Table of Contents

Toggle

Likhitha Infrastructure, a Hyderabad based oil and gas pipeline manufacturing company. The company was established in 1998 as a private company and undertaken many projects.

The company was founded by Mr. Srinivasa Rao, who holds 97.46% of stakes which accounts for 1.42 Cr shares. The company is currently shifting to a public company by offering fresh sales of 51 lakh shares through IPO. This is a kind of book built on Issues IPO.

The IPO fundraising is going to benefit them by,

· Fulfilling the working capital requirement.

· General Corporate Purpose.

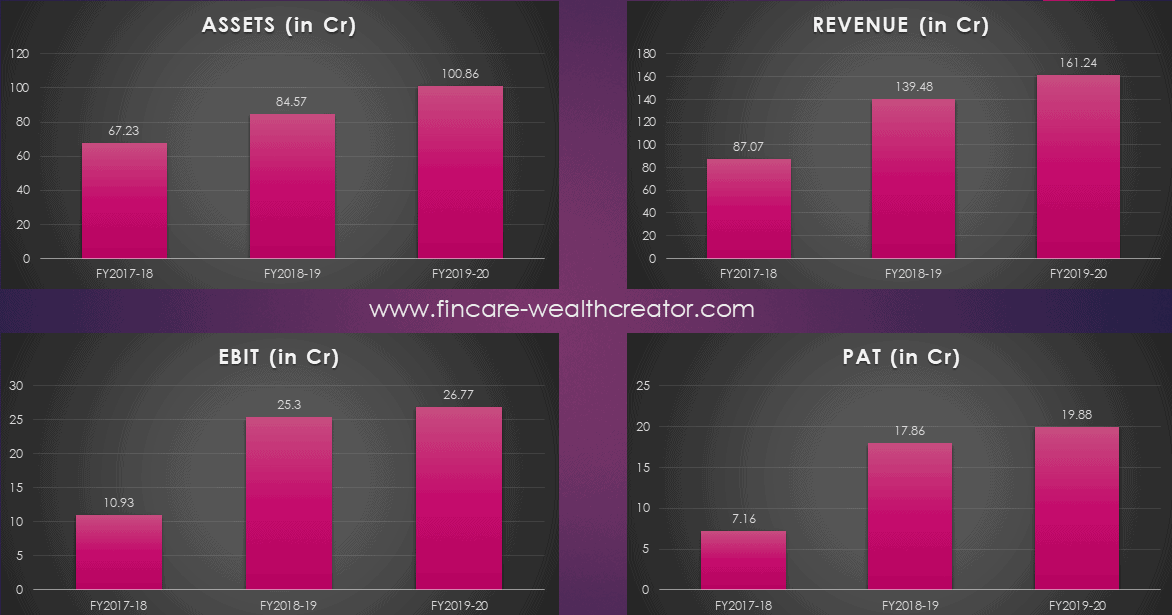

The IPO fund size is Rs. 61.2 Cr. The company holds the current asset of Rs. 100 Cr and Revenue of Rs. 161.2 Cr in FY 2019-20. Even though the size of the company is small, its operation and focus are to enlarge in monopoly.

They are the first company to execute the Trans-National Cross Country Hydrocarbon Pipeline Project. The project was done between India and Nepal.

Let us all deep dive into the company’s business behaviors, industrial opportunities, financial performance, and fundamental analysis.

Likhitha infrastructure IPO – Business Overview:

In simple term, the company is based on an Oil and Gas pipeline infrastructure service provider. This comprises of,

· Oil and Gas Pipelines.

· City Gas Distribution projects.

· Cross Country Pipeline projects.

· Operation and Maintenance Services.

· Trans-National Cross Country hydrocarbon pipeline project.

· MDPE (Medium Density Polyethylene) Pipe laying.

The company’s revenue hugely depends upon

· Work Contract – Rs. 126.97 Cr (78.75%)

· Operation and Maintenance – Rs. 34.26 Cr (21.25%)

The most important and supporting point for the investors is, the operation and Maintenance share in revenue is increasing year on year. The maintenance charges are service-based income, and it is a kind of fixed income.

Even if they lag with any projects in the future, the maintenance charges have to be fixed by the company.

The company has 20+ years of experience in the industry, with penetration in 16+ states and 2 Union Territories.

The company has completed many projects with GAIL, ONGC, Indian Oil, HCG, Indian Oil Adani Gas, Bharat Petroleum, Gail Gas Limited, Indraprastha Gas Limited, and Torrent Gas.

