Table of Contents

ToggleWhat is a Debt Trap?

A debt trap occurs when a borrower is only able to afford the monthly interest payments, leaving the principal amount still outstanding. These traps are formed through the accumulation of numerous high-interest loans.

People fall under this trap mainly because of top-up loans, debt consolidation and finally paying only the minimum balance of a credit card. The important factor is that people don’t find themselves being under this trap for a long time.

Example of Debt Trap:

For example in 2010 in India, the government provided education loans for undergraduate and postgraduates. Which has given you an interest-free loan facility till you complete your degree. Post degree completion the interest starts accumulating in your existing debt.

Most students who have taken education loans don’t have the awareness of the interest amount it has grown. As they don’t pay either the principal amount or the interest amount for so many years.

For the loan amount of ₹1,50,000 was taken for education. If the loan principal and interest amount are not paid for 4 years post-completion of course.

The current payable amount will be around ₹2,50,000. You are going to pay an extra ₹1,00,000. This is completely due to your improper knowledge of debt management.

How the Debt Trap Cycle Works:

A debt trap simply works as a cycle, but the core point here is improper knowledge of debt and financial management.

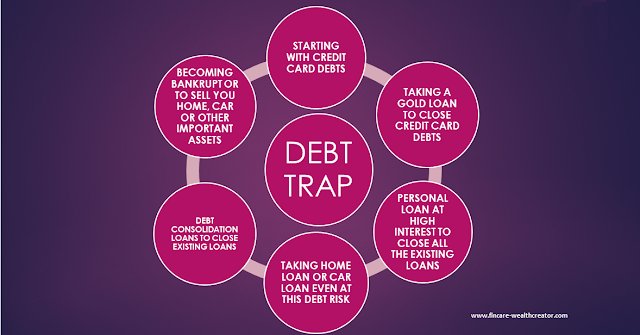

The initial phase of the debt trap starts with credit cards, education loans, and gold loans. This becomes a trap when you don’t pay their installments or EMI properly.

Let us see the cycle.

By the above cycle, you would have understood, how a debt trap can lead to losing all the important assets. When you have a proper tracking of budget, especially income, expenses, and debts. You will not fall into these categories.

Everyone will be having some debts. Even I too had all the debt materials 2 personal loans, which turned into loan consolidation, 2 vehicle loans, and 1 gold loan as a history of debts.

What I did was proper financial planning and tracking of all my debts and EMI properly. Whenever I take a loan, the first thing I do is, take a dairy note every month of total tenures. Then, I will tick down the months in which I complete payment. This gave me the viability of the remaining months of payment and made my mindset to close all my debts.

Since the last two years, I haven’t had any debts and I won’t take any other debts as I am more clear with goal-based investments and the power of compounding.

How do you Avoid Debt Traps?

You can avoid debt traps by following three simple steps

1. Proper Tracking of Budget:

In many topics related to financial planning of Fincareplan, we use to say proper budgeting. Of course, this is the most important and primary step to get out of all financial burdens to achieve financial freedom.

As I informed you earlier I managed to close my debts and not take any new debts.

- Maintain a proper diary or Excel to track your payments on the installation date of the month.

- More important is calculating all your income and expenses.

- Never try to get any type of expenses more than the income.

- Never get a loan to show you’re wealthy to others. This is done everywhere for marriage, car, and even home.

- Whatever it may be plan according to your income and do expenses within your income.

- Always have this in mind, you should save 30% of your income towards savings.

Proper budgeting is the starting point for financial freedom. Please have a look at how to manage your monthly budget.

2. Avoiding High Interest Loans or Debts:

- The biggest trap is taking a loan in an emergency and doesn’t care about the interest rate.

- Most people take these loans to handle both emergency and health issues.

- These are the trapping loans that will eventually increase your possibility of a debt trap.

- The way to overcome these issues is by having a proper emergency fund and health insurance with adequate coverage.

3. Avoiding Materialistic Dreams Over Loan:

Everyone has a dream, most dreams are materialistic like bike, car, home, etc. Once, people have been paid a salary of 30K or more, they are in a mindset to buy the whole world.

We won’t advise you to buy these above dreams at the beginning of your career. First, you should align your life securities like term insurance, health insurance, and emergency funds.

After that, you should focus on goal-based investments. So, you should never buy these dreams through loans. Dreams should be emotional and should be achieved by the proper route map. So, avoid loans or EMI for purchasing any kind of materialistic deeds.

Consult a Financial Planner

The final and most important way to handle the debt trap is to consult a financial planner. It is not a compulsory move, but when you feel that you can’t control your debts.

When you can’t make proper savings or investments. When you feel, you don’t have enough time to track your expenses, debts, and investments. Then, you should consult a financial planner or fee-only advisors.

Conclusion

- Debt traps happen due to a lack of tracking of the debts we have and accumulating debts.

- These traps will spoil your life’s peace and happiness and may lead to personal bankruptcy.

- These can be resolved by proper budgeting, tracking of income and expenses, and avoiding high-interest loans.

- Don’t buy your materialistic dreams with loans.

- If needed consult a financial planner or fee-only advisors.

FAQs

-

What is a debt trap in simple words?

A debt trap is when you can only afford to pay the interest on your loans, leaving the principal amount untouched. This cycle often leads to a never-ending accumulation of debt.

-

How do you know if you are in a debt trap?

You may be in a debt trap if you find yourself struggling to make more than just the minimum payments on your debts, and if your total debt continues to grow despite your efforts.

-

Why is debt a trap?

Debt becomes a trap when the interest payments consume a significant portion of your income, making it difficult to pay down the principal amount. This can lead to a cycle of borrowing just to stay afloat.

-

What is the poverty debt trap?

The poverty debt trap refers to a situation where individuals or families living in poverty rely on borrowing to meet basic needs, but the high-interest rates and fees associated with borrowing keep them trapped in a cycle of debt.

-

How do you avoid debt traps?

To avoid debt traps, it’s important to live within your means, create a budget, and prioritize paying off high-interest debts first. Building an emergency fund can also help prevent the need for borrowing in times of financial strain.