Table of Contents

Toggle

Mazagon Dock comes for IPO, which is a Central government based company. The promoter is the President of India. The promoter holding was 20.17 Cr shares. The company was started in the year 1934.

The company is the leading defense public company that works under the Ministry of Defense. Their major functionalities are

- Construction of warships

- Construction of Submarines

- Merchant Ships

- Other vessels for commercial clients.

The company is located in Mumbai and Nhava. The main aim of the IPO is to,

- Invest in the company’s growth by reinvesting of 15.17% of shares to the public.

- Entering into the stock exchange.

The offer can be opted by,

- Retail Investor – 35%

- Non-Institutional Investors – 15%

- QIB Investors – 49%

- Eligible Employees – 1%

The bid of a share in the IPO stands between Rs. 134 to Rs. 145. So, the total capital the organization is looking after is Rs. 443.69 Cr. This issue is completely an offer for sale and there are no fresh issues.

By this IPO, the promoters are selling almost 3.06 Lakhs of shares. Let us understand the complete details of

- Business Overview

- Financial Performance

- Fundamental Analysis

- Peer comparison

Business Overview – Mazagon Dock IPO:

The company primarily looks after building warships and submarines for the Indian Navy. They also do the repair and refit works of the ships.

The company holds a total capacity of 40,000 DWT. By 2020, the company has produced almost 795 vessels which include,

- 25 warships

- 4 missile boats

- 3 Submarines

- 6 Lender class frigates

- 3 Godavari class frigates

- 3 Shivalik class frigates

- 3 Corvettes

- 6 Destroyers.

It is one the largest public-sector defense companies, which constitutes Goa Shipyard Limited under their groups.

Few key launches they have made recently are,

- Vela – Fourth Scorpene Class Submarine.

- IMPHAL – Third Destroyer project 15B

- Karanj – Third Scorpene Class Submarine

- Mormugao – Second Ship of Project 15B

- KALVARI – First Scorpene Class Submarine

The company is focused on building Naval and Merchant Ships. The major revenue flows are from,

- Ship Construction – 4422.39 Cr (80%)

- Sale of Base and Depot Spares – 388.91 (7%)

- Ship repair – 158.93 Cr (2.8%)

- Miscellaneous Sales – 1.18 Cr (0.002%)

- Sale of scrap and stores – 5.34 Cr (0.01%)

There is a huge demand in the industry and there are only a few companies to support the demand in India.

The shipbuilding industry is growing at a CAGR of 13.4% with a 943.4 Cr industry value in 2015-16.

The company holds an 18% market share of the Ship repairing Industry, which is the second largest in the ship repairing industry. Cochin Shipyard dominated with 38% of the market share.

The shipbuilding and repairing industry has huge demand both domestically and internationally.

The company has strong growth plans and the major disadvantages will be

- Changeover of political parties.

- Union Budget allocation.

- Quality issues have to be often.

Key Strengths of the Company:

- Only one public defense company is constructing submarines.

- World-class infrastructure, in serving the demands of the Indian Ministry of Defense.

- Location – which is closely associated with vendors and clients.

- Increase in Indigenization of vessels.

- Established strong financial and order books track record.

- Experienced Management and well-equipped Engineers.

- Zero Debt Company.

- High Dividend-yielding company.

