Table of Contents

ToggleAxis small cap fund was started in January 2013 by Axis Asset Management Company. This fund has shown outstanding performance compared to other small cap mutual funds for the past 10 years.

The fund is compared with it is benchmark Nifty Smallcap 100 TRI. The fund has performed almost 23.83% per annum from the time of inception. Whereas, the category average is at 17.26% in the last 10 years.

Axis small cap fund has performed 2.4x times compared to Nifty 50 Index. At the same time, when the Nifty 50 has performed -3.93% in the last 1 year, Axis fund has produced 7.57% as a return in the last 1 year.

The fund we are looking for is with direct and growth options.

Axis Small Cap Fund Direct Growth – An Overview:

Axis small cap fund direct growth is one of the best small cap funds in India. Currently, the actively managed fund has a fund size of 11394.24 Cr.

The expense ratio of 0.51%. The expense ratio is seen to be the lowest among the smallcap compared to category average expense ratio of smallcap funds is 0.8%.

The fund has almost 74 securities as holdings and the top 20 holding shares about 52%. The fund has more diversified.

When we move to smallcap funds, diversification will help the fund to be with low volatility and better risk-adjusted return.

The P/B (Price to Book Value) is 3.17 and P/E (Price to earnings per share) is 22.02. The P/E is at a fair price.

The minimum amount to invest in this fund is Rs. 100 through SIP and first-time Lumpsum will be Rs. 5000 minimum.

Returns are taxed up to 15% if redeemed within a year. When redeemed after 1 year, LTCG (long-term capital gain) tax of 10% is applicable in the interest earned more than 1 lakhs in a financial year.

Axis Small Cap Fund Direct Growth NAV:

Here is the NAV of various plans as on 20th feb 2023.

- The current NAV of axis small cap fund direct growth is Rs. 71.41 per unit

- NAV of Axis small cap regular growth fund is Rs. 63.43 per unit.

Performance of Axis Small Cap Fund Direct Growth Plan:

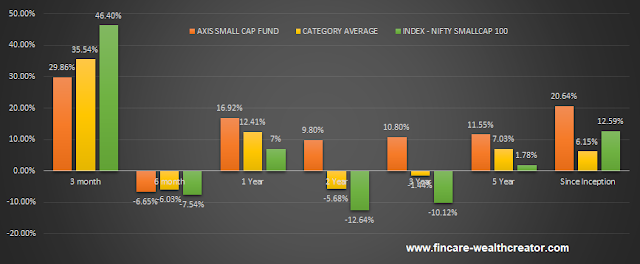

source: Moneycontrol

The fund has outperformed its peers. Stands 1st in 3, 5 years and since inception performance in smallcap funds. Also, 2ndin the category over 5 years’ performance.

The fund has performed almost 24.45% per annum vs 18.54% of Index Nifty Smallcap 100 TRI from the time of inception.

The amount invested in 2013 should have grown to 6.5 times in 2022. But, the benchmark Nifty Smallcap Index has grown 4.6 times.

From the above performance graph, we can understand how volatile the nifty small cap 100 index is. The last five year returns are only 1.78% from the index.

Small funds always tend to be more volatile. Whenever the market corrects or crashes, the first stocks to fall will be the small-cap companies.

Instead of these volatile and other situations, the fund manager has maintained almost more than 10% return over every year’s performance.

Only in the last three months performance fund has been beaten by both category average and index.

Even though, investments on smallcap funds should be done with more cautious and it has to be maintained for the long run.

Axis Small Cap Fund Direct Growth – Risk Management:

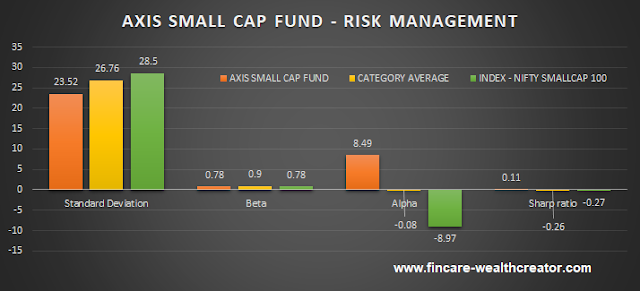

In terms of risk management, we will be analyzing four parameters. Alpha, Beta, standard deviation, and sharp ratio.

We will be analyzing these parameters for the last 5 years to find out the volatility and risk-adjusted returns of the fund.

VOLATILITY:

In terms of volatility, the fund is less compared category average and is similar to that of the Index.

RISK-ADJUSTED RETURN:

The risk-adjusted return is very high when compared to that of both index and category.

Overall, the risk management of the fund is below average volatility and high risk-adjusted return.

Key Takeaway:

- This fund was taken into analysis to show the investors, that even there are few smallcap funds that outperform the market index.

- Investors should be more aware before investing in smallcap funds. The volatility is very higher than other large-cap and mid-cap funds.

- There are only a few funds like axis smallcap fund, SBI smallcap fund has performed well in the past.

- These funds have fallen on a high note during the current market crash. That’s the reason for the lower performance in the last 6 months.

- Even if the P/E value is at a fair price, we advise waiting for a minimum of 2 years. Let a crash happen or the earnings of the market increase.

- Once the earnings increase, we can enter smallcap funds and should hold the fund for a minimum 7-10 years to overcome the volatility.