Table of Contents

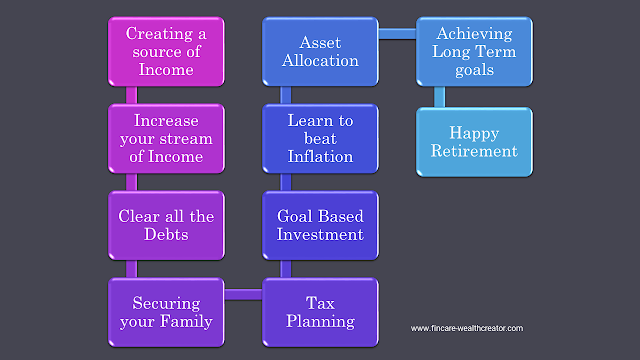

ToggleFinancial management is completely on managing our income, expense, savings, goal setting, and goal-based investments, and achieving them within the life period.

On the other hand, it is known as the complete financial planning pathway starting from income until retirement. This is the best education every individual should learn and develop.

Handling personal finance is not taught to you anywhere in life. This is the mandated subject you should have to learn when you reach age 10.

If not, stay and learn with us the process and complete flow of financial management

Process of Financial Management

1. Creating a Source of Income:

To start your financial management process, the foremost is making a source of income.

It can be by employment, self-employment, business, Investing, or trading.

Once you create a source of income, try to invest your extra time to earn more.

Concentrate on investing your time and energy to upgrade your skills. More than your degree, your skills will pay you.

The main objective of income is to save a minimum of 30% of your income. You can add more portions to savings, but at least aim to meet the minimum cutoff.

In the case of trading or investment, you need to open a DEMAT account. Click here to open a free DEMAT account

2. Increase Your Streams of Income:

The second step in financial management is to increase the streams of income.

“You will be one step ahead of poverty if you depend on a single source of income”, said Warren Buffet.

Multiple streams of income will keep your family in complete safety. In which passive income will add more weightage down the line of life.

While you are in the comfort zone with a single source of income, push yourself to a secure zone with multiple streams of income.

3. Clear All the Debits:

The third step of financial management is clearing all your debt. Recently, readers should have gone through the debt trap.

In which you should be clear about how debt makes an individual and their dependents to be bankrupt.

Debt and wealth both operate in the principle of compounding. More debt makes you suffer, and more wealth makes you prosper.

Plan high pay debts and try to take low interest rate consolidation loans and make all the debts in a single package. Then pay the single debt with full attention with full focus.

More important is never to take any new loans for a car, bike, appliances, home, marriage, child education, etc.

4. Securing Your Family:

The fourth step to focus on financial management is securing your family. Securing is the process of having term insurance, health insurance, and minimum 6-month income as emergency funds.

The main advantage of security for the family is, it makes you and your family free from financial burdens. It releases your mind from being frustrated about, who will take care of your family after you or at the time of any job loss.

5. Tax Planning:

The fifth step of financial management is tax planning. Most successful billionaires pay zero tax.

When you cross taxable income of more than 5 lakhs, you are subject to pay tax. You must apply for tax exemption by proper tax-saving investments.

We have written an article on Tax exemption and tax planning, where we have calculated up to 9.5 Lakhs year package, you can avoid tax.

The amount that you pay as income tax can be still used for investment and can grow your wealth.

The major tax-saving investments can be placed in ELSS, NPS, Medical insurance, and HRA.

6. Goal Based Investments:

There are many types of investments to do. In financial management, you should go with goal based investments.

You should align all your investments towards your goals like a dream home, dream car, children’s education, retirement, etc.

This makes an emotional connection and also adds purpose to your investments. This becomes the fuel for your financial planning.

It makes to continue with the same spirit you had while starting your investment journey.

7. Learn to Beat Inflation:

Recently, we have shared an article on the inflation spikes up to 6.93%. Inflation is the biggest material every investor should look into in financial management courses.

The simple thing is, that your investment return should be more than the average inflation of the country. In the last 10 years, the average inflation was between 6-7%.

So, any investment that yields more than 7% return per year is termed as a wise investment. This is the only way to beat inflation.

So, avoid investing in LIC endowment, and cashback policies. Also, when it comes to long-term goal based investments avoid FD and RD.

8. Asset Allocation:

Asset allocation is more important. You just can’t invest in equity or fixed-income instruments. There should be risk appetite measures in deriving the proportion of equity, gold, bonds, and fixed income instruments.

Asset allocation can diversify your investment instruments and risk will be minimized. You should be comfortable and project a certain interest rate return.

While planning long term more than 20 years, a 10-14% return per year is more comfortable for an investor.

So, plan your asset allocations to get the desired 10-14% return. You should balance your risk and reward.

9. Achieving Your Long Term Dreams:

The ninth step of financial management will be achieving your long term dreams. Once you have done all the above 8 steps, all your long term dreams will be achieved.

These phases are fruit-bearing phases, if all the above phases are done properly.

It will keep you more active while you achieve your long term dreams. This will keep your retirement life in a very positive and safe mode.

10. Happy Retirement:

The main and ultimate goal of financial management is early retirement. Always, plan to retire by 45. There are many videos and articles which provide information on early retirement.

Retirement life has to start with a huge corpus, if you don’t have a corpus, don’t retire.

Before the retirement phase, start working on building a passive income and have a happy retirement life.

Check out the article on the Importance of Financial Management for Students.

Conclusion:

These 10 steps complete the financial management. This is the best education one should learn more than school and college educations. Starting from a source of income to a happy retirement, your complete life is been included.