Table of Contents

ToggleOur readers could relate to previous topics, where we have discussed ultra short term funds. As we focus on goal based investments, we have written a topic on liquid funds for emergency funds.

On the same track, ultra short term funds can be best for short term goals investing. In this topic, you will be learning how these funds will be the better choice than post office savings accounts, RD, FD, PPF, and liquid funds.

By the end of this module, you will invest your time in researching better risk-adjusted returns. Many funds in this category have performed to yield a return of 8-10% per annum.

Ultra Short Funds – Overview:

The funds come under debt funds. It invests the treasury bills, NCD bonds of GOI, RBI, and corporate bonds which have a maturity period between 3 -6 months.

As it has a short maturity period like liquid funds, the risk profile of these funds is very low. It has no exit load. But, it transfers only after 2 working days while you redeem them. So it can’t be a feasible material of investment for emergencies. As an emergency comes all of a sudden and needs cash immediately.

As we correlate with short term goals. Always plan this fund for goal tenure between 2 years to 7 years. For a goal tenure of 10 years, the GILT fund will be the best option.

Short Term Goals:

The short term goals are termed as goals with a 1-5 year period. The goals can vary from person to person. Here is a list of a few goals that you can map for yourself and start investing in ultra short term funds.

- Bike.

- Car.

- Laptop.

- Desktop.

- DSLR Camera.

- Accumulation Money for lease.

- Accumulation funds for expanding your business.

- Foreign Trips.

- Investing options when the equity market is overvalued.

Finally, you can use these funds as the option to park your retirement corpus. So, you will yield a nearly 8-9% return. This fund will be the best investment material post-retirement along with Govt Bonds.

Why Ultra Short Term Fund is Best Compared to Traditional Savings Method:

The traditional savings method is a common savings material that most of us have done in the past. They are,

- Bank savings account (3-4% interest rate)

- Post office savings account (5-6% interest rate)

- Fixed Deposit (5-6.5% interest rate)

- Recurring Deposit (5-6.5% interest rate)

Bank Account: It has high liquidity, a very low interest rate, and zero taxation at withdrawal.

Post Office Savings Account: Same as a bank account, but the interest rate is slightly higher than the bank and lesser than the ultra-short fund.

Fixed Deposit and Recurring Deposits: Both these deposits have a decent return, but are slightly lower than ultra-short funds and liquid funds. But it has 10% TDS (tax deducted at source).

In a few banks, if redeemed before the tenure. They might deduct some charges, which you won’t be aware of.

Ultra short term fund: This provides a better return than liquid funds, FD, and RD. It offers high liquidity with zero exit load.

Tax is laid only on the interest gained more than 1 lakhs. As it is long term capital gain, the tax is 20% on the interest earned more than 1 lakhs.

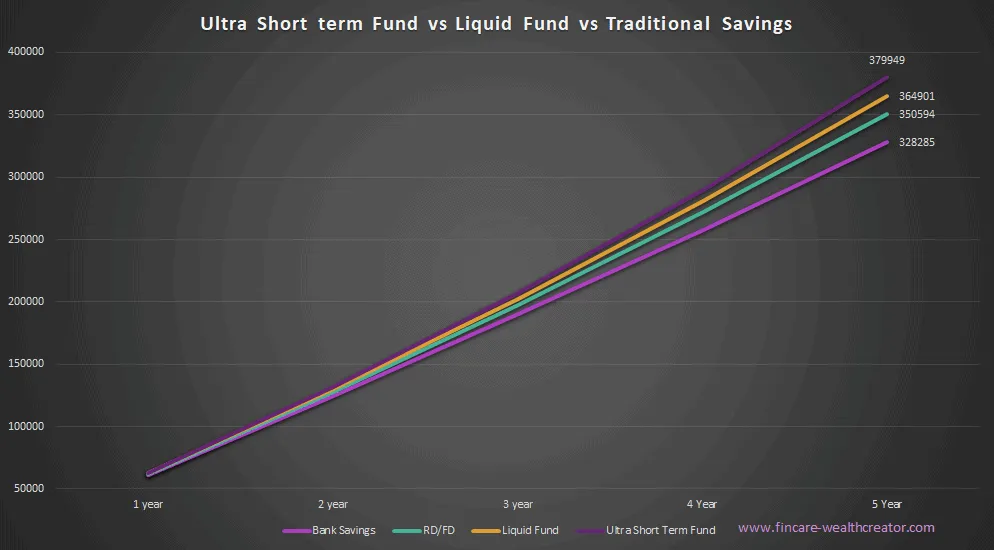

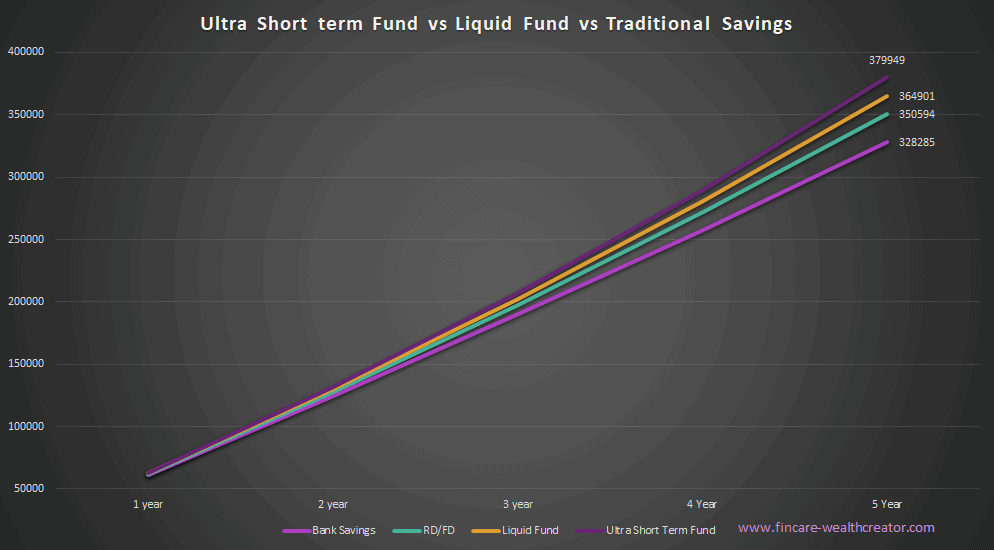

Let us understand the performance analysis between all the investments that we discussed earlier. Let us assume investing Rs. 5000 per month for 5 years and will make you all clear, how ultra short term fund has better returns.

How to Select Ultra Short Term Fund:

Like liquid funds, the same criteria should be employed in selecting these types of funds.

- In the top 10 and Top 20 holdings, RBI bonds, and AAA CRISIL rating bonds should be invested in.

- Number of holdings should be more than 100. So, more diversification leads to low volatility and risk.

- Average maturity should be less than 5 months i.e. 0.42 Years.

- The expense ratio should be very low.

- The fund size should be more than 5000 cr.

- Don’t choose a fund by seeing the star rating and past performance.

Conclusion:

- Ultra short term funds should be used as an investment option for short term goals.

- The goals with a tenure of 1-7 years can be invested in using these funds.

- These funds have a slightly higher risk and slightly higher returns than liquid funds.

- Instead of the savings bank, FD, and RD choose ultra-short funds.

- These funds have zero exit charges and will be credited back within 2 days after redemption.