Table of Contents

ToggleThe most important lesson in personal finance planning is retirement planning, It’s not always how much we earn, rather how much we save is more important. Throughout our series on financial planning, we have stressed a lot about savings coming before expenses.

As we discussed in our topic on Home Loan, we have to plan to build our own home in the place we will be retiring. We all will be getting a good connection with that topic while we move forward.

Let us research on the following topic,

- Why we need retirement planning

- What is retirement

- When to Start Investing for Retirement

- Corpus needed for retirement – Calculation Based

Why we need Retirement Planning:

Most of us forget, there is a life after retirement. Retirement has no age limit. In some cases, they attain it at 50 years old, some don’t attain it even after 60 years of old.

This is only because of improper knowledge of financial planning. We have seen people build a home after retirement with PF corpus and close their debt at the age of 60 have no money to further their lives and depend completely on their children.

This is described to be the worst financial planning in life. We have to accumulate a corpus to enjoy our retirement life till death and give back the remaining corpus to our children and grandchildren.

Before retirement, we all should have accomplished our major humanity dreams or goals such as children’s education, marriage, a dream home, bike, and car. These things have to be achieved before retirement, if not your retirement the period will be of dreams.

When you plan well ahead in your career when cash flow reaches your bank account, you can achieve all this even earlier in your retirement age and possibly retire early. The reason for planning your retirement is the most important.

What is Retirement?

This is the most common thing which every employee has in their mind, that too on early retirement. Also, people think that retirement is the period after which we won’t work and spend the remaining days of life happily.

Retirement is not about quitting our work, it’s all about working, enjoying, and taking leisure breaks with family independently, which means will not be under the rules and regulations of an organization or a boss.

Your life becomes free from external stress and you can focus on your passion, and dream and have a good time with your family.

Anyhow, we can lead this discussion forward by the definition, most of us have, “After retirement, there is no work”

If we plan the retirement age as 60, then what is the total corpus we need to live till our last day, and how we can collect those funds, from when we should start our investment to achieve the same planning?

We have to remember, that the income stops at 60 and expenses continue to grow as inflation increases.

When To Start Investing For Retirement?

Employee:

The best advice is to plan from the 1st-month salary, a portion of income should be moved to retirement. Unfortunately, 99% of us might have failed in doing so.

The only thing that our company does a good part in our lives is automatically debit our PF amount and deposit it in an EPF account with the other half being paid by the employer.

Few retired government or bank employees will be receiving a pension every month, nowadays government has stopped pensions for its employees.

Self-employee:

In the case of the Self-employed Doctors, Auditors, Chartered Accountants, actors, and actresses can work till they decide to stop, there is no beginning for retirement, and so they don’t have the option pension as income flow continues till they decide to quit working.

At the same time, they have to understand life is not only about earning, but it should also be colored with more happiness with family. There needs a plan.

So, independent of the nature of the job or qualification, there should be two parts of our life.

- Where we have to earn, save, and enjoy.

- Another, follow our passion and enjoy it.

To have both the combination in our life retirement planning should be started at the age of 21-25. If not started yet, today is the best day to start planning your retirement.

Corpus Needed For Retirement:

The corpus is the total amount you have as cash or liquidity oriented assets like stocks, mutual funds, bonds, and fixed income deposits, by which you live your total life span.

We have to understand this, it is not a condition for our children to look after us while we retire, it’s our duty to accumulate a retirement corpus and hand a few of our assets to the next generation while we move out of the world.

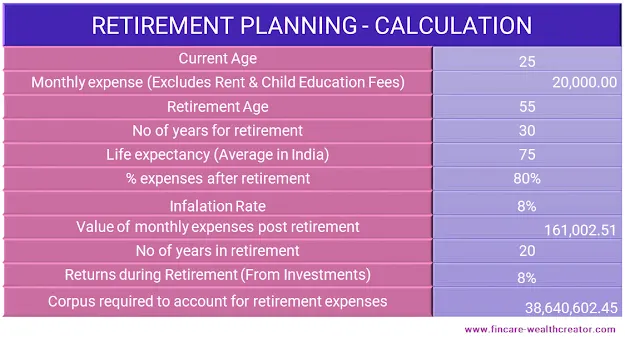

So, for a person at the age of 25 to start retirement planning, Things he should consider while planning

- Age of Retirement

- Current Monthly Expenses (Excluding all savings, investments, children’s marriage, and educational expenses, as these things will not exist in our retirement period)

- Life Expectancy – In India, Life expectancy is 75 years (Average)

- Inflation rate – Currently it is at 8%

- Return on Corpus Investments – The average return that we plan to yield from the total corpus, as we know money has to grow. We will be investing in fixed-income materials or debt funds where market volatility is not involved, but we have to invest the corpus for the return.

Considering all these factors in mind, we have done a calculation. Please find the below image.

So, the total corpus the person should have in his hand or his asset allocation for retirement should be 3.86 Crores. Is it possible is not where we should focus, we should focus on how we can attain the corpus to lead our retirement life peacefully.

The only way to attain this huge corpus amount is by starting to invest yearly, so if the same person starts investing in various asset classes like stocks, bonds, debt funds, EPF, NPS, and PPF at the age of 25, they will have 30 years to invest, and if they add 10% of amount every year adding to their investment portfolio, then they should start Rs.6000 every month from age 25 and incrementing 10% every year till the year of a planned retirement. The rate interest planned is 10% per annum.

To access the calculator, click here

Conclusion:

Retirement planning is very vital and should be started at an early age. Retirement is not something to take a rest and enjoy the rest of life, it’s a condition of freeing ourselves from stressed jobs and following our passion.

There is still life after retirement, where income declines and expenses rise.

Don’t give a burden to your children by not planning and saving corpus for retirement, instead give them some assets while you move out of the world.

Start investing Rs. 6000 and incrementing 10% every year, expecting 10% of annual return to accumulate the corpus of 3.86 crores.