Table of Contents

ToggleGold was first used as currency in ancient times before the invention of FIAT currencies (Government-issued currencies). In recent decades, gold has been considered, the only hard asset of tangible property in many middle-class families.

Even our parents and grandparents might have thought us investing in gold as it is the only investment that will never give us a loss. Is it so? We shall discuss the phase of the pros and cons of Gold as an investment.

Before getting into it, dig into the past, most of us buy Gold as ornaments (22 karats), contrarily only a few people go for Pure Gold which is in the form of a Coin or Biscuit (24 karats). Remember, when you acquire gold as an ornament, you have to pay an extra amount for its wastage & GST.

Reasons to Invest in Gold:

- High Liquidity: Gold is quite easy to buy and sell in the open market, making it a favorable choice for investors who might need to quickly convert it into cash during an emergency.

- Limited Supply: Gold is a limited resource, and there’s only a finite supply of it on Earth. The combination of this scarcity and an increasing demand for gold contributes to maintaining its value over time.

- Hedge Against Inflation: Gold is widely recognized for its role as a safeguard against inflation. As the general prices of goods and services increase, the value of paper currencies typically declines. Yet, historically, the price of gold has risen alongside inflation, preserving your purchasing power over time.

- In India, the buying of gold is primarily associated with auspiciousness in many cultures and religions prevalent, also at wedding functions.

- In the course of an emergency, people use their gold to pledge to get a gold loan, which is less than a personal loan in interest rate.

- Families in India will take their pride and status, in the fact about how much gold runs through a member’s possessions.

Benefits of Gold Investment:

- Gold is a metal its price increases as the inflation rate increases.

- The price of gold will be in a flat curve while the market and economy will be in a growth phase, and it will be in the growth phase while the economy drops.

- It is inversely proportional to a country’s economy.

- It can give you a two-digit growth rate if you buy digital gold, as you can trade gold in the commodity market.

- Gold can be stored as physical, in the form of a Coin or Biscuit.

- It has faster liquidity of converting into money.

Gold Price Historical Data:

In recent times, the whole world has been facing a financial crisis and economic slowdown, in India, owing to that the current price of Gold 24 karat 10 grams is Rs. 47,819 as of 19th June 2020.

The price of 24 Karat Gold on 31st May 2019 was Rs. 3,234. So, in the last year, it has grown at a rate of 45%. The reason behind this is, that the stock market crashed due to the economic slowdown that happened last year post-July, the gold price hiked nearly Rs. 40,000, and owing to the COVID–19 pandemic situation, the gold price hiked towards Rs. 47,819.

In the same way, there happened a gold price hike in 2009 – 2010 due to the 2008 economic crash from Rs. 15000 to Rs. 22450 in 2013, which shared a growth of 27% per annum.

Note: The growth is calculated by XIRR

Gold Price History in India:

| Years | 24 Karat Gold Rate (10 Gms) | 22 Karat Gold Rate (10 Gms) | 24 Karat Gold Jewel Wastage & GST Added |

|---|---|---|---|

| 2010 | ₹18,500.00 | ₹16,916.67 | ₹21,830.00 |

| 2011 | ₹26,400.00 | ₹24,177.78 | ₹31,152.00 |

| 2012 | ₹31,050.00 | ₹28,444.17 | ₹36,579.00 |

| 2013 | ₹29,600.00 | ₹27,088.89 | ₹34,928.00 |

| 2014 | ₹28,006.50 | ₹25,533.88 | ₹33,048.17 |

| 2015 | ₹26,343.50 | ₹24,035.21 | ₹31,116.83 |

| 2016 | ₹28,623.50 | ₹26,105.21 | ₹33,813.33 |

| 2017 | ₹29,667.50 | ₹27,033.75 | ₹35,091.45 |

| 2018 | ₹31,438.00 | ₹28,615.00 | ₹37,144.84 |

| 2019 | ₹35,220.00 | ₹32,067.50 | ₹41,609.60 |

| 2020 | ₹48,651.00 | ₹44,648.25 | ₹57,442.18 |

| 2021 | ₹48,720.00 | ₹44,725.00 | ₹57,449.60 |

| 2022 | ₹52,670.00 | ₹48,597.78 | ₹62,154.60 |

| 2023 | ₹65,330.00 | ₹60,166.67 | ₹77,104.40 |

| 2024 | ₹67,295.00 | ₹62,135.42 | ₹79,424.10 |

Wastage was 15% of the price of gold, and GST was 3%.

*The growth was calculated by XIRR

Gold Price Trends Over Years:

