Table of Contents

ToggleInfosys Shares, one of the stocks which occupy every investor’s portfolio. The second-largest Information tech company based out of Bangalore has released the Q2’2021 result. In the Q2’2021 result, they have posted a huge profit of 20.5% in Net profit compared to last year.

It has posted a growth of 14.45% compared to the previous quarter posting Rs. 4845 Cr of Net profit. The result of the company has surpassed the expected growth of the industry experts around 2-3% growth. It has surpassed the results of both TCS and Wipro results.

Kindly have a look at,

In sharing the success of Q2’2021 achievement, they have shared two good news to employees i) hike effective 1st January 2021 and promotions to all levels ii) 100% variable pay, and Incentives to employees for Q2’2021 performance.

Also, they have announced an interim dividend payout to their shareholders. The interim dividend is Rs. 12 with a record date of 11th November 2020.

Apart from quarterly results, It is always important to find the financial and fundamental analysis of a company.

Infosys Shares – Business Overview:

As an organization, the main theme of operation is “Sustainable and Resilient”. In the same way, providing sustainable solutions to clients on their business needs through digital and core business mediums.

Unlike, Wipro and TCS, which is currently investing in digital platform solutions like Agile technology, Data Analysis & Artificial Intelligence, Cloud infrastructure, etc. Infosys has already started to increase its share of revenue in digital business.

The main strategies the company has decided to look forward to in FISCAL 2021 are,

- Digitalization of processes.

- Migration to Cloud based Technology.

- Workplace and business transformation.

- Cyber Security Controls.

- Cost Structure Optimization in IT.

They provide solutions on two bases, in which their total business revenue depends upon

- Digital

- Artificial Intelligence and Analytics

- Big Data Management

- Engineer Digital Products

- IoT (Internet of Things)

- Cloud Application

- Cyber Securities

- Core

- Application Management and Development Services

- Independent Validation Solutions

- Product Engineering and Management.

- Infrastructure Management Services.

- Enterprise Application Implementation

- Support and Integration services.

The company has completely focused on improving productivity with better cost management for its clients. This will eventually give more return on investment. They have huge digitalization and better AI products. Their products and platforms are,

- Finacle

- Edge Suite

- Infosys NIA

- Infosys McCamish

- Panaya

- Skava

- Stater Mortgage Servicing Platform

- Wingspan

The company has been awarded by Forbes as the “3rd Best Regarded Company in the World”.

Business Segment and Revenue Split UPS:

The major business comes from Financial Services and Insurance. It accounts for 31.5% of the total revenue of FY2019-20.

Let us see the revenue bifurcation from services,

- Financial Services and Insurance – 31.5%

- Retail Business – 15.5%

- Communication, Telecom, and Media – 13.2%

- Energy, Utilities, Resources, and Services – 12.9%

- Manufacturing – 10.1%

- Hi-Tech – 7.7%

- Life Sciences and Healthcare – 6.4%

- Others – 2.7%

In the last two years, the digital business has grabbed a share of the CORE business.

- Digital Business has grown from 31.2% in 2019 to 39.2% in 2020. The Digital business has grown at a CAGR of 35.91% over the last two years. Currently, the Digital Business share is 47.31% as of Q2’2020-21

- The CORE business has fallen from 68.8% in 2019 to 60.8% in 2020. As of now the CORE business share of Q2’2020-21 is 52.69%

- This has clearly shown, that when their peers are concentrating on digital businesses, they are improving the revenue share. Business dominated by nearly 50% is a huge positive for the companies next 10 years’ growth.

The business has penetrated all across the world. The geographical split of the revenue as per Q2’2020-21 is,

- North America – 60.72% vs 61.5% (FY2019-20)

- Europe – 24.33% vs 24.1% (FY2019-20)

- India – 3% vs 2.6% (FY2019-20)

- Rest of World – 11.95% vs 11.8% (FY2019-20)

The business is strongly dominated in America and Europe. The changes in the revenue splits are negligible.

Client Base:

- The client base for FY2019-20 is 1411 clients. In the last 4 years, the client base has grown at a CAGR of 6.62%. The client base in FY2015-26 was 1092 clients.

- The number of $USD 100 million+ client base has grown from 14 in 2016 to 28 in 2020. Which is a phenomenal growth in terms of high volume clients.

