Table of Contents

ToggleThe GILT fund is one of the debt funds which invests in G-Sec bonds. G-Sec bonds are government security bonds. It is the most trustable bond where credit risk and liquidity risk are zero.

This fund should have a minimum of 80% investments in G-Sec bonds. This will be best for long term investors. In the long term like 10 years are more, the funds are performing on an average of 9-12% interest.

If you are thinking of mapping your children’s higher education or children’s marriage. Which is in the other 10-15 years, this fund can be the best way for goal-based investment.

Why You Should Invest in Gilt Fund Over G-sec Bonds:

G-SEC bonds can be bought in the primary and secondary markets. It can be sold only in the secondary market. It is not easy for retail investors to invest in G-Sec bonds. Because the single face value will be a minimum of 1 lakh – 10 lakhs.

In this case, retail investors or people like you and me who plan Rs. 1000 or Rs. 500 to save for long term for some goals can choose the GILT fund.

Many GILT funds can systematically invest a minimum of Rs. 500 every month. This makes it easier than investing a large corpus, perhaps you invest in the same G-Sec bonds.

You must check with the AMC which helps you to invest with the minimum expense ratio. Apart from that, G-Sec bonds can’t be sold in the primary market, it can be sold only in the secondary market. So, the profit will change with the bond yield at that time.

In the case of the GILT fund, there is no exit load. So, you can redeem it even in an emergency. But remember when it is redeemed after 10 years, the goal of investment will be materialized.

Is Any Risk Associated With Gilt Fund?

Like the G-Sec bond, the only risk associated is interest rate risk. The interest rate risk is associated with the Repo rate by RBI. This risk won’t give you a negative return while investing for a longer period like more than 3 years. But the return will be equal to a liquid fund.

What is Interest Rate Risk?

Whenever the repo rate comes down the bond yield moves up and so, the interest rate contracts. This is known as interest rate risk. The relationship between bond yield and interest rate is well explained in our previous topic debt market and its terminologies.

Example:

When the repo rate decreases, the current bond which is launched by the government will have a lower interest rate. So, the existing bonds with a higher interest rate will have more demand. The demand will increase the return of the bond. This eventually decreases the bond yield.

When the repo rate increases, the demand for the existing bond decreases as more investors will be attracted to the new interest rate, which will be higher. The decrease in demand will reduce the return.

NOTE: When you stay investing for 10 years in GILT FUND, there will be no risk associated with the fund. There will be no credit or liquidity risk associated with the fund.

Criteria to Choose Gilt Fund:

- We always advise investing in funds that hold G-SEC bonds of more than 10 years of maturity period.

- When you have a 10-year maturity period these repo rate changes won’t affect the interest rate of the fund.

- Select the funds with a minimum expense ratio.

- Choose a fund with maximum holding in Government Sovereign holdings (G-SEC).

Discussion on ICICI Constant Maturity Gilt Fund:

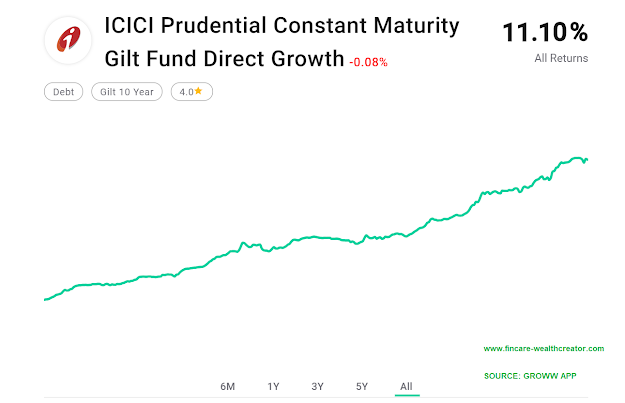

Source: Groww App – ICICI CONSTANT MATURITY GILT FUND

· These funds hold 95.2% in G-sec bonds with 10 years of maturity bond. Also, 4.8% in other debt materials.

· The fund has performed almost more than 11% from the time of inception (i.e.) 6 years.

· The average maturity period of the fund is 10.16 years. So this fund is one of the best long-term investment materials.

· Also offers 6.18% as yield to maturity. When yield to maturity is higher, the returns will be higher.

· The fund has performed over the category average in 1 year, 2 years, 3 years, and 5 year performance

§ 1 year – 11.6%

§ 3 years – 10.3%

§ 5 years – 10.8%

§ 6 Years – 11.1%

The performance is comparatively higher than most of the equity mutual funds.

Including market indices like Nifty 50 and Sensex which have given negative returns in the last 3 years, the fund has obtained more than 10% returns.

Conclusion:

· GILT fund is considered to be a moderate risk investment for short term goals in the debt market.

· When you choose these funds for the long term over 10 years, this will be the best investment material.

· Many mid-long terms goals can be mapped under this fund as they don’t have any credit risk

· It has performed well on an average of 10% return in the last 5 years, whereas equity mutual funds perform around 5%.

· As an investor, it is not proud to stick with only equity. Your ultimate goal is a good return. So, you should have these funds in your portfolio.