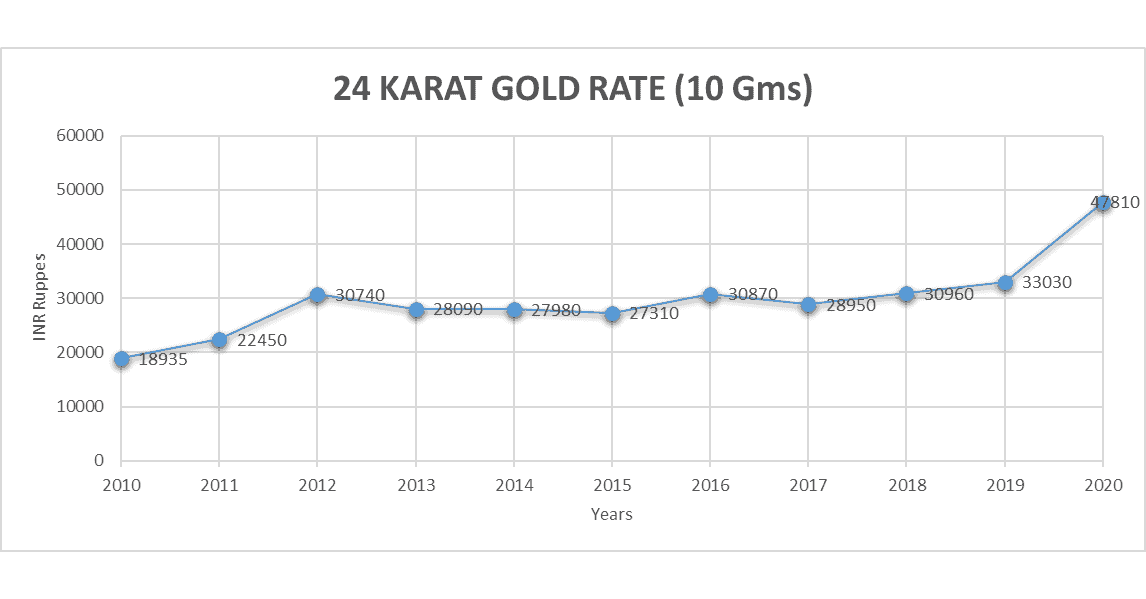

- In the above graph, we have demonstrated the price range of gold from 2010 – 2020 on June 19th. Initially, there was a price hike from Rs.18935 in 2010 to Rs. 30740 in 2012 at a growth of 27.37% per annum.

- From 2012 to 2018 the range started from 30740 to 30960, with a growth of 0.12% per annum. Even in that flat phase, there were fluctuations in price. The price even came down to negative growth in the years 2013, 2014, 2015, and 2017, for four consecutive years.

- 2019 and 2020 to date, the price is in high growth. This is due to the economic slowdown, the world trade war, and the COVID-19 pandemic.

Note: Like the Stock market, Gold price will also fall at some time, but while keeping it in the long run, it gives a growth of 8-10% per annum.

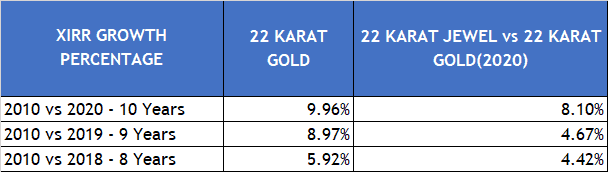

From the above table, we can find the growth of gold prices over 10, 9 & 8 years.

For example, when we buy 10 grams of 22 Karat gold with 15% wastage and 3% GST (it was VAT earlier) for Rs. 20859.

- The price of the same 10 gm gold was 29490 in 2018. This, the 8-year growth is only 4.42%.

- The price of the same 10 gm gold was 31470 in 2019. Thus, the 9-year growth is only 4.67%.

- The Price of the same 10 gm gold is 45530 in 2020. S0 the 10 years growth is 8.1%.

The ornament that you buy with the addition of wastage and GST taxes will not be considered while you sell the ornament back, they will consider only the current price.

Do & Don’t for Investors:

- In the long run of 10 periods, Gold can yield 8-10% annualized return, so gold can be considered as one of the portfolio allocations on wealth creation. You have to hold and consider in the long run.

- If you can trade Gold by opening a Demat account in the Commodity market, where there is no wastage or GST involved, you can get the maximum capital gain in gold, please don’t trade. Invest in Gold in the long run.

- If you can’t trade as the risk involved in the market, you can buy physical gold as 24 karats or 22 karats as a Gold Coin or Gold Biscuit, where the wastage is only 2% + GST 3%.

- In times of emergency, you can sell those gold coins and yield money.

- You should not save or consider Jewels as an Investment.

- Don’t buy gold at a high price, while the price curve is flat, which is the correct time to buy gold.

- Don’t buy gold for any emergency, since gold is used in an emergency.

- Never keep on exchanging jewels for new models. When it comes to exchanging jewels, all the while you have to pay more interest in Wastage.

Conclusion:

- When it comes to gold as an investment, you can consider it to be your part of the investment, you should not invest your whole money in gold.

- Gold should be an alternative to emergency funds, while your emergency funds exhausted in some emergencies, you can pledge your gold and convert it into money and use it for your emergency.

- In this whole understanding, of Gold as an Investment, we were figuring out the graphical, XIRR calculation to make you all understand gold is not a good product to invest in in the long run, which yields less for a 7-9 years period, only when considering 10 years period Gold gives 8% returns.

- In Investment, it is not about the money you invest. It’s all about how long you invest, hold, and what percentage is the return.

- Considering the above points, instead of investing in gold in the long run, you can invest in the equity market. Especially, in passive mutual funds (Index Funds) which can give you an annualized return of 12% P.A.

- Above all, Gold is essential in every family. Every family should have some part of Gold.

- A minimum of 300-500 grams of gold has to be accumulated by a family, which they have to consider as an emergency fund rather than an investment.

This subject is completely taken from practical sense from most of the successful financial leaders and even from my mentors and myself.

If you have any thoughts or comments please do share with us. Also, if we need to cover up on any specific topic please let us know. We will work together in bringing valuable content to enhance the wealth of your life.