Table of Contents

Toggle

Most option traders are familiar with the term India VIX but don’t know about the function of the volatility index. Here, we can simplify the calculation to better understand our fincareplan readers.

In our previous article, we gained a basic understanding of derivatives markets. Now, let’s move to advanced levels in options trading. Before we proceed, we will explain what India VIX is.

India VIX is a volatility index; that value will be computed from the nifty index option premium. People comment that the market is highly volatile today; they say what it is and how it will be measured. Try to understand the basic terms one by one.

Volatility:

Per the National Stock Exchange of India, volatility is often described as the “rate and magnitude of changes in prices and finance, often referred to as risk. In simple terms, volatility is the uncertainty about the price changes in a security or index value. The higher the volatility, the higher the risk.

What is the Volatility Index?

The volatility index measures market volatility over the near term. Professional options traders take positions based on the VIX movement, which they predict from the volatility index.

Generally, during times of volatility, the market moves higher low to higher high or lower high to lower low, and the volatility index keeps on rising. If the volatility index declines, the volatility of the index also decreases.

Remember one thing the volatility index differs from a price index like NIFTY and BANK NIFTY. The price index is calculated using the price movements of underlying stocks.

The volatility index is calculated using the order book of the underlying index options and is denoted as an annualized percentage.

The Chicago board of options exchange was the first to introduce the volatility index for the U.S market index S&P 100 in 1993.

The calculation was changed in 2003, and a revised methodology was adopted in the S&P 500 index option. Since its inception, it has been one of the most important for derivative traders, based on the volatility, traders set up their trade-in near month contract.

India VIX Index:

It is a volatility index computed by the National Stock Exchange (NSE) based on the order book of NIFTY options. India VIX indicates the trader’s perception of the

Computation Methodology:

India VIX is calculated based on the Black Scholes Model which is used to price the option premium. The model uses different kinds of key variables to arrive at the fair price of an option contract.

- Strike price

- Current market price

- Time to expiry

- Risk-free rate

- Market volatility

We don’t discuss the complex formula of the Black-Scholes method for calculating the India VIX but try to simplify the interpretation of the volatility index.

For example, India VIX was trading at 20.30, what it mean? It represents an expected annual change of 20% in the index price movement for the next month.

It’s defined as the market range between + 20% and – 20% from the current spot price of the nifty. Just calculate the price range of the next year if nifty was traded around 13000. It indicates that the nifty range will be 10400 to 15600 for the next year.

If you want to know about the monthly range, use the below formulae

Monthly range in index = VIX / √ 12

Here, we assume the 30 calendar days for 12 months and try to calculate the monthly range in nifty, which will be 20.30/3.46 = 5.86 %, almost 750 points deviation expected in the next month.

It will be helpful for the option writers to identify the index range to short the out-of-the-money option to collect the premium. For option sellers, theta (time decay) is a friend, and volatility is an enemy. That’s why they are very much cautious about the volatility index.

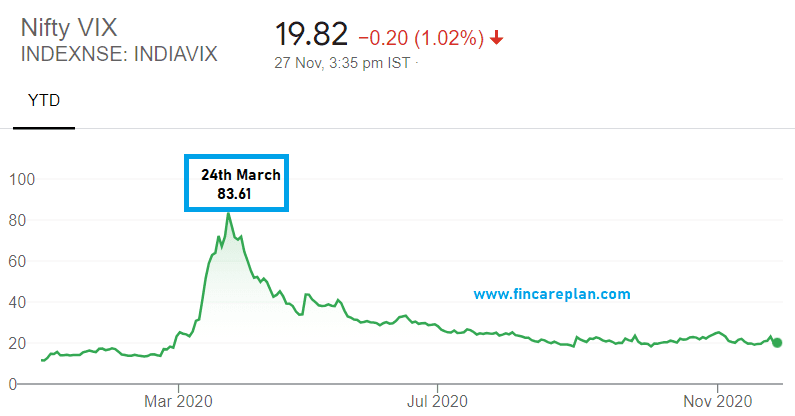

Movement of India VIX in Covid 2020 Market Crash:

The above picture shows a clear understanding of the India VIX movement. For your understanding in March 2020, India VIX touched the high of 85.34, and nifty touched the bottom of 7500.

In November 2020, the scenario was changed. VIX was bottom of the table, and nifty was trading around 13000. These two indexes were inversely proportional to each other.

Conclusion:

- Options traders and investors will gain a fair idea of the India VIX and understand the negative correlation between it and the volatility index.

- The market will capture the number of factors, based on that underlying stock price will vary. Don’t blindly follow the VIX, it’s also one of the numerical factors to identify the market movement.