In these completed projects of piping, they have covered almost 600 KM in India.

They hold 31 ongoing projects. The ongoing projects will cover another 800 KM of the pipeline.

Industrial Opportunities:

Global Oil and Gas Industry Services: Global energy consumption has grown twice the average growth rate in 2018 compared to 2010.

· Huge demand for Electricity

· Demand for all fuels has increased. Natural gas demand is leading in front.

Indian Oil and Gas Industry: The industry is one of the top eight core industries in India. The Indian economy is closely related to energy demand.

The demand for Oil and Gas is estimated to grow year on year in India. This is majorly due to the increase in urbanization, the count of vehicles and household fuels has increased in huge in the last 10 years.

Gas pipeline infrastructure has completed almost 16,981 km at the beginning of April 2020. Currently, GOI has planned to invest Rs. 70, 000 Cr to expand the gas pipeline network in India.

India’s energy demand is expected to grow 100% by 2035 from 2017. In 2017 the demand was at 753.7 Mtoe and expected to be 1516 Mtoe.

Crude Oil consumption is expected to grow at a CAGR of 3.6% from 2020 to 2040.

Natural gas consumption is expected to grow at a CAGR of 4.31%. It would reach 143.08 million tonnes by 2040.

Natural Gas Infrastructure in India: The Indian economy strongly believes to increase as energy consumption increases.

The share of natural gas in the energy consumption market is expected to grow by 20% from 2020 to 2025.

In the future, the natural gas demand will grow at a CAGR of 6.3% from 246.2 MMSCMD (Million Metric Standard Cubic Meter per Day) in 2012-13 to 746 MMSCMD by 2029-30.

Gas-based power generation is expected to grow from 36% to 47%.

The supply of natural gas is expected to grow at a CAGR of 7.2%.

As the industry grows, the pipeline supplier and transportation of gas lines producing companies will eventually grow. So, Likhitha Infrastructure is likely to grow in a very consistent phase in the future.

Financial Performance – Likhitha Infrastructure IPO:

The above image will make you clear the financial performance between FY2017-18 to FY2019-20.

· Revenue has grown at a CAGR of 36.08% in the last 3 years.

· Asset has grown at a CAGR of 22.48% in the last 3 years.

· EBIT has grown at a CAGR of 66.63% in the last 3 years.

· PAT has grown at a CAGR of 66.54% in the last 3 years

Fundamental Analysis – Likhitha Infrastructure IPO:

· Total Number of Shares – 1.97 Cr Shares.

· EPS (FY2019-20) – 13.59

· 3 Years EPS Growth – 66.54%

· Price to Earnings (P/E) – 8.83 (Attractive)

· Return on Net Worth (FY2019-20) – 33.06%

· Net Asset Value per share – Rs. 41.83 per share

Excess Liquid Cash Per Share:

Liquid Assets:

· Fixed Assets:

§ Investments – 0.02 Cr

§ Other Financial Assets – 2.69 Cr

· Current Assets:

§ Investments – 5.76 Cr

§ Cash & Cash Equivalent – 3.78 Cr

§ Bank Balance – 11.25 Cr

§ Other Financial Assets – 23.78 Cr

Total Liquid Assets – 47.28 Cr

Total Liabilities – 30.9 Cr

Excess Liquid cash – 16.38 Cr

Excess Liquid cash per share – Rs. 8.31 per share.

IPO Allotment:

· Retail Investors – 35%

· Non – Institutional Investors – 15%

· QIB (Anchor Investors) – 50%

Important Details of IPO:

· IPO ISSUES – 51 lakhs shares.

· Price Band – Rs. 117 to Rs. 120.

· IPO Size – 61.2 Cr.

· Issue Opens – 29th September 2020

· Issue Closes – 1st October 2020

· Market capital – Rs. 175 Cr

· Minimum Lot – 1 Lot – 125 shares – Rs. 15,000

· Maximum Lot – 13 Lots – 1625 Shares – Rs. 1, 95,000.

· Finalisation on Basis of Allotment – 7th October 2020.

· Initiation of Refund – 8th October 2020

· Shares Credit to DEMAT Account – 9th October 2020

· IPO shares listing date – 12th October.

Insights to Investors:

· One of the monopoly type companies which is growing fast in deliverable of projects.

· The Industry demands are very high and the company is likely to benefit in a better way

· P/E is attractive, and the company is with zero debt.

· One of the best companies for long term investors and it pays dividends and bonuses regularly for its investors.

· There are only a few players in the Oil and Gas consumption field and they are clients for this company in pipeline distribution.