Table of Contents

ToggleSun TV network which is led by Mr. Kalanithi Maran as Executive Chairman, was incorporated on the 14th of April 1993. In 2 years the company had grown to 24 Channel Company.

Currently, the network is extended to 33 channels and into 4 languages. They are also launching Sun Marathi in the Marathi language.

The company with 1357 employees has reached almost 95 million houses in terms of telecasts across 27 countries. Countries including the U.S.A, Canada, Europe, Singapore, Malaysia, Sri Lanka, South Africa, Australia, and New Zealand.

The company has shown a strong 5-year revenue growth of CAGR 8.68%, which is higher than the industry average 5-year growth.

Let us go through a complete analysis of organizations,

- Business Overview.

- Financial Performance.

- Fundamental Analysis.

Sun TV Network Shares – Business Overview:

The company has strong penetration in every house of Southern India in Media transmission. The company is working in multiple segments of media and IPL ownership.

They are,

1. TV Channels – The biggest brands of them are Sun TV, Gemini TV, Udaya TV, and Surya TV. They have both standard and high-definition channels. These 33 channels compromise entertaining people through various services,

- Serials

- Reality Show

- Kids channel

- Comedy

- Music

- News

- Films

2. Sun Direct DTH – It started in 2007. Currently, it has 16 million subscribers. Their aim in promoting the product is to reach all the houses of southern India.

3. FM Radio Station – It has 48 FM radios across the nation with three important brands,

- Suriyan FM Station.

- Red FM Station.

- Magic FM Station.

4. NEWSPAPER – They are a predominant leader in daily newspapers in Tamil. The papers are Dinakaran, Tamizh Murasu, and Malai Murasu.

5. WEEKLY MAGAZINE – They have a collection of various weekly magazines, which have been widely bought in Tamil Nadu. The magazines are Kunguman, Kungumam Thozhi, Muthurani, Vannathirai, Kungumam Chimzh, and Aanmigam Palan.

6. Sun Next App – In the digital transformation, they are competent to become an OTT (Over the Top) platform. They have their film, reality shows, serials, etc. in the app and the access is chargeable. The app holds almost 50,000 hours of TV content.

7. Sun Pictures – One of the top production houses of the Tamil Nadu film industry is Sun Pictures. As of now, they have launched 21 films, a majorly more popular film.

8. IPL Franchise – Sunrisers Hyderabad is a franchise owned by Sun TV Network.

The company has earned a revenue of Rs. 3780.5 Cr, in which the revenue bifurcation is,

- Subscriptions – Rs. 1726.1 Cr (45.66%)

- Advertising & Sale of Broadcast – Rs. 1363.43 Cr (36.1%)

- IPL Income – Rs. 244.45 Cr (6.47%)

- Movie Distribution – Rs. 69.91 Cr (1.85%)

- Others – Rs. 245.09 Cr (6.48%)

As long as people live, they need entertainment. Sun TV network has been a giant in providing a full package of entertainment across 4 languages (5 states). Now they are focusing on moving its share in the 5th language, which is Marathi.

As for business plans and management, the company is in a perfect position. Revenue growth of 8.68% is a good holding of long-term shares.

SUN TV Network Shares – Financial Performance:

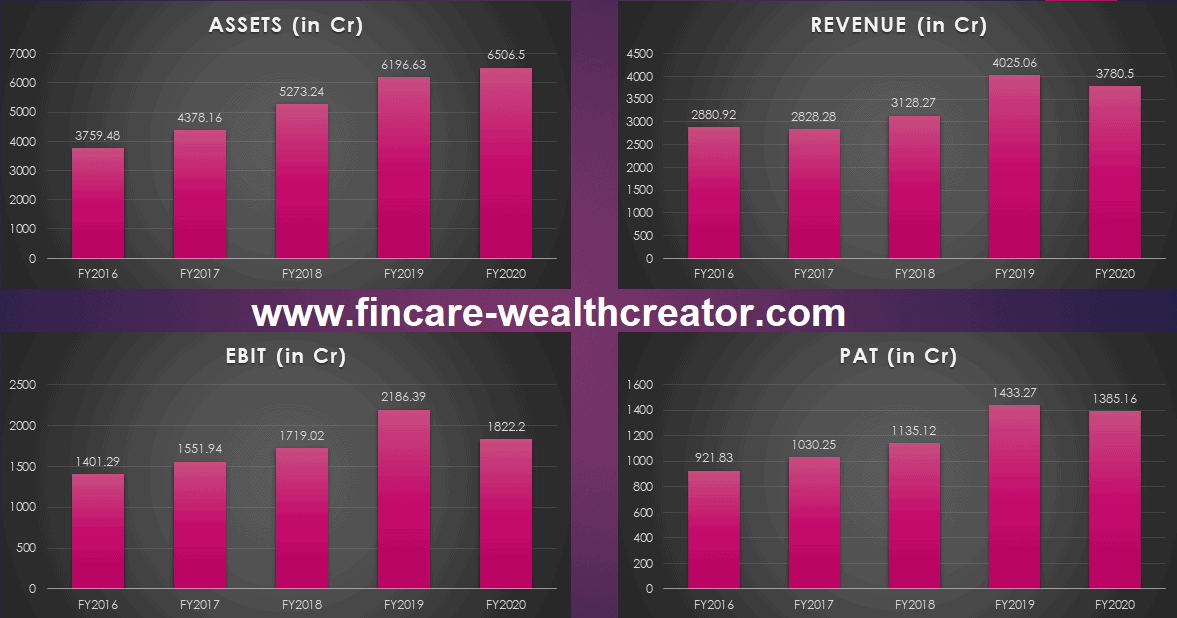

The above image presents you with the journey of the last five years of business outcomes in terms of financials.

