Table of Contents

Toggle

In the previous topic, we learned about tax planning and tax exemption components to pay zero tax on incomes between 9 and 9.5 lakhs. We all know that Section 80C allows us to exempt our taxes up to 1.5 Lakhs.

Here, we shall discuss investing in such components with high lock-in periods; we must expect to beat the inflation and yield a minimum of 8% annual return.

With this objective, let us compare ELSS vs PPF, considering all their pros and cons, and then learn how ELSS will surpass PPF by 70%.

Let us learn about these investment portfolios in detail, and finally, we can compare.

ELSS (Equity Linked Savings Scheme):

ELSS is a type of Mutual fund with a lock-in period of 3 years. This is the only difference from other actively managed mutual funds. ELSS, which is invested in equity mutual funds, has a market-related risk. Return on investments is taxable if it is greater than 1 Lakh. ELSS is the only option to get a maximum reward as a return in tax exemption components of 10-16% per annum.

Features of ELSS:

In ELSS, 80% of the amount is invested in Equity, and the other 20% is invested in equity-related instruments and cash components.

Fund Diversification:

Despite market risk, ELSS is the same as mutual funds, and the fund is allocated with a diversified portfolio of many sectors, such as Banking, FMCG, IT, Automobiles, Oil and gas, and Pharma. The most important point to remember here is that, as per SEBI (Securities Exchange Board of India), any mutual fund should not hold more than 10% of its allocation in a single company share.

Fund diversification will eventually lead to low risk in the long term. Compared with PPF, which has to be held for 15 years, we hold ELSS for the long term for more benefits.

Payment Methods:

SIP (SYSTEMATIC INVESTMENT PLANS): You can start your investments in ELSS with a minimum of Rs. 500 as SIP. Investing every month will increase discipline in investing. This is an easy method for beginners to invest in ELSS.

LUMPSUM: You can invest the desired amount in ELSS in a single lump sum. This can be done when the market is low, for which you should have better market knowledge to yield more capital gain.

Learn about the difference between SIP and Lumpsum.

Things to Remember While Investing in ELSS:

· Even though it is an actively managed fund, choose a Direct fund over a Regular Fund(brokerage charges are included).

· Analyse risk and reward before choosing a fund.

· Select the fund with the majority of Nifty Index shares.

· Rather than looking for a fund Star rating, look at fund diversification.

· Don’t focus on funds with high returns; look for 12-14% return per annum for 15 years.

· Choose the growth option, as you will carry the fund for 15 years, and compound interest works.

Public Provident Fund (PPF):

PPF is one of the options that most people use it as an option when it comes to the tax exemption component. There are some problems that we don’t understand while picking a PPF account;

· The interest rate is not fixed as Fixed Deposit, it keeps on changing for every quarter by GOI.

· The lock-in period is 15 years; we can withdraw the partial amount only after 7 years in an emergency.

· The current interest rate is 7.1%, earlier it was 7.9%. Once upon a time, around the 2000s, its rate was 11%. As the repo rate decreases, the interest rate of PPF also declines.

· Low liquidity cannot be used for the short term.

· In long-term investing, PPF will never beat inflation.

Advantages of PPF

· It can be initiated from our nearby post office and banks.

· It can be started with a minimum amount of Rs. 500. To keep the account open, we must deposit a minimum of Rs. 500 monthly.

· Unlike SIP, we can deposit any amount we desire every month, but the minimum deposit should be Rs. 500.

· Unlike SIP, it doesn’t require depositing on some particular date every month.

· After 5 years, we will be eligible for a personal loan with a lesser interest rate than bank loans.

· If someone doesn’t care about inflation and fears taking a market risk, they can go for PPF rather than ELSS.

To find PPF’s historical interest rate, click here

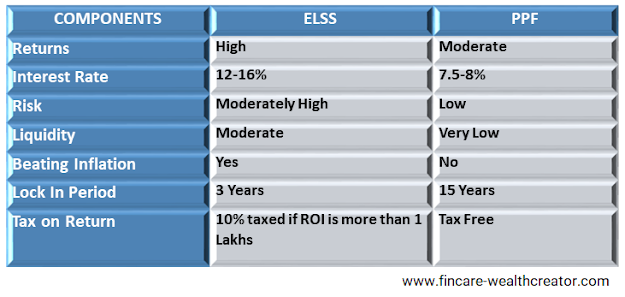

Comparison of ELSS vs PPF:

In this agenda, we will compare ELSS and PPF in some important components, such as Returns, Risk, Beating Inflation, Liquidity, Tax on returns, rate of returns, Lock-in periods, etc.

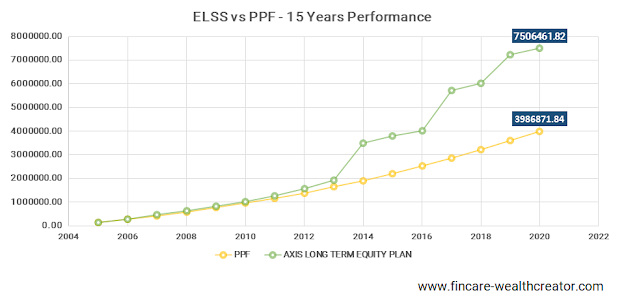

Let us now compare the ELSS vs PPF in a graphical representation,

As we can use Rs. 1.5 lakhs as a tax exemption in Section 80C, we will be paying EPF, which comes under 80C. Let us assume Rs. 30,000 is paid by EPF. So, for the remaining Rs.1.2 Lakhs of tax exemption, one individual chooses ELSS, and another prefers PPF over ELSS as it has low risk. As the annual amount is Rs.1.2 lakhs, they invest Rs. 10,000 monthly.

Let us see where these two people land after 15 years of wealth gain.

We have chosen AXIS LONG TERM EQUITY FUND, DIRECT GROWTH in ELSS. It has demonstrated a 16.24% CARG return.

PPF has earned a wealth of Rs.39.86 Lakhs

ELSS has earned a wealth of Rs.75.06 Lakhs. After deducting 10% tax, the total amount earned is Rs. 67.56 Lakhs. ELSS has surpassed PFF by 70% over 15 years and also beats inflation, which is the ultimate aim of investments. So, from these analyses, it’s better to prefer ELSS over PPF regarding section 80C tax exemption.

PPF Account Holders – What to do Further:

What should you do next once you decide to move all your money to ELSS to gain 80% more wealth than PPF but still hold PPF?

Closing the PPF account is not advisable, as you will lose all the amount you invested earlier. Just continue with a minimum amount of Rs. 500 and park all the remaining amount you consider for section 80C in ELSS.

Key Takeaways – ELSS vs PPF:

· PPF and ELSS are tax exemption components under Section 80C up to Rs. 1.5 Lakhs.

· PPF has low risk, liquidity returns, and lock-in periods of about 15 years.

· PPF should be availed by people who don’t care about Inflation and those who fear risk.

· ELSS is an actively managed mutual fund with 3 3-year lock-in period.

· As we compare ELSS with PPF, which has 15 15-year lock-in period, ELSS will be considered to hold for 15 years, and the expected return rate will be around 12-16% per annum.

· There is a risk associated with ELSS as it is linked with the share market, but while holding for 15 years, the risk will be minimized, and the return will beat the inflation

· The wealth gained by ELSS for 15 years will be 70% more than PPF.