity.

- There is volatility in the GILT fund, which is dominated by the change in interest rate.

- In Gilt funds, 80% of the fund has to be parked only in G-Sec bonds.

2. Overnight Funds:

- The mutual funds that hold securities like bonds with single-day maturity are diversified as overnight funds.

- The average return of the fund is about 5-6% per annum.

- As it is a single-day maturity period, people who need their capital to be safe and with an interest rate that is better than a savings account can choose overnight funds.

3. Liquid Funds:

- Liquid Fund is a type of debt fund that includes, investments in treasury bills, RBI bonds, NCD, and other types of corporate bonds with 91 days of maturity.

- Since the maturity period is about 3 months, the risk is very minimal compared to all types of debt and equity mutual funds.

- Emergency funds can be accumulated by these funds.

- The average return that we can earn is 7-8% per annum, which is better than FD, RD, Post office savings schemes, and banks.

- If the fund is redeemed within 7 days, the exit load will be 0.07%.

Explore the potential earnings from a Post Office Recurring Deposit (RD) with the free online calculator. Use the Post Office RD calculator to determine your returns effortlessly.

4. Ultra Short Term Funds:

- The funds that are invested over the bonds or commercial papers with a 3-6 month maturity period are termed the ultra-short fund.

- This fund is also associated with very low risk.

- The average return is higher than liquid funds with a yield of 8-9% interest per annum.

- The only risk is when the fund has corporate bonds that too with CRISIL Rating A and lesser.

- The main advantage of ultra-short-term funds is zero exit load.

5. Short Term Fund:

- This fund holds bonds with a 1-3 year maturity period and is associated with low risk as it lends funds to the bank and corporate bonds with ratings in mind.

- The 3-year return is on average 5.5-6.5% per annum.

- Before investing in such funds, please go through the allocation of bonds and their percentage of investments the fund manager does and calculate your risk.

6. Dynamic Bond Funds:

- Dynamic bond funds have the allocation of both short term and long term bonds, in the concepts of averaging the risk and reward.

- This minimizes the risk of interest rate fluctuation in the near term.

- The maturity period will be in the mixture of 3-7 years.

- There is some interest rate risk involved in dynamic bonds.

- The average return of dynamic bond funds is 7.5-8.5% for 5 years.

7. Corporate Bond Funds:

- Corporate bond funds should have a minimum of 80% of their allocation in corporate bonds.

- Corporate bonds can yield a high return, as well as risk is also associated with it, anyhow it has to be invested in high CRISIL/CARE-rated bonds only to minimize the risk involved.

- When it invests in low-grade funds, the risk increases.

8. Credit Risk Debt Funds:

- The fund with 65% of Low-grade corporate bonds is called credit risk funds.

- Unlike other debt funds it can yield high returns but the risk is high relatively equal to equity.

- It can be used as an investment option when countries economy is in good shape.

9. Bank and PSU Debt Funds:

- Banking and PSU debt funds are invested in the debt and money market instruments of bank bonds.

- This includes both Public Sector Undertaking Bonds (PSU) and Public Financial Institutions (PFI).

- Bank & PSU debt funds are one of the high performing Debt mutual funds in India

Who Should Invest in Debt Fund

In the above-classified debt fund types, we have understood the characteristics of debt funds. Now, it is our choice to pick the correct debt fund for the right portfolio management.

Debt funds are an ideal choice for investors who look for very low risk, a stable income, or returns that are higher than FD. Yes, Debt funds are always better than FD.

Besides this, the basic investment goal of debt funds should be beating inflation. Choose wisely on the CRISIL rating, and the bonds providing returns of more than 7-8% per annum.

You should invest in debt funds only for a short to medium duration of 1-5 years, a maximum of 7 years. In such a case, our aim of investment return should not be equal to equity. We have to be satisfied while traveling along with the inflation which is much more needed. We can classify into two categories of investment.

- Short Term Investment for less than 3 years.

