Table of Contents

ToggleIn our previous topic on Retirement planning, we have got a fair idea of how important is retirement planning, and also we calculated the required corpus while we retire.

On average, we require 3-5 Crores as corpus when we retire to live till age 75 (average life expectancy in India), before retiring, we should have Medical insurance. So, there will not be any impact on the corpus we saved. Here, we are about to go with the following topics to discuss

- What asset to choose?

- Understanding the Risk and reward of asset classes.

- Risk appetite.

- Asset allocation during the retirement phase.

What Asset to Choose:

Before planning on an investment strategy for retirement, the main thing which we have to understand is, choosing the assets to invest wisely.

· We have to understand the asset should have quick liquidity at the time of the retirement period. “An illiquid asset is always a liability”.

· The second most important thing is “Income Accumulation followed by Income generation” is what we should focus while investing.

Keeping these two things in mind we have to look at choosing the asset class.

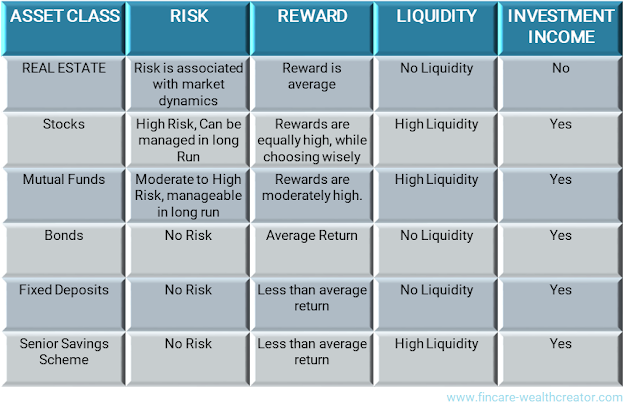

These are the few asset classes with high liquidity and income generation as interest or dividend.

1. Stocks – High Liquidity & Income generation as price increases and a dividend yield

2. Mutual Funds – High Liquidity and the returns are on average of 10-16% per year

3. Bonds – Low liquidity, but they can be sold in the secondary market at the time of an emergency. Anyhow, we can earn interest as income. This can be withdrawn every year or can be accumulated

4. Debt Funds – High Liquidity, the average return, and will be the same as inflation.

5. Fixed Deposits – Low liquidity, but can redeem the yearly interest, which can be considered as income

6. Real Estate – Considerably no liquidity and no income generation until we sell it. Why is termed as no liquidity? If our car defaults with sudden breakdown we can’t get any money for that emergency from real estate. This is why we term real estate as illiquid during our retirement period.

We have touched on the two criteria for the selection of asset class liquidity and income generation assets.

Understanding Risk and Reward of Asset Class:

The second part is to understand the risk and reward of the asset class. Every asset class has its own risk, reward, and risk management. The only thing is how we handle all these.

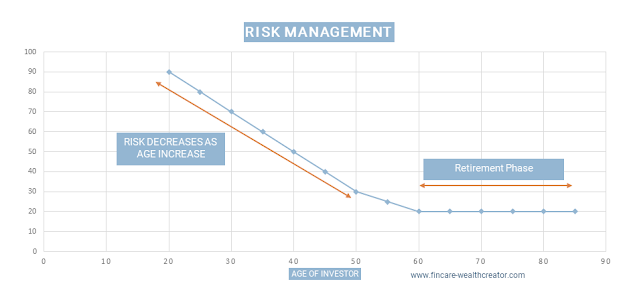

· When we are young, say at age 20 we start our retirement planning’s, then we have a long runway for more than 25 – 30 years, still we can plan to retire at 45.

· As an early starter, we can handle the risk very. So our major asset allocation will be at high risk and high reward components.

· While we start investing in the middle age period, (i.e.) age 35-45. We have a shorter runway and we can’t take on complete high risk, we have to segregate our investments between high, moderate, and low-risk components.

· If we are a later comer into an investment, after 45. The time period to investment will be only 10-15 years, so it will be a very short runway for us to accumulate the desired corpus.

· At this period, the risk cannot be managed as at the age of 25, the amount invested will become higher to manage the risk and reward as we will be choosing low-risk funds.

|

As the age travels, the risk has to come down in retirement planning, and during the retirement phase, the total corpus has to be at low risk, income generating with high liquidity investments.

Risk Appetite:

This is considered the most important once we know about risk and reward. Appetite means, how much risk we can take. This is cannot be constant over all ages and it is not necessary to maintain the same way of risk during the retirement phase. To understand more we can split this into three phases

- Initial Earning Phase (Age: 20-40)

- Nearing Retirement Phase (Age: 40-60)

- Retirement Phase (Post-retirement)

|

| RISK APPETITE ACROSS AGE’S |

This is the most ideal phase to start our investment planning for retirement. One who starts their investment over this phase will have a good long run can easily manage risk and will earn a high reward.

In this period up to 60%, we can have our investments our high risk direct stock, equity mutual funds. 40% in bond, and fixed income materials. If needed, we can invest in real estate also with the right price. Anyhow, we have to sell those properties before we retire to have liquid cash.

Nearing Retirement Phase (Age: 40-60):

This is the final range in investing for retirement corpus, after which the retirement phase starts. So, our high-risk investments will come down and low-risk investments have to be increased in our assets. So that we will have more liquid cash investments, this way of handling will lead to a happier retirement.

Retirement Phase (Post Retirement):

This is the phase after retirement. So, people continue to work on their passion. Retirement is not termed as quitting from earning. This is the phase for following passion and enjoyment.

Here, we have to look at having high liquidity investment material and income generation with low-risk investments like bonds. As mentioned in the graph above as the age increases our investment risk has to come down, but actually during the retirement phase, it has to be flattened. The maximum risk u can handle during this period is 20%.

Asset Allocation During Retirement Phase:

Before moving deep into this section, we have to understand what to do before planning retirement or moving towards retirement is making our emergency funds in cash or in the bank which has immediate liquidity.

The Next thing is if we are been employed and receive EPF from our employer, please don’t withdraw any of the amount until we retire, because the interest rate is 8.5% with EPF (Employee Provident Fund). Now let’s move towards the asset allocation during retirement.

· 40% of our investment should be of ready liquid cash or in the bank account, preferably senior citizen savings scheme offered by the post office, where the interest rate is 6.8% P.A.

· Next 40% of our investments should be parked in 10 years bonds offered by RBI or GOI where credit risk is Zero. You can earn yearly interest, which will be a sort of pension. Currently, the interest rate varies between 7.75-8.5% per annum.

· 10% of the asset class can be parked in Index mutual funds and this funds should have a history of minimum 15 years of investments, we should not start investing in any of the equity funds after retirement, where people can’t digest the risk appetite.

· 10% of assets can be maintained in stocks to transfer to our children, Should have only the stock that provides their investors with the dividend. This will be also an income for the retired people.

Apart from this, we can have NPS, which provides a monthly pension. The only disadvantage in NPS is investors should invest till 60 years of their age. Anyhow, it provides a nominal return of 9-10% P.A.

Conclusion:

· Once, we all understand the benefit of accumulating retirement corpus. We have to understand the investment process and income flow

· Understand, that during retirement, we have to maintain risk adjustment as well as income generation through investments.

· Before reaching the retirement phase, we should have medical insurance and a 1-year emergency fund.

· We should always invest in assets that have high liquidity, income accumulation, and generation.

· Risk appetite has to be managed well with age, age is always inversely proportional to the risk.

· Plan well on the asset allocation during the retirement phase.