Table of Contents

ToggleOne of the most essential and basic needs in every human life is shelter. Housing loans have become a big market in India, as the Government of India has given tax exemptions. Here, we will discuss how a home loan can impact your financial management and the benefits of home loans.

History of the Housing Loan Market:

Housing loan in India was initiated in 1985 by the Union government by providing a solution to its citizens on larger demand at home. Especially in the 2019 Union budget, our honorable Finance Minister introduced Section 80EEA, which offers an additional Rs. 1.5 lakhs tax exemption with existing 2 lakhs to Section 24. This might encourage citizens to boost the housing loan market.

The government has introduced a new scheme to boost the Real Estate Industry, PRADHAN MANDIRI AWAS YOJANA in 2020, with a subsidiary of 2.6 lakhs for an individual. The home loan market contributes about 10% of the total GDP. Since 2019, this market has been in little decline due to the government announcement, which was an advantage. The housing loan market is strongly dominated by Banks, NBFCs, and HFCs.

Check out our article on the difference between NBFC and Banks.

The first home loan was introduced by HDFC Bank in 1971, followed by ICICI Bank SBI, and then other PSUs.

Payment Tenures and Interest Rate:

PAYMENT TENURE: In India, we have major options for tenure starting from 1-30 years, but in the multiple of 5 years, major bank provides. Most people opt for 20 years of tenure, followed by 10 years and 30 years. Only a few people choose 5 years or less.

Why Tenure is important to understand?

· As long as tenure increases, the monthly EMI becomes smaller, which will benefit monthly budgeting and it will provide us with short-term happiness

· When we pick a home loan on long tenure, like 20 or 30 years, the total amount payable will be 2-3 times the principal amount.

· Take short-term tenure, like less than 10 years. So, the repayable amount will be less than 2 times the principal. Yes, of course, the monthly EMI increases.

· To handle the EMI part, take the loan amount in a smaller amount, and the EMI amount should be equal to the monthly house rent +/- Rs. 5000.

Impact of Home Loan:

To begin with, let us understand why we all need to own a home and why we all deserve it. We are going to take loans to build our own homes, not to lease or rent a house.

One should build their own home in one’s native or the place where one is going to settle. It should not be built using a housing loan if it is not our native. Even if we plan to settle there, please don’t take a housing loan. Built it using your complete cash.

So let us now discuss the impact of home loans on our financial management.

Let us assume the loan amount which we plan for our home is 25 lakhs (let it be minimum). We shall discuss through differentiation between 20 years and 30 years of tenure. The interest rate here will be 8.5% which is the average interest offered by most of the banks (As RBI has reduced the repo rate, current home loan interest offered by some banks is 7.25-8%).

|

| LOAN TENURE COMPARISION |

As per the above image, we can understand the differentiation between two tenures – 20 years and 30 years.

· The 20 years and 30 years tenure will take 2 times the amount you borrow as loan principal. Put, you are building 1 home with the money to build 2 homes.

· As tenure decreases, the EMI increases, and the interest amount we pay reduces.

· This is the power of compounding. If you can understand the power of compounding, you can use it and become rich.

Thus, we have understood how home loans impact our financial growth and 30 years of tenure is almost our career period. So, a home loan will make us stick to commitments and we have to run for closing EMI till the end of our career, hence financial freedom will become an unmet dream for most of the home loan EMI payers.

How to Own a Home:

In this section, we are going to learn an alternate way to build our own dream home without a single penny by taking a loan. We should understand that we can’t own a home until we pay our final EMI in the bank because the documents which belong to the home will be under the bank’s custody. So, the home doesn’t belong to us, until we are debt-free. So, how to own a home.

· Plan or set a goal on a dream home with a timeline, which might be 10 years or 15 years.

· Plan the total budget of your home. Also, calculate if you take a home loan, what will be the EMI? If you are ready to take a loan, then you should be ready to invest. Go for rent or lease, and invest the remaining amount (Calculated EMI – Monthly rent) in investments that yield a minimum of 8-10% return.

· For Example, if the planned budget of your home is 30 lakhs, so for a tenure of 20 years you have to pay an EMI of Rs. 30,000 per month. So, you can take a home on rent for a monthly Rs. 15,000 and you can invest the remaining Rs. 15,000 in equity or debt funds.

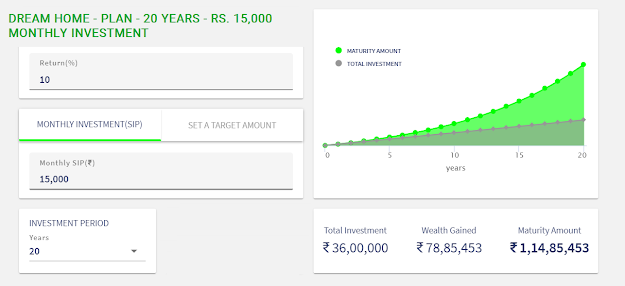

· Let us assume the return is 10% and the amount invested per month is Rs. 15,000 as listed earlier in SIP (Systematic Investment Plan). Let’s find out how much will be the return after the same 20 years.

|

| HOME – PLAN – SIP |

· From the above image, we can clearly understand, that while we invest we earn almost more than 3 times the money we invest. If you pay the home loans, we are going to pay more than 2 times of money to your bank and make them rich.

· So, when we understand the power of compounding we don’t lose our money by paying bank loans, instead, we grow our money by investing smartly.

Many people will have this in mind; the price of homes and land will appreciate, so we should invest by loans 20 years prior. Of course, the land value increases but not by 2 or 3 times. It will increase by a maximum of 50% if most of us buy a home in metro cities where the real estate market is in a high boom. We can discuss more in our next topic, “Real Estate as Investment.”

Who can go for a Home Loan?

I don’t recommend a home loan under any circumstances. However, there are a few ways to benefit from one.

· People who plan their tenure less than 5 years and planning their dream home at the place of settlement.

· People who need the benefit of tax exemption can opt, but they must be more cautious. Please avoid the home loan if your EMI is more than 30% of your total income. It is very dangerous for your financial management.

· People whose EMI amount will be similar to their monthly rent can use a home loan. They can have two benefits 1. It becomes their own home 2. Tax benefits.

Other than these conditions, please stay away from home loans.

Conclusion:

· In simple terms, please don’t go for a home loan, as you will pay more than 2 times the principal amount.

· Instead, plan a dream home about a tenure, invest the remaining amount from the planned home EMI amount and rent, and earn more than 3 times the amount invested.

· If you wish to take a loan, go for a tenure of less than 10 years.

· If monthly EMI equals the rent amount spent, avail of a home loan.