- Mid Term Investment between 2-7 years.

Investment for less than 5 years:

- In an Investment of less than 3 years, our objective will be very low risk and have a decent return, after understanding over the types of debt funds.

- The preferable funds are liquid funds and Ultra short-term funds.

- Other than these two types of funds, there are fluctuations, and some kind of volatility is found.

- Also, when the fund manager invests in low-graded bonds, the credit risk increases.

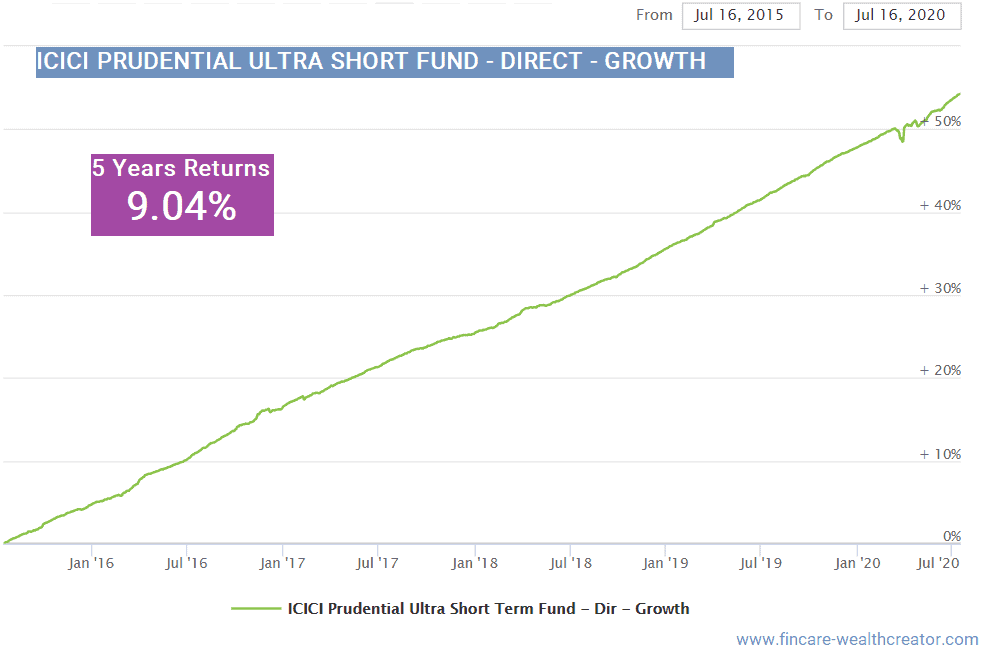

- Let me show with an example of the Ultra Short Term Fund, which provides 5 years return of 9.04% per annum.

- In the above image, you can see the type of steadiness increases in NAV, this shows how ultra-short-term funds and liquid funds have a fixed income. There are some risks related to these funds too, which can be seen later in this subject.

Investments of more than 3 years:

- When it comes to more than 3 to 7 years, there are two options for investment. The term is known as mid term investment as per goal.

- Equity while economic conditions are good or investing in debt funds to get a decent return.

- GILT Funds, Bank PSU Debt Funds, Corporate Bond Funds, and Credit Risk Debt Funds will be the choice of investment when it comes to debt funds.

- Investors will benefit from holding investments for more than 5 years in such funds

Factors to check before Investing in Equity Mutual Funds

Four parameters can be classified into two options. They are,

- Growth or Dividend

- Direct Plan or Regular Plan.

Growth or Dividend:

- The growth option means, the bonds/CDs/GILT that your fund holds will be providing interest rate gains every year, which will come to your fund and will add directly to NAV, so NAV value will grow along with principal and interest rates of investment.

- The dividend option means, the interest rate gain payout of the bonds, will be credited into the bank account. There will be no effect of dividends in NAV.

