Table of Contents

Toggle

Wipro shares have released their Q2’2021 result on yesterday (13.10.2020). The Wipro share price shed down 6.78% on the next day of the quarterly result. One of the largest IT companies has registered a decline of 7.3% year on year in net dollar revenue.

The result has disappointed the brokerage analysts, who expected the revenue growth to spark around 1.5% to 3%. After these disappointments, investors will be pleased with,

- The net profit has shown a growth of 2.8% Q-o-Q.

- Shares buyback for Rs. 400 per share.

The company has completely invested its time and energy in digital transformation and agile adaptability. Over the 75 years old company has strongly looked into creating more patents year after year. Also, deep diving in bringing customer engagement strategies.

Let us take you through the deeper analysis of the company, which would spark the intent of investors and aspiring investors of Wipro shares

Wipro Shares – Business Overview:

From FY2019-20, the company has started its strategic approach on “Digital First”. They have built the strategy on four pillars,

- Business Transformation.

- Modernization.

- Connected Intelligence

- Trust.

With these strong pillars, the company is strengthening its presence on the upcoming and future-driven technologies. The company has a strong business impact on clients by deriving its services in

- Digital Strategy Advisory and Business Process Services

- Customer-Centric Designs

- Technology Consulting

- IT Consulting

- Application design and development

- Re-engineering and Maintenance.

- System Integration

- Package Implementation.

- Global Infrastructure Services

- Cloud, mobility & Analytical Services

These services are offered to major industries like

- Business, Financial Services and Insurance (BFSI)

- Health Business Unit

- Consumer Business Unit

- Energy, Natural Resources, and Utilities

- Manufacturing

- Technology

- Communication

Apart from this, they have a strong presence in B2B business on technological solutions and products offered to other IT and related industries.

- IT products

- Cloud enterprise platform

- Cloud and infrastructure services

- Industrial and Engineering Services

- Data Analytics and Artificial Intelligence.

- Cyber Security and Risk Services.

- Digital Operation and Platforms

The company is investing its revenue in the Research and Development of new technologies. The R&D expenses have widely grown in the last two years. It has grown from 304.1 Cr in 2017 to 461.9 Cr in 2019 with a CAGR of 23.24% per annum

The number of patents is reasonably increasing from 2000+ in 2017 to 2300+ in 2019. The current attrition rate is 14.7% which has come down from 17.8% in the previous year.

Gender diversity is well maintained in the organization with 35% of women employees.

From a business perspective, the company is well-planned for its future. Building strong fundamentals and portfolios which will be leading them in front. If not now, the company will tend to grow its revenue and assets in the future.

Financial Performance – Wipro Shares:

Business without revenue growth will not bring any smiles to investors. Come, let us have a detailed analysis of the financial aspect of the company.

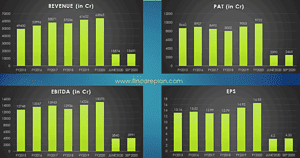

The above image gives a clear picture of the last 5 years and the last two quarters’ financial performance. The parameters we will be looking at are Revenue, EBITDA, PAT, and EPS.

- 5 years of Revenue growth is 5.27%, which is lower than the industry average. The industry average is 9.83%

- EBITDA 5-year growth is at a CAGR of 3.4%. The EBITA has also shown a growth quarter on quarter.

- The 5 years PAT (Profit after Tax) is just at a CAGR of 2.35%. The industry average growth rate of PAT is at a CAGR of 8.06%

- In the last 5 years, they have lost the market share from 15.5% to 12.68%. This has a huge impact in terms of financial performance.

Even though the company has shown year on year growth (except this Q2’2021 vs Q2’2020), the growth in revenue and other financial parameters are very low.

But in the last 6 months, the stock price has moved to 100% post-COVID. That is why we continuously say there is no relation between business performance and share price.

As an intelligent investor, you should look at the business fundamentals and values and not at the share price.

Please have a look at TCS Shares Price Review by Fincareplan.

Wipro Shares – Fundamental Analysis:

Total number of Equity Shares: 571.29 Cr Shares

Market capital: 200109.35 Cr

Let us understand the fundamental analysis parameters.

Valuation Ratio:

- Book Value: Rs. 96.83 Cr

- Price to Book value (P/B): 3.61

- Earnings Per Share (TTM): 16.92

- Price to Earnings (P/E): 20.71 (Fair Price)

- Industry P/E: 27.76

- Dividend Yeild; 0.28% (Poor)

- Debt to Equity Ratio (D/E): 0.14

- Current ratio: 2.4

- Interest Coverage Ratio: 17.75

- Return on Equity (ROE): 17.57%

- Net Profit Margin: 15.22%

- Net Profit to Revenue: 15.22%

- Free Cash Flow: Rs. 7841.6

Shareholding Pattern:

- Promoters – 75.89%

- FII – 8.66%

- DII – 9.3%

- Mutual Funds – 1.45%

- Insurance Company – 5%

- Financial Institutions – 0.72%

- Others – 2.13%

- Retail Investors – 6.15%

Excess Liquid Cash Per Share:

Total Asset:

- Fixes Asset:

- Investments: Rs. 930.2 Cr

- Other Financial Asset: Rs. 672 Cr

- Current Asset:

- Investments: Rs. 25812.9 Cr

- Cash & Cash Equivalent: Rs. 14232.6 Cr

- Other Financial Assets: Rs. 1089.3 Cr

- Total Liquid Assets: Rs. 42737 Cr

- Total Liabilities: Rs. 25772.9 Cr

- Excess Liquid Asset: Rs. 16964.1 Cr

Excess Liquid Cash Per Share: Rs. 29.69 per Share.

Intrinsic Value:

- EPS (TTM): 16.92

- 5 Year EPS Growth: 5.15%

- 5 Years Revenue growth: 5.27%

- 1 Year EPS: 2.41%

- 1 Year Revenue Growth: 3.62%

The Stock is 1.67 times more volatile than Nifty. So, we should consider a Margin of safety (MOS) of min 10% to 20%

Considering, the highest Growth of Revenue of 5.27 as expected growth, and EPS (TTM) of 16.92, the intrinsic value will be between,

Rs. 151.68 to Rs. 170.64 per share. Even at the highest value, the share price is 105% overvalued

Insights for Investors:

- The share price is completely overvalued.

- You can’t invest in a share whose price grows more than 100%, but revenue and EPS grow at 3-5% per year.

- Adopted in future technology is the only best advantage.

- The company has focused on reducing its debts and increasing excess liquid cash per share.

- Even after the Q2’2021 result, the share price has fallen by 6.72% in a single day. The reality is, that the share price has to be corrected hugely.

- Don’t invest in any share as the market booms on it. Understand the business, calculate the values, and be conservative always.