Table of Contents

ToggleThis will be the pop-up question for beginners who have a home loan. Pre-closing the home loans or investing. The interesting fact lying here is making people in double minds and never start to invest.

This topic will cover all permutations and combinations of the new investors having loans, which eat their wealth. So, you will wear the same shoes and check whether to close the loans first or to start investments.

At the end of the subject, you will come to know why you should close your loans on top priority by 10 years and have a few investments side by side to create wealth over 20 years

Prepayment of Home Loan or to Invest – Top Priority:

More than differentiating both steps, you should focus on achieving both things in equal parallel.

Home loans will erode your wealth, whereas investing grows your wealth.

· The foremost priority and focus should be towards the pre-closure of home loans.

· At the same time, you should build an emergency fund. The other goal-based investments are not a compulsory one.

· The people who all have home loans should try to save a minimum of 50% of their salary by completely avoiding their WANTS.

· If the home loan is the only debt they have, they should avoid all future debt and have to close as soon as possible.

· Avoid unwanted expenses like family trips, eating outside foods, frequent travels, overspending shopping, and all materialistic dreams like a Car, Big Inch TV, and the most expensive appliances, until you close all your home loan debts.

· The 100% focus of life should be on closing the Home loan debt and making our life debt-free.

The compound effect applies to everyone’s life. The compound effect makes people rich for those who invest and save. It makes the people poor, who keep on creating their debts.

Home Loan and Income Tax:

Most people who are employees, opt for home loans as a tax exemption tool. Currently, people can exempt their tax up to 3.5 lakhs in both the principal and interest they pay.

Unfortunately, many people pay tax even after paying exemption loan interest and principal up to 3.5 lakhs.

We have written an article on Tax planning, where you can be tax-free up to 9.5 Lakhs even without a home loan.

Considering the fact above, you should pay to take only if get an annual pay of more than 12 lakhs. If you pay taxes having a home loan, you should book an appointment with a tax consultant and plan your tax exemptions.

You should invest 1.5 lakhs in Section 80C, where EPF will be the main component, the rest of the amount should be invested in the ELSS scheme. Please have a look at ELSS VS PPF.

So, this ultimately invests in you even if you have a home loan.

How Much You Save If You Pre-Pay The Home Loan?

In this section, you will understand the benefits of closing the loans in 15, 10, and 5 years. Most of the home loans are taken for a tenure of 20 years.

Let me assume, an average home loan of 30 lakhs with 20 Years of tenure for an interest rate of 8.5% per year.

Principle Amount – 30, 00, 000.

Interest to be paid – 32, 48, 327.

Total Amount after 20 years – 62, 48, 327.

The monthly EMI will 26, 035.

The calculation and documents were taken from the HDFC Home Loan Calculator.

1st Year – 2.52 lakhs Interest to pay & 0.59 Lakhs principal to pay

20th Year – 0.14 lakhs interest to pay & 2.98 Lakhs principal to pay

This is how every home loan works, as it has the pre-closure option. Initially, all your EMI deposits will cover the Interest amount only.

So, to reduce this very quickly, you have to deposit more amount in the principal amount which is apart from the monthly EMI amount.

The loan amount we took here is 30 lakhs. To avail 30 lakhs home loan, the minimum taxable income which is taken home will be 10 lakhs a year.

Monthly income – Rs. 83,000.

Monthly EMI – 26, 035. So, the remaining amount – Rs. 56, 965.

Split this into four categories,

1. Basic NEEDS for life – Groceries, Vegetables, fruits, milk, water, electricity bill gas bill, Children’s education RD or Savings, term insurance, medical insurance premiums, etc.

2. Emergency Fund – Of course, independent of the status of your life, you certainly need 6-12 months as an emergency fund. As a newbie to investment life, you will not have an emergency fund.

3. Investments – If you still believe you can invest a few amounts in Index equity funds remaining you can deposit in a home loan.

4. Other funds – The total The remaining amount will be used as an additional amount to monthly EMI in closing the home loan as quickly as possible.

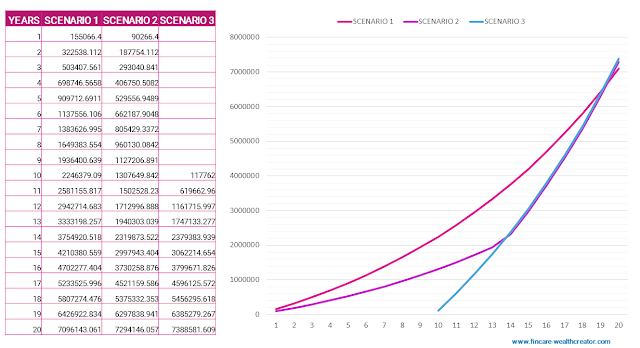

Let us take this situational analysis into three categories and will find benefits over each scenario.

SCENARIO 1: An individual will only pay an EMI of Rs. 26035, Rs. 5000 for an emergency fund, NEEDS Rs. 40000, and 11,965 for Investment.

So, for Loan payment – 26305; Investment – 11,965.

SCENARIO 2: An individual will pay an EMI of Rs. 26035 and add Rs.5000 as per payment for loan closure, Rs. 5000 for emergency funds, Rs. 40000 for NEEDS, and 6965 for Investments.

So, for loan Closure payment – 31035; Investments – 6965.

SCENARIO 3: An individual will not invest any amount apart from an emergency fund of Rs. 5000 every month, Rs. 40000 for needs, and the remaining complete amount of pre-closure of the loan with the amount of Rs. 38000.

So, Loan closure payment – 38000; Investments – 0.

Will do a detailed analysis of two parameters:

1. How many years it will take to close the loan in each scenario?

2. At the end of 20 years, what will be the wealth created? Considering, that once they complete the loans, the complete amount will be deposited towards the investment of a minimum of 8% returns per year.

Analysis On Three Scenarios:

1. Scenario 1 takes 20 years to close the loan; Scenario 2 takes almost 14 years to close the loan; Scenario 3 takes almost 10 years to close the loan.

2. It is more important to get rid of the debt first.

3. When you close your bank loan by 10 years and then invest the same amount for another 10 years will yield more than the amount of investing Rs. 11965 per month for 20 years at an 8% return.

4. The graph has shown clearly all three scenarios are contributing nearly the same wealth creation.

5. If you neither don’t invest nor don’t focus on the pre-closure of a home loan. Then your debt burden will continue for 20 years without any wealth created.

6. The above three scenarios have resulted in the wealth creation of nearly 73 lakhs after 20 years.

7. Scenario 2 has saved almost 11.58 Lakhs compared to Scenario 1

8. Scenario 3 has saved almost 18 lakhs compared to Scenario 1, in terms of interest to pay.

Conclusion:

· It is important to have a mindset of investing, until you have this mindset this topic will be irrelevant to you.

· It is important in both ways to pre-close the home loan and to invest at the same time.

· If you could close the home loan within 10 years and invest the same amount for the next years, you can grow your wealth in many ways.

· It is most important to have all your NEEDS and to accumulate your emergency funds. Irrespective of your situation.