Here the key highlighting factors are,

1. Assets – It has grown from Rs. 3759.48 Cr to Rs. 6506.51 Cr with a CAGR of 12% P.A.

2. Revenue – It is growing at a rate of 8.68% CAGR for the last 5 years. This is higher than the industry average revenue growth for 5 years. Industry average revenue growth is about 5.64%

3. EBIT – The 5 years growth of EBIT in CAGR is 12.1% per annum. Despite the lower revenue of Q1’2020-21, the EBIT has grown over Q4’2019-20.

4. PAT – The PAT is growing at a rate of 12.11% CAGR in the last 5 years per annum. This is higher than the industry average PAT growth. The industry average PAT growth is -1.95%.

The company has grown its market share in the last 5 years from 20.7% to 23.9%.

As per financial performance, the company has completely focused on profits and benefiting its shareholders in terms of dividends. The dividend payout is 50% of its profit in the FY2019-20.

Fundamental Analysis – SUN TV Network Shares:

Please find the fundamental attributes that you should see as an intelligent investor after business study and financial performance.

The attributes are,

- Total Number of Shares: 39,40,84,620 shares.

- Face Value: Rs. 5 per share.

- Market Capital – 18,281.59 Crores (Mid-Cap Stocks)

- Share price – 460.5 (September 23, 2020)

- Book Value – Rs. 143.71 Cr

- Price to Book value – 3.25

- Earnings per share (Trailing twelve months) – Rs. 31.87

- Price to Earnings – 14.43 (Attracting P/E ratio)

- 5 Years EPS Growth – 12.1%

- Dividend Yield – 5.39%

- Debt to Equity – 0.0%

- Current ratio – 3.23 (FY2109-20) vs 1.7 (FY2018-19)

- Interest Coverage ratio – 26.4

Shareholders Pattern:

- Promoters – 75%

- Retail Investors – 17.75%

- Mutual Funds – 6.89%

- FII – 0.32%

- NRI – 0.24%

There were zero promoter shares pledged in the past. So, it accounts for the confidence that the promoters hold in their company. This ensures safety for investors.

EXCESS LIQUID CASH PER SHARE:

LIQUID ASSETS:

· FIXED ASSETS:

§ Investments – Rs. 277.49 Cr

§ Cash and Equivalents – Rs. 11.06 Cr

§ Bank Balance – Rs. 73.08 Cr

§ Other financial Assets – Rs. 207.89 Cr

· CURRENT ASSETS:

§ Investments – Rs. 1957.94 Cr

§ Cash and Equivalents – Rs. 402.48 Cr

§ Bank Balance – Rs. 126.34 Cr

§ Other financial Assets – Rs. 224.32 cr

TOTAL LIQUID ASSETS – Rs. 3280.6 Cr

TOTAL LIABILITIES – Rs. 692.57 Cr

EXCESS LIQUID CASH – Rs. 2588 Cr

EXCESS LIQUID CASH PER SHARE – Rs. 65.68

Intrinsic Value:

Considering Revenue growth of 8.68 in the last 5 years, and EPS (TTM) of 31.87. The intrinsic value will be Rs. 450 per share.

Considering the Margin of safety (MOS) of 20% maximum, the intrinsic value will be Rs. 360 per share. So, the intrinsic value will be between Rs. 360 – Rs. 450 per share.

Considering the fundamental aspects, intrinsic value, and excess liquid cash per share, the company is very strong in its fundamental

Dividends:

As an investor, you should always check or consider the dividend that the company offers its investors. Always keep in mind, that dividends are like rental income or passive income. These dividends will be more helpful during your retirement period.

If you had 10,000 shares by 2010 in Sun TV network, you would have earned almost Rs, 12,10,000 as dividends up to date.

On average the company has provided its shareholders Rs. 12.1 per share. Recently the company has increased the dividend amount and has shared 50% of profit as a dividend to shareholders. In the year 2020, they have paid a dividend with 2 interims and the total amount paid is Rs. 20 per share.

Strengths:

- Increased in 5 years of Revenue growth, Asset growth, EBIT, and PAT growth.

- These growths have been higher than the industry average.

- Attractive P/E.

- EPS has been growing for years with 12.1% in the last 5 years.

- The dividend payout has increased by 100% in the last 1 year and 35.72% growth in 3 years payout.

- No pledged on promoter holdings.

- Increased Foreign Institutional holdings by 1.37% in the last 3 months.

- Zero Debt Company.

- The average ROE is 24.86%

Weakness:

- Despite having 5 years of revenue growth of 8.68%, the last 1-year revenue growth is -6.04%

- The last 1 year PAT (Net Income) growth is -3.35%.

- Decreased Mutual funds holdings in the last 6 months.

- Even Q1’2020-21 revenue has come down compared to Q4’2019-20.