Direct Plan or Regular Plan:

Opting for Regular and Direct plans has an impact on the overall returns due to the expense ratio. As we have mentioned the expense ratio is associated with the mutual fund, as it is the only fee that the fund house collects. The variety of expense ratios depends on opting Direct or Regular plan.

- Direct Plan: When u choose a plan directly, without the help of any brokers involved, then it is classified as a Direct plan. In a direct plan, the expense ratio will be between 0.4-1.25%.

- Regular Plan: When a fund is chosen from a distributor or broker, it is known as a Regular plan. The expense ratio associated with the regular plan is 1.5-2.5%.

Note: Always go for a Direct plan, a higher expense ratio will impact on overall returns of your fund.

Risks Associated With Debt Funds:

3 types of risks can be faced by a debt funds investor,

- Credit Risk – It is the default in principle and interest from the bond issuer’s end

- Interest Rate Risk – This happens when the market sees fluctuations in the interest rates

- Liquidity Risk – When an AMC/Fund house defaults in holding liquid cash, hence forced to sell securities in a secondary market with decrements.

Here are a few examples of risks that happened in the Money Market.

- When the company fails to pay out its debts back, the credit risk increases and the NAV falls all of a sudden. Eg, This January all Franklin Templeton debt fund’s NAV fell to nearly 5% in a single day, and investors have a terrible mindset about what happened. This is because Vodafone, Idea failed to pay off its debt.

- When the Fund size is less than 1000 crores, there is a chance of high risk in NAV fall when the majority of investors redeem their investments. In 2020 March, when COVID-19 was declared a pandemic and lockdown was announced, all the investors took their money from debt funds and all funds saw a shortfall in NAV.

- Another risk is Interest rate risk, which is highly associated with Bonds with more than 3 years of the lock-in period.

Conclusion

- Debt funds are suitable for investors who are likely to get a return more than the traditional way of savings.

- People who want to invest in the bond market, but don’t have sufficient amounts as Lumpsum or required liquidity, at any time, can go for debt funds.

- The risk with debt funds is low when compared to equity.

- Ensure you invest in the funds holding High CRISIL-rated bonds or Government bonds.

- Don’t be greedy in investment seeing 1-year growth, invest in funds that have no risk and average growth.

- Plan your goals and allocate them towards your funds, Less than 5 years tenure of any goal debt funds will be the best choice.

FAQs

-

How Does Debt Funds Work?

Debt Funds managing fund houses invest in debt securities like bonds and other fixed-income materials. They choose these bonds wisely as per the rating by CRISIL or CARE.

The ultimate aim behind the debt funds is to earn the interest rate from the bonds as income. These bonds are held for long term and short term in relationship with the interest rates. The falling interest rates imply holding the bond for the long term, and the rising interest rates will play a role in short term investment.

-

Is Debt Funds Better than FD?

Yes, Debt funds are always better than FD. The returns of Debt funds range between 7% to 9% per annum, whereas FD yields 4.5% to 6% per annum. The risk with debt funds is comparatively the same as FD (Fixed Deposits). Debt funds don’t have any lock-in period, but FD has.

-

Is Debt Funds Good for Long Term?

No, debt funds are not good for the long term. Even though they overcome the inflation rate, Debt funds are good for short term and mid term investments. In the case of long term investment, choosing Equity Mutual Funds will be ideal, as it yield 14-20% per annum, and the risk becomes nullified in the long term.

-

Are Debt Funds Risk-Free?

Yes, Debt Funds hold three natures of risks. They are Liquidity risk, credit risk, and Interest rate risk. Yet, the risks are not similar to equity funds.

-

What are Debt Funds vs Equity Funds?

Here is the comparison between debt funds to equity funds in the following factors.

Returns of Investment – Low to Moderate compared to Equity funds

Risk – Very Low risk compared to Equity Funds

Expense ratio – Lower compared to Equity funds

Taxation – LTCG for Debt funds is 20% and it is applicable only after 3 years of investment. In Equity funds, the LTCG is 10% and is applicable after 1 year of investment.