Table of Contents

Toggle

Happiest Mind Technologies which was started in the year 2011 and originated in Bangalore has decided to be a public company by offering an IPO (Initial Public Offering).

The company aims at a total of 702 Cr of investment through IPO with a price band of a share between Rs. 165 – 166. It brings almost 4.23 Cr shares to stock exchanges NSE and BSE.

The company with its tagline of “Born Digital Born Agile” has focused its business on digital business service (DBS). DBS shares almost 97% of the total revenue generated by the company.

Besides this, the company has laid a strong foundation across Product Engineering Services (PES) and Infrastructure Management and Security services (IMSS).

In addition, the company has focused on the most demanded and dominant technology services. They are focusing on new-age technologies like

- Artificial Intelligence.

- Big Data management.

- Analytics.

- Internet of Things (IoT).

- DevOps.

- Cloud engineering.

Happiest Mind Technologies being an IT core company offers its services to various industries. They are airlines, automobile, banking, FMCG, education, energy, healthcare, manufacturing, retail, and travel.

DISCLAIMER: We are not a SEBI registered advisor. We don’t promote any stock or mutual funds. Information shared is for a better understanding of a particular company. Always refer to your financial advisor before investing in equity instruments.

HAPPIEST MIND – Founder:

As an investor, you should be aware of the founder or Chief executive officer, who leads the Journey. In the market, New MD or CEO appointments will make a rally.

In this way, the founder and CEO of the company is Mr. Ashok Soota.

He is none other than the founder of Mind Tree, an IT consulting company. He started the company in the year 1999. Later in 2007, the company was listed in NSE, and BSE with an IPO launch. The company has oversubscribed by 103.29%.

Before Mind Tree, he was working as Vice president of Wipro.

With ample experience in Information Technology, he has demonstrated the growth of Mind Tree, L& T InfoTech, and Happiest Mind technologies.

So, Mr. Ashok Soota is himself a brand and completely focusing on new-age technologies. This IPO also will oversubscribe.

Digital Business Services:

The company’s key strength segment is DBS which holds almost 97% of total revenue.

The segmentation of digital business services as per FY2019-2020 are

· Digital Infrastructure Cloud (31.27%)

· SaaS (29.4%)

· Security Solutions (14.97%)

· Artificial Intelligence/Analytics (11.6%)

· Internet of Things (9.8%)

Happiest Minds Technologies is leading in front when it comes to digital business services when compared to its peers.

None of its peers have more than 50% of the revenue share from Digital businesses. The peer’s shares on digital business are,

1. Infosys (44%)

2. Mind Tree (49%)

3. Zensar (45%)

4. NIIT Tech (30%)

5. L&T InfoTech (38%)

Happiest Minds – Financial Analysis:

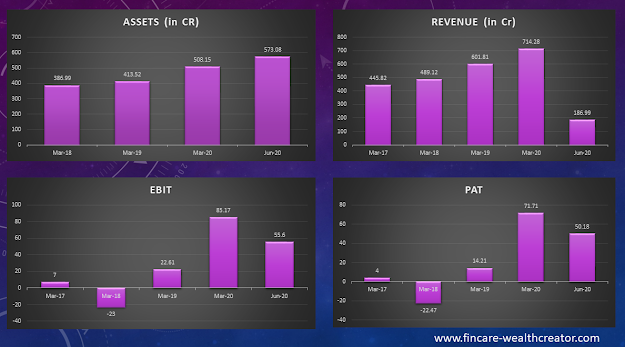

We could track the performance over FY2016-2020 and Q1 of 2020-21.

The company has shown a good track record in terms of performance. The profit is not huge only because of its expense and not on cash flow.

The above image will clear the financial background of the company. We have taken four major aspects to review,

· Total Asset.

· Total Revenue

· Earnings Before Income Tax (EBIT)

· Profit after Tax

There is a phenomenal growth in terms of total assets, from 386.99 in FY17-18 to 508.15 Cr by FY19-20.

Revenue has grown with a CAGR of 20.8% for the last 4 years. Also, in Q1 of FY 2020-21, the revenue is at 186.99. With this pace, the revenue will move towards 747.96 Cr by this financial year-end.