Infosys Shares – FinancialNFOSYS SHARES – FINANCIAL PERFORMANCE:

Once we got a steady message on business and company profile looking at the future. Let us confirm whether their strategies have been honored through financial performance

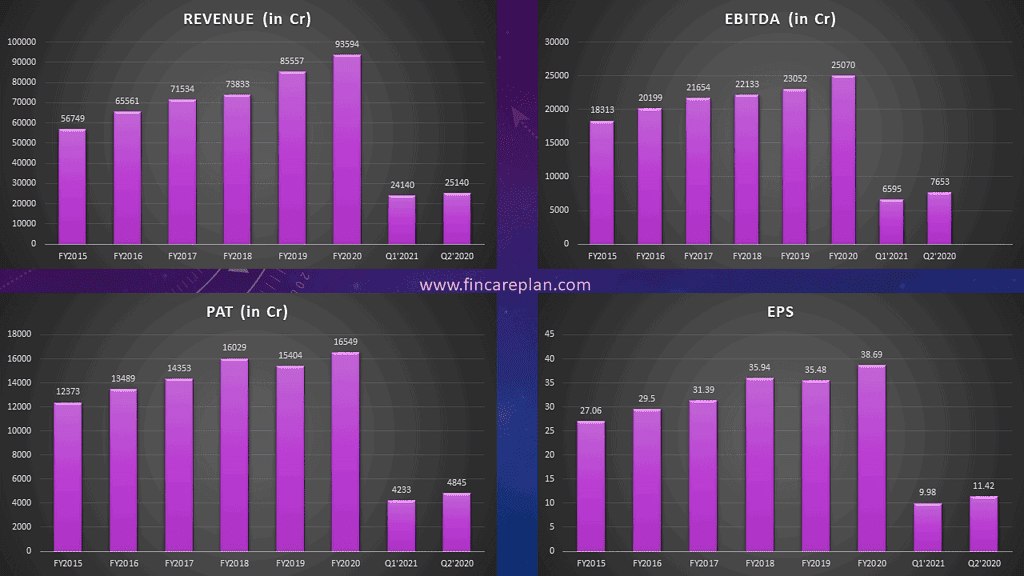

The above image will give you a clear idea of the last 5 years and the last 2 quarters revenue, EBITDA, PAT, and EPS. You can see only in FY2019, PAT and EPS have shown a fall than the previous year. Other than that, all the year’s performance has shown at least a minimum growth than the previous year.

- The 5 years revenue has grown at a CAGR of 10.52%, which is higher than the industry average. The industry average revenue has grown at a CAGR of 9.83%.

- EBITDA has grown at a CAGR of 6.49% per annum in the last 5 years.

- Net profit has grown at a CAGR of 6.05% in the last 5 years, which is very low compared to the industry average. The industry average is at a CAGR of 8.06%

- The market share has increased from 17.81% to 18.57% in the last 5 years.

Fundamental Analysis – Infosys Shares:

Number of Shares – 425.89 Cr Shares

Market Capital – 4,72,002 Cr

Valuation Ratio:

The foremost analysis we should do on fundamental analysis.

- Book Value – Rs. 153.67

- Price to Book value – 7.21

- Earnings per share (TTM) – 42.1

- Price to Earnings (P/E) – 26.32 (Very Expensive)

- Industry P/E – 26.98

- Dividend Yield – 1.58%

- Debt to Equity Ratio – 0%

- Current Ratio (Asset/Liabilites) – 2.62

- Interest Coverage Ratio – 130.45

- Return on Equity (ROE) – 25.35%

- Net Profit Margin – 17.63%

- Free Cash Flow – Rs. 13696 Cr

- Enterprise value / EBITDA: 17.54 (Overvalued)

Shareholding Pattern:

- Promoters – 13.16%

- FII – 30.43%

- Financial Institutions – 0.05%

- Insurance Companies – 11.43%

- Mutual Funds – 13.84%

- Other DII’s – 20.96%

- Retail Investors – 10.12%

Excess Liquid Cash Per Cash:

Total Liquid Assets:

- Fixed Assets

- Investments: Rs. 7754 Cr

- Other Financial Assets: Rs. 642 Cr

- Current Assets

- Investments: Rs. 3600 Cr

- Cash and Cash Equivalent: Rs. 22411 Cr

- Other Financial Assets: Rs. 6359

Total Liquid Asset: Rs. 40766 cr

Total Liabilities: Rs. 27114 Cr

Excess Liquid Cash: Rs. 13622 Cr

Excess liquid cash per share: Rs. 31.98 per share

Intrinsic Value:

EPS (TTM) – Rs. 42.1 per Share

5 years EPS Growth – 6.05%

1 year EPS Growth (TTM) – 17%

5 years of revenue growth – 10.25%

Even if we consider, last TTM EPS growth of 17%, EPS (TTM) of 42.1, and Margin of Safety at 20%.

The intrinsic value will be around – 839.

The current share price is 32.4% overvalued than the intrinsic value

Insights to Investor:

- One of the best equity shares in terms of performance.

- Amid the COVID situation, the Q2’2021 result has shown 20.1% growth compared to last year.

- The business process of digital solutions which shares nearly 47% of total revenue will be the highlighting point to discuss when compared to peers in the business overview

- Strong business plan, management, and employee retention rate. Serving benefits for employees and shareholders with hikes and dividends.

- Strong financial performance year on year in the last 5 years in terms of revenue.

- Despite all the positive on the share, it is currently traded at 39% higher than the intrinsic value with an estimated 17% growth the next year. the expected growth is the maximum, which is not sure.

- As an Intelligent or Contrarian Investor, You should wait for the share price to come below the intrinsic value.