Table of Contents

ToggleHDFC Life Click 2 wealth plan is a Unit Linked Insurance plan (ULIP). Investors should understand there is an equal difference between insurance and investment.

Investment is a method by which you grow your money by depositing in FD, RD, Bonds, and other equity securities. The main aim of the investment is to yield a return in the long term which will beat inflation.

Insurance means, securing our family. It doesn’t mean to grow money. That’s the reason Fincare Wealth Creator promotes only pure term insurance to secure your family.

In this topic, you should understand,

- What is ULIP?

- Overview of HDFC click 2 wealth plan.

- The advantage over other ULIP plans.

- Disadvantages over equity investment.

- Insights for investors.

Unit Linked Insurance Plan (ULIP):

ULIP is the plan by which an individual can invest and insure at the same time. Some portion of the premium amount goes to the insurance category and the rest will be invested in materials like mutual funds. Both equity and debt instruments.

ULIP is promoted for long term investments like planning for children’s education, retirement, etc. It also provides tax benefits under section 80C.

ULIP has market exposed risk, and there is no fixed return like FD, RD, debt funds, etc. However, it is market-linked, and the expenses of the product are more huge than equity mutual funds.

There are many charges related to ULIP. They are

- Fund management charges

- Premium allocation charges

- Admin charges

- Discontinuance charges

A ULIP plan will be comprised of multiple plans and it is easy for a policyholder to shift between the plans at any point of the policy tenure.

So many ULIPs are designed in a way that policyholders can’t track the NAV, its holdings, and other details as transparent in mutual funds.

A ULIP should hold a minimum of 5 years as a lock-in period. So, the investment material is illiquid.

Overview of HDFC Life Click 2 Wealth Plan:

The plan is comprised of almost 10 plans

- Diversified Equity fund

- Bluechip fund

- Balanced fund

- Bond fund

- Discovery fund

- Equity Advantage fund

- Opportunities fund

- Liquid fund

- Bond plus fund

- Secure advantage fund

The plan has a minimum lock-in period of 5 years. The policy can last for 40 years.

There are three types of plan options an individual can choose from:

1. Invest Plus: This plan comprises a combination of insurance and investment

2. Premium waiver option: This plan is used to secure your family. In terms of the policy payer’s absence, the remaining premium will be paid by the company. Also, the life cover will be extended till maturity.

3. Golden Years Benefit option: This plan is completely focused on retirement planning. This is the only plan which has a half yearly payment method. Life cover is obtained until 99 years and has legacy transfer facilities.

- The fund management cost is about 1.35%

- It offers an additional 1% of the annualized premiums to your fund for the first 5 years.

- Return on mortality charges on maturity.

- Choice of transferring between all the 10 funds.

- Top up of premium is available about 125% of the sum assured amount.

- Partial withdrawal of the amount is available at the time of emergency.

Death benefits:

- The nominee can withdraw the securities against the current fund value (NAV).

- 105% of the sum assured amount will be paid to the nominee as the death benefit.

- In the case of the premium waiver option, the remaining premiums will be waived off and the coverage will continue till maturity.

Advantage of HDFC Life Click 2 Wealth over other ULIP Plans:

There are a few advantages in comparison with other ULIP plans.

- The plan has only fund management costs. Unlike other ULIP plans, there is no premium allocation, policy admin, partial withdrawal, switching, discontinuance, premium redirecting, or miscellaneous charges.

- Even the fund management charges are lower than compared with other ULIP plans. The charges are 0.8% for liquid and bond funds and 1.35% for other funds.

- A special addition of 1% is paid to the annual premium paid in a year for 5 years.

- Unlike other ULIP plans, the HDFC ULIP plan has a benefit for investors to track the fund performance and NAV.

Disadvantages of HDFC Life Click 2 Wealth Over Equity Mutual Funds:

- When it is compared to mutual funds, there are many mutual funds with low expense ratios.

- Axis bluechip funds and UTI Nifty Index funds are top-performing funds in the equity market. These funds have an expense ratio of 0.51% and 0.1% respectively.

- Mutual funds are highly liquidable. Even the tax saving mutual funds (ELSS) have only a 3-year lock-in period.

- No investor will be able to track their holding in this ULIP policy. As per a survey, most people don’t know even the policy name. So, shifting between the funds is merely impossible for any intelligent.

- Mostly all the ULIP policies are regular funds. We always recommend investing in direct funds.

- Even this ULIP plan doesn’t have the visibility of its holding. Mutual funds have complete transparency in terms of their holdings.

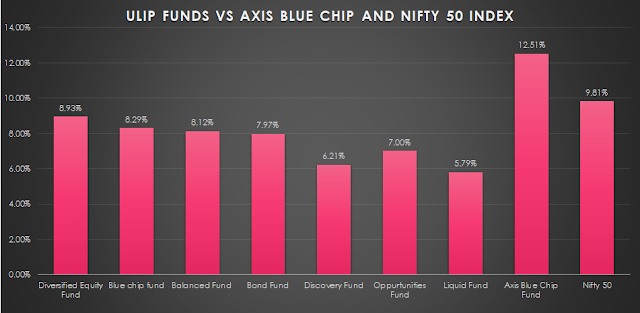

In the above image, you can find all the funds of HDFC click 2 wealth ULIP holdings that have completed 5 years. There are 7 plans which have been completed in 5 years. We have compared it with a performing axis bluechip fund and also the Nifty 50 index.

- There are no funds that have performed more than the Nifty 50 Index.

- Even the liquid fund is 5.75, where the category average is at 7.5%. This is the major disadvantage of these ULIP funds. You can’t find the exact reason for the worst performance when compared to the category average.

- There are many hidden charges other than fund management costs. They are,

§ Partition of amount for Insurance

§ Mortality charges (age 25 – 0.1%; age 30 – 0.11%; age 35 – 0.13%; age 40 – 0.19%; age 45 – 0.28%; age 50 – 0.49%; age 55 – 0.83%; age 60 – 1.23%)

§ GST – 18%

- Not all premiums are paid into investment. So the exact return for the premium amount invested will be 20-35% less than the NAV return which is shown in the above image.

- If this is the scenario, no investment will beat inflation.

Insight for Investors:

- Investors shouldn’t collapse between investment and insurance. Fincare wealth creator prefers only pure term insurance as a type of insurance to protect your family.

- In terms of investment. If the investments are long term, it should beat inflation. With the performance minus the hidden charges, no fund will beat inflation in the long term

- The low risk funds like debt materials are yielding only 5.7% even in NAV performance. If we calculate removing the charges it will be around 4% only.

- This policy will be attractive for every individual because of their promotions and the advantages they offer.

- When you fail to analyze, you will be under the trap. These kinds of products are promoted for tax savings. For tax savings, you can go with ELSS, most funds have overperformed the index.

- If you need to grow your money, you can choose fixed-income instruments for short-term goals. Equity and Index funds for long-term goals.

- As a goal based investor, avoid ULIP plans for sure. Be an intelligent investor and grow your wealth.