Financial Performance – Mazagon Dock IPO

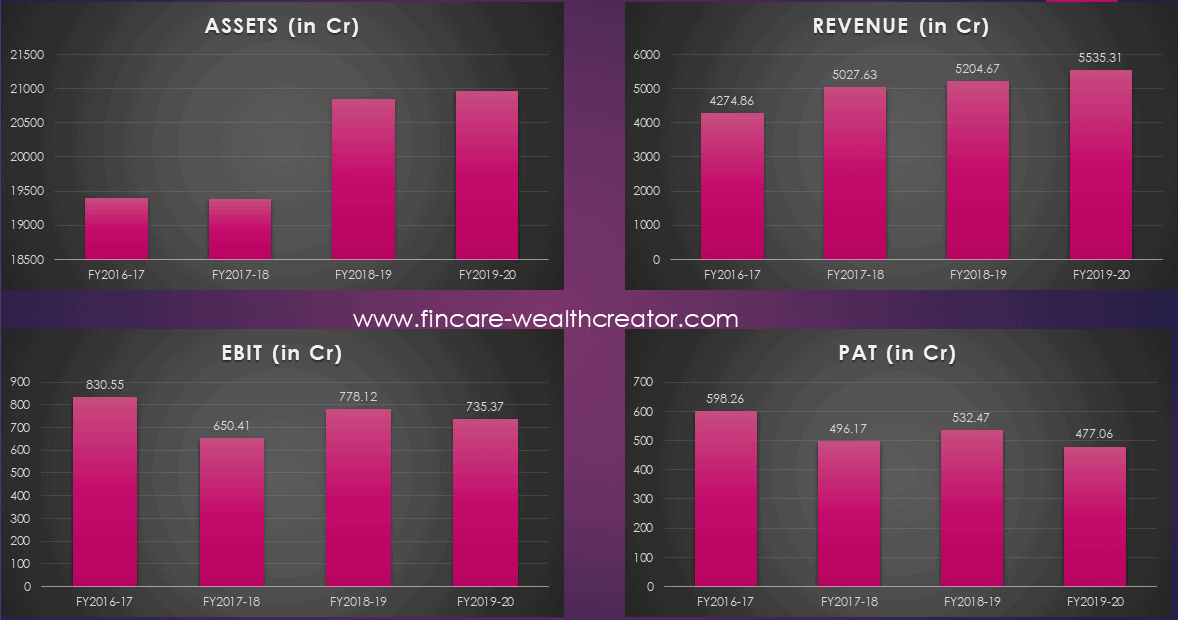

The above image is the track record of financial performance from FY2016-17 to FY2019-20.

- Revenue has grown by a CAGR of 12.25% in the last 4 years. Last year’s growth in revenue is 7.88%. Even though the revenue growth has come down, there is still a decent growth in the organization.

- Even though the EBIT and PAT have come down in years, there was a pattern in which 1 year the PAT moves up and the other year the PAT comes down.

- Financially the company is strong as the company asset is grown strongly over the years.

Fundamental Analysis – Mazagon Dock IPO:

- EPS – 21.36 (FY2019-20)

- EPS is degrowing year on year as PAT degrown.

- P/E – 6.78 (Attractive)

- Industry P/E – 11.25

- ROE (Return on Equity) – 4.59%, the ROE is growing year on year.

- ROCE – 6.49%. Like ROE, ROCE is also increasing at a decent rate.

- RoNW – 15.54% (FY2019-20)

Peer Comparison – Mazagon Dock IPO:

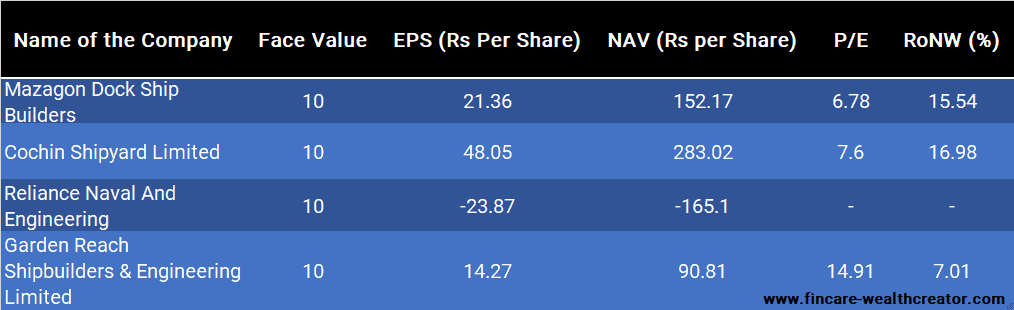

Please the above picture clearly and find the peer statistics of the fundamental business behaviors.

- Least P/E when compared to Peers.

- NAV (Net Asset Value) per share is 152.17 share, which is a good sign. Only Cochin shipyards hold 283.02 Rs per share. As Cochin shipyards hold 38% of the market share.

- RoNW (Return on Net Worth) is about 15.54% which is equally the same as Cochin shipyards.

Insights to Investors:

- Attractive P/E ratio compared to the industry average.

- High dividend-paying company, this is one of the long term stocks to be in the portfolio.

- Zero debt and comes under the Ministry of Defence. The huge demand industry is growing at a good rate.

- The share price is less than the intrinsic value.