EBIT has moved from 7 Cr in FY16-17 to 85.17 Cr in FY19-20. There was nearly 23 Cr loss in FY17-18 still the company has come back strongly. The loss is mainly because the company has invested in R&D and expenses related to their employee’s salaries.

PAT has also grown after a loss from 2018 to -22.47Cr and bagged 71.71 Cr in FY2019-20. The interesting fact is, in the Q1 of FY2020-21, the PAT is addressed at 50.18 Cr. This is one of the strong points for investors to fall towards the IPO.

ROE (Return on Equity) has grown at a rate of 32.8% of CAGR.

ROCE (Return on Capital Employed) has grown by about CAGR of 27.8%

Sources:

1. Financial Report of FY2017-18

2. Financial Report of FY2018-09

3. Financial Report of FY2019-20

Excess Cash Per Share:

The excess cash is considered to be liquidable cash which a company has. The Excess cash is calculated by total liquidable Assets minus Total liabilities.

The data are taken from the Financial Report of FY 2020-21, the total number of shares held by promoters was 14.02 Cr shares

Liquidable Assets,

· Fixed Assets – Rs. 7.67 Cr

· Current Assets – Rs. 83 Cr

· Cash & Cash Equivalents – Rs. 43.52 Cr

· Other Current Assets – Rs. 224.77 Cr

Total Liquidable Assets – Rs. 363 Cr.

TOTAL Liabilities – Rs. 242.5 Cr

Excess liquidable Cash = Rs. 121 cr.

Excess Cash per Share = Rs. 8.63 per share.

P/E RATIO:

The P/E ratio is one of the fundamental analyses that we should calculate for IPO.

The IPO price band of Happiest Minds is Rs. 166. The Earnings per share is 7.21 (As per Financial Report of FY 2020-21). So the P/E is about 23.02 times its earnings.

INDUSTRY P/E: The Information Technology Industry P/E is 23.62.

So, the P/E is the same as to industry.

Happiest Minds – Customer Acquisition:

As the company rules the digital business services in India. It has made its strong footpath over the USA, the UK, Australia, and other parts of Asia.

The company has almost 148 customers out of India, of which 1 client serves more than 10 million USD of Business.

They have increased the client base, which provides a minimum of 1 million USD from 16 in 2018 to 25 in 2020. It has shown a growth of 16.04% on CAGR.

IMPORTANT DATES – HAPPIEST MINDS IPO:

1. Bid Opens – 7th September 2020.

2. Bid Closes – 9th September 2020.

3. Finalization of Allotment – 14th September 2020

4. Initiation of Refund – 15th September 2020.

5. Credit of Shares to DEMAT Account – 15th September 2020.

6. IPO shares listing Date – 17th September 2020.

Important Information on IPO:

· Price band of a Share – Rs. 165 to Rs. 166.

· Lot range – 1 to 13 Lots

· Lot size – 90 Shares

· Minimum Shares – 90 Shares = Rs. 14,940.

· Maximum Shares – 1170 Shares = Rs. 1, 94, 220.

· Promoters Shares – 356 Lakhs Equity Shares.

· Fresh Issue for Sale – 66 lakhs equity Shares.

Strength:

· Founder Mr. Ashok Soota as a brand.

· Assets are growing year on year.

· Focusing on Digital Business Services.

· Strong Growth in Q1 of FY 2020-21.

· Focusing on new-age technologies like AI, Big Data management, Cloud, and DevOps.

· Revenue growth of 20.82% year on year.

Weakness:

· Growth in profit is a concern.

· The Intrinsic value is nowhere around the current price band.

· Expenses are increasing year on year.

Click here, to open a free DEMAT with Angel Broking

Conclusion:

· As per the business model the company is very strong and well-focused.

· The technologies that the company is focusing on will be the future of the IT industry. Holding 97% of revenue in digital business services is always an added advantage.

· The Current price band of IPO is not suitable for long term investors. The intrinsic value is between Rs. 86 – Rs. 113 per share.

· Fincare Wealth Creator doesn’t promote IPO, as it is mainly used as a material for trading. Investors should wait for the opportunity.

· Finally, Happiest Mind Technologies is the best company to invest in for the long term, but you should wait for the correct value in the market.