Table of Contents

ToggleTAX EXEMPTION:

This is the most important topic in financial planning. Most people are aiming to pay zero tax, but no one plans about tax exemption, well in advance. This is only because of a lack of knowledge in tax planning and tax exemption. The richest people in the world pay ZERO TAX. Have you ever noticed this why? It’s because they plan their taxes well in advance, and do as their plan.

In this topic, we shall learn about, how one can pay zero tax until the annual income of 9 lakhs, thereby can save Rs.62,400 per year.

In India, there are two types of tax structures,

1. Old Tax regime (all deduction are included)

2. New Tax regime (No deduction are included)

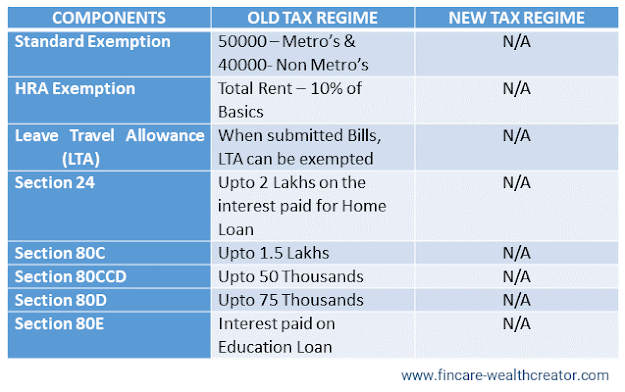

First, let us differentiate the common difference between the two Tax Slab in detail:

TAX SLABS IN INDIA:

As mentioned earlier, in India there are two tax slabs. It’s completely the sole ownership of the taxpayer to choose between Old and New tax regime. Let’s go through the differences in the components

|

| Tax Slab – Old Tax Regime Vs New Tax Regime |

Seeing this, we all might think the new tax regime has lesser tax to be paid, but the actual loophole is completely different. While filling a tax, there is no exemption for the New Tax regime. Let’s have a look at how the Old Tax regime is different from New tax regime

|

| Tax exemption Components |

These are the most used sections for tax exemption. Still, there are many other tax exemption sections, which we can discuss by the end of the topic.

From the above picture, we can diagnose that the New Tax regime is not going to help us with the exemption. Let us discuss on tax exemption section in detail. Anyhow, it’s up to one’s individual decision to prefer the Old Tax regime or New Tax regime.

HRA EXEMPTION:

House rent allowance is the most important component for the people who live in a rent home. HRA is calculated in two methods;

1. Annual rent amount – 10% of Basic Pay.

2. 50% of HRA allowance provided on a payslip.

The least amount of these two calculations will be considered for HRA Exemption.

– If one pays till 1 lakh of annual rent, then it doesn’t require Landlord’s Pan card.

– If annual rent paid exceeds 1 Lakhs, then it is compulsory to submit the Landlord’s Pan card.

SECTION – 24:

· This section is useful for those who have taken Home Loan, a taxpayer can exempt a maximum of 2 lakhs in the interest paid annually on the home loans.

· Section 24 is applicable only if your house stamp value is less than 45 lakhs.

SECTION 80EEA:

· In the 2019 Union budget, our honorable Finance Minister announced an additional benefit for taxpayers with a home loan under Section 80EEA, an additional of 1.5 Lakhs can be claimed as an exemption.

· This can be claimed only as an addition to Section 24 of 2 Lakhs.

· If some one’s home loan interest is less than 2 lakhs per year, then they can’t avail of this section.

SECTION 80C:

The most important section that every taxpayer will be aware of. With the Section 80C, an individual can plan tax exemption up to 1.5 Lakhs in a financial year.

There are various packages included in Section 80C. They are as follow,

· EMPLOYEE PROVIDENT FUND – The amount which is detected from your monthly salary as EPF will be the first, to be under this section. The current interest rate offered by EPF is 8.5%.

· LIFE INSURANCE POLICIES – This includes Life insurance policies like term insurance, ULIP, endowment policies, and cashback policies. The total amount which is paid annually excluding the taxes paid.

