Table of Contents

Toggle“If you don’t plan your emergency situation well in advance, you will end up as a debt creator”

Nowadays, Jobs and businesses have become unpredictable and insecure. In the last few years, we all have come across news that many lakhs of people have been fired by their organizations.

Many people became disoriented in those situations thinking about their future and what to do next. The expenses remain the same for the next month whereas the income will be NIL.

This puts us under stress, and we won’t focus on getting the next right job or business. In recent days (March 2020 – June 2020), due to COVID-19, the whole world is under lockdown.

Many people lost their businesses or jobs and have been in trouble due to their enormous debt. This is because most of us lead our life by being “Paycheck to Paycheck”.

This type of emergency has happened in everyone’s life in the past decades. Most of the people who planned for this emergency may lead their lives peacefully and have moved on to the next phase. What made these people move on easily in this emergency phase of life, that most of us can’t?

The only answer is, that they might have built an emergency fund along with their daily expenses, savings, and investments. As we have suggested in our first topic – FUNDAMENTALS TO BE KNOWN BEFORE PLANNING THE FINANCIAL GOALS, once you have purchased a Term and Medical Insurance, you have to save a minimum of 6 times your monthly income.

In this chapter, we will discuss widely on,

- Why an Emergency Fund is needed?

- How to make an Emergency Fund?

- Options to park an Emergency Fund.

Why an Emergency Fund?

As we all know, an emergency doesn’t happen with pre-scheduled so that we can handle it with awareness. An emergency doesn’t occur only in economic crisis, loss of a job, and pandemic.

But, also in medical emergencies, replacement of electronic goods, cars and motorcycles, etc. These types of expenses occur all of a sudden and if we don’t have a reserve amount with us, we have to repay these costs with our current month’s budget or credit card and EMI cards. This will never lead to a healthy financial life.

If you have a reserve amount of your 6-12 month income as an emergency fund, you can easily handle this situation and overcome it without any debts.

How to Make an Emergency Fund

In the previous topic, we might have gone through the concept of NEEDS, WANTS, and SAVINGS and the proportion to allocate in each category.

- Foremost, concentrate the maximum of your savings to be parked in emergency funds.

- It’s not only about the percentage of savings but also minimizes your WANTS and adds more amount to emergency funds.

- If you have any debt, concentrate on closing those debts and simultaneously build an emergency fund.

- If you are less paid and your NEEDS cover the maximum income, try to work extra hours or do some side hustle to increase your income and park more funds for emergencies.

- Develop your skills and try to upgrade in your profession. Save all the amount that you are paid through the promotion into emergency funds and other investments.

- Plan a budget and try to adhere to it, and also try to save some money from the budget.

- Till you can save 3 months of your income, please be aggressive and park more funds for Emergency.

- Once, you have your 3 months of emergency funds, you can reduce the amount you park at the emergency fund & diversify your allocation for emergency funds and investments.

Options to Park Emergency Funds:

Before planning an emergency fund, you have to consider these parameters.

- Capital has to be protected.

- Instant Liquidation.

- Emergency Fund is not an investment.

Now, considering these parameters there are few options where we can place our fund to get a protected capital, instant liquidity with some Capital Gain.

- Savings Account

- Premium Savings Account

- Liquid Funds

Savings Account:

We open a normal account in a bank that is very near to our home for some transactions and savings. Most people believe that the bank is safe and opt to save their total assets in the bank.

A Bank Savings account gives you faster liquidity, protection of capital, and zero market risk involved. An interesting fact over here is, it pays you on an average of 2.5-3% interest per Annum. If someone cares only about the safety of the capital and doesn’t care about the interest rate, then a Bank Savings Account will be the preferable choice.

Premium Savings Account:

This type of savings account is known in all the banks, but people have little light on this premium savings account. This is also called a Flexi – Fixed Deposit in some banks.

The propaganda of this premium savings account is you have to maintain a minimum balance of 25K every month and this can happen only if there is an account balance.

The amount more than 25K you maintain will be allocated in the ledger Balance. The ledger balance will be paid at an interest rate of 5.25 – 6%.

This account will be suitable for those who are looking for fixed deposits and instant liquidation. The only risk associated here is interest rate is decided by REPO RATE & REVERSE REPO RATE, but capital is always safe over here.

Note: Please don’t park your amount in some banks that pay more interest with low CRISIL ratings, always prefer well-reputed banks with average returns.

Liquid Fund:

Liquid Fund is associated with the Debt Market. These funds are the funds with 91 days maturity period. This is the only fund that is associated with low risk in debt funds. The interest rate of liquid funds ranges from 7-8.5% per annum. There are no exit load charges if redeemed after 7 days of investment. Liquid funds also can be withdrawn instantly.

Liquid funds will be the preferred choice of investment for wise people, who always make their investments to beat inflation. The liquid fund provides you capital protection, faster liquidity, and beats inflation.

Before investing in Liquid Funds, please study completely about liquid funds and then park your money. Also, go through the FACT SHEETS of the Liquid fund and check their CRISIL or CARE rating.

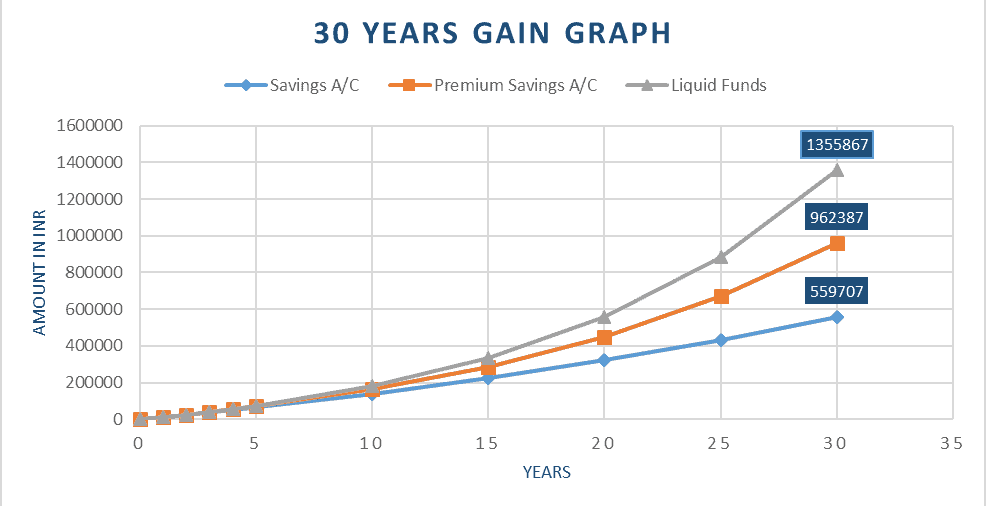

Please find the graphical differentiation in the interest rate of all three types.

This is an example of people A, B, and C, who deposit Rs. 1000 every month for the accumulation of Emergency funds. A, B, and C choose different options from each other and let us see what will be their corpus after 30 years.

This subject is completely taken from practical sense from most of the successful financial leaders and even from my mentors and myself.

If you have any thoughts or comments please do share with us. Also, if we need to cover up on any specific topic please let us know. We will work together in bringing valuable content to enhance the wealth of your life.