· PUBLIC PROVIDENT FUND (PPF) – PPF is an account that can be opened in the post office and bank. The minimum of Rs.500 has to be paid every month, it doesn’t matter to pay the fixed amount for every month. You have to pay for 15 years and it is locked in 15 years. The current interest rate offered by PPF is 7.1% P.A.

· SUKANYA SAMRIDDHI YOJANA – This is as same as PPF but the only difference is, it will be applicable only for two girl children who are less than 10 years old in a family. We have to pay for 15 years and the lock-in period is for 21 Years. If needed for child education, we can withdraw 50% of the amount while the child attains 18 years old. The Current interest rate of SSY is 7.6% P.A.

· 5 YEARS TAX SAVING FIXED DEPOSIT – Up to a sum of Rs. 50,000 can be used for tax exemption under 80C, the lock-in period is 5 years. The interest paid out depends on the Repo rate and bank.

· EQUITY LINKED SAVINGS SCHEME (ELSS) – ELSS is a type of actively managed mutual fund, with a lock-in period of 3 years. This is the only type of mutual fund which used for tax saving. The interesting fact here is, the interest rate will be around 10-12% which is the highest payout in this 80C.

· CHILDREN’S TUITION FEES – The total tuition fees paid in a financial year for 2 children can also be used for tax savings.

· NATIONAL SAVINGS CERTIFICATE – It is a type of savings done in the post office which yields an interest of 6.8% per annum. NSC is investing in a savings bond, which has a low-risk profile and also has a lock-in period of 5 years.

· Finally, you can avail of up to 1.5 lakhs on the home loan principal.

SECTION 80CCD:

Section 80CCD is related to pension, and we have to invest till 60 years and after which we will be getting some portion as Lumpsum and the other part will be paid as pension for every month. There are two types of schemes involved in Section 80CCD. The total amount we avail for tax exemption by 80CCD is Rs. 50,000. This is an additional 50,000 from Section 80C.

1. National Pension Scheme (NPS).

2. Atal Pension Yojana.

NATIONAL PENSION SCHEME:

The national pension scheme is created by generating a PRAN Number (Permanent Retirement Account Number). If we can invest continuously for up to 60 years, we can opt for NPS, or else please don’t have NPS in tax planning. This will be a unique number. There are two types of NPS in terms of TIERS;

· TIER I – It’s a kind of retirement fund which can be taken only at the age of 60 years as some portion and remaining will be paid as pension every month. Unless an emergency, we can’t withdraw any amount till the age of 60. The minimum requirement to keep TIER I account activated is to invest a minimum of Rs. 6000 every year.

· TIER II – It’s a kind of voluntary retirement fund, it can be withdrawn. TIER II can be activated, only if we have a subscription TIER I. TIER II has no minimum amount to deposit every year.

NPS is completely market-linked, both equity and debt. Since we have to hold for a long time, the annual return will be 9-10%. If we can accumulate or maintain until our 60 years, this is the best pension scheme offered by the government.

At the age of 60, we will be receiving 60% of the matured amount as Lumpsum and the other 40% will be still in market funds and will be receiving a monthly pension. The monthly pension will be higher when compared to other pension schemes.

ATAL PENSION YOJANA:

As same to NPS, Atal Pension Yojana also require a PRAN number to open an account. It is governed by Govt of India, the maximum amount we can receive a pension after the age 60 will be Rs. 5000.

If a person starts APY at the age of 18, he has to pay monthly Rs. 210 till the age of 60 to receive monthly Rs. 5000.

It is not market-linked. So, the risk associated here is zero.

SECTION 80D:

Section 80D is completely a beneficiary for Medical Insurance.

· In a small family, consisting of husband and wife with 2 children, they can opt up to Rs. 25,000 for a year as an exemption.

· In case of protecting parents with medical insurance, they avail an additional of Rs 25,000 as an exemption.

· In case, the parents are senior citizens, they can avail of additional Rs. 25,000 as an exemption.

If, all these criteria matches, then an individual taxpayer can avail of tax exemption up to Rs. 75,000 in a year.

SECTION 80DD:

This section is used to cover the medical expenditure of the dependent disability. The disability should be a minimum of 40%. The dependent can be a spouse, children, parents, brothers, and sisters.

· For Disability of 40% – 80%, Rs.75,000 can be used for exemption.

· For Disability more than 80%, Rs.1.25 Lakhs can be used for exemption.

SECTION 80DDB:

This section is covered for an individual, who has incurred medical expenses for specific disease treatment. The deduction is based on the age and treatment or capped amount, which one is lower.

SECTION 80U:

This is section is covered for an independent disability person’s medical expenses.

An amount of Rs. 75,000 can be used for an exemption for an individual with disabilities.

An amount of Rs.1.25 Lakhs can be exempted from an individual with severe disabilities.

SECTION 80G:

Section 80G, in simple terms, is the exemption in tax, in occasion to the donations we pay. It can be PM relief fund, CM relief fund, donations to orphanage centers.

The limit for 80G is 100% in some cases and have capping in some cases.

LEAVE TRAVEL ALLOWANCE AND MEDICAL ALLOWANCE:

The LTA and medical allowance are included in the payslip and we can avail exemption of tax up to 100% on submitting the original supporting documents.

In common, most of the organizations provide 1-month basic pay as LTA and Rs.12,500 as medical Insurance.

HOW TO CALCULATE TAX PLANNING:

It is very simple to calculate tax. The formula is

Income Tax = (Taxable income) * (Tax Slap – Percentage)* Cess (4%).

Taxable income = Total Earnings – Total Tax Exemption.

REBATE 87A:

This is a special section, which was announced during Union budget 2019 by our honorable Finance Minister. When an individual’s taxable income is less than 5 lakhs, the government waives off the tax to be paid. Earlier it was under 5% tax and to pay Rs. 12,500.

This Rebate 87A is applicable for both the Old Tax regime and the New Tax regime.

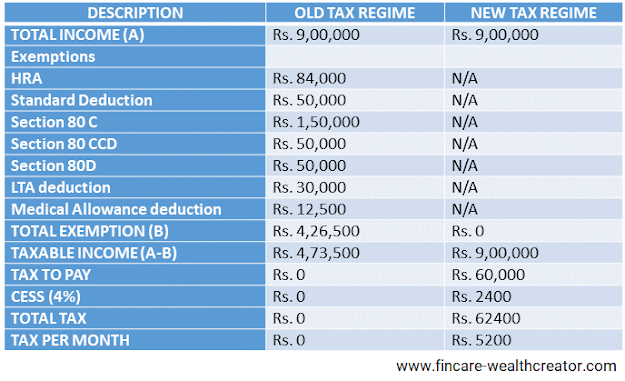

HOW TAX PLANNING HELPS TO PAY ZERO TAX FOR PACKAGE OF 9 LAKHS:

Here we are about to learn how we can be a zero taxpayer by planning our tax well in advance. Let us assume, an individual is earning 9 lakhs per year and will continue to work till he’s 60 years and do plan well and do all exemptions of taxes through proper investment tools. He lives in a home for 1.2Lakhs annual rent and yearly basic pay of 3.6 Lakhs. So, the LTA will be Rs. 30,000 per year.

We can also calculate the difference in tax to be paid by choosing Old Tax regime vs New Tax Regime

|

| Tax Calculation |

As per the above image, the old tax regime taxable income is less than 5 lakhs, so as per Rebate 87A, we need not pay any tax.

From this, we have learned the Old Tax regime with proper tax exemption is relatively good than the New Tax regime.

CONCLUSION:

· Tax planning should start at beginning day of the Financial year and submit the tax deductions, to avoid TDS (Tax deducted at Source).

· Choose Old Tax regime over New Tax regime, you will save some money on the investment, thereby you can reduce your tax too.

· Understand all the tax exemption sections and wisely plan it.

· We don’t advise home loan as a tax saving component, you can see there are many components by which you can still be a zero taxpayer.

· Don’t plan to invest completely on LIC policy when it comes to 80C, there are many other components with much benefits ahead.

· While you plan wisely you can save Rs.62400 annually when compared to New Tax Regime.