Table of Contents

Toggle

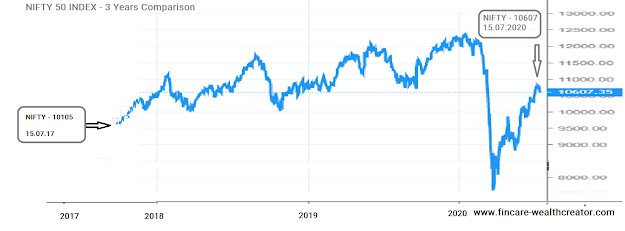

NIFTY 50 INDEX:

15th July 2020. The market ended with a positive value of 10618 (+0.1%); yesterday, there was a decline of 1.8%. Today, the market opened with a positive moment of around 1.2%; by this, the market disappointed the investors by falling to 0.1%. In this topic, we are going to cover the following topics

- NIFTY 50 – Basic Understanding.

Fair Value of NIFTY 50 P/E. - 3 Years Returns Calculation.

- What an Intelligent Investor should do at present.

NIFTY 50 INDEX – Basic Understanding:

Nifty 50 is the most important index among one of the leading stock exchanges, NSE (National Stock Exchange), which was started in Mumbai in 1992. The major indices of NSE are Nifty Next 50, Nifty 100, Bank Nifty, Nifty IT, etc. NSE holds almost 1952 company shares with a market capitalization of USD 2.27 trillion, as per 2018 data. It is the most traded stock exchange as it was the first to introduce electronic transactions.

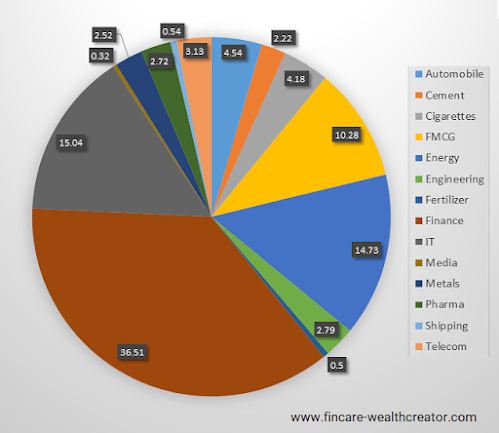

Nifty 50 has the components of India’s top 50 companies with various sectors. The allocation of sectors is as follows,

|

| NIFTY 50 INDEX – SECTORAL DISTRIBUTION |

- Automobile – 4.54%

- Cement – 2.22%

- Cigarettes – 4.18%

- FMCG – 10.28%

- Oil & Energy – 14.73%

- Engineering – 2.79%

- Fertilizer – 0.5%

- Finance – 36.51%

- IT – 15.04%

- Media – 0.32%

- Metals – 2.52%

- Pharma – 2.72%.

- Shipping – 0.54%.

Fair Value of Nifty 50 P/E:

To evaluate the Nifty 50 index, we must understand how to calculate its P/E. In simple terms, P/E is the Price of Nifty 50 divided by Earnings after tax. Using P/E, we can analyze whether the Nifty is undervalued or overvalued.

P/E Ratio vs Market Valuation:

- Less than 12 – Very Attractive.

- 12 – 16 – Attractive.

- 17 – 21 – Fair.

- 21-25 – Expensive.

- More than 25 – Very Expensive.

The current P/E is 27.88 which is highly expensive, the market is overvalued.

In 2017, the P/E was 24.9, which was also expensive. The market had good earnings and was in good shape for its boom. Considering the situation of COVID-19, many sectors have lost completely, like automobiles and airlines, and some have impacted media, banking, and IT. These are highly valued, and investors have to make a decision.

To find the P/E value of the Nifty 50 Index, Please click HERE

3-Years Return Calculation:

The nifty 50 Index was at 10105 on 15th July 2017; today (15th July 2020), it is at 10607.35. The XIRR growth of the market is just 1.63% return per annum; instead, it’s better to have money in the bank.

To calculate XIRR, please click HERE

We all know that investing in equity is the only way to surpass inflation and gives us a 10-16% annual return. We must know when to invest to get the desired return. The best time to invest is when the market P/E is Fair or attractive.

We cannot expect the same return of 10-16% P.A. by investing in a very expensive bullish market. During a bullish stream, always analyze your investment strategy with earnings and the market price at which it’s traded.

Who Drives the Market?

The market is heavily dominated by FII (Foreign Institutional Investors) and DII (Domestic Institutional Investors).

The market is moved by the speculator, and the long-term investors are out of it; they just keep watching. In this highly expensive market, being a speculator or trader is like having a knife with sharp blades on both sides.

In the last four days, FII has withdrawn 2823 Crores, and DII has withdrawn 3464 crores from the cash market (stock market). Hence, the current market is well-driven by speculators.

What an Intelligent Investor does at Present:

- To be intelligent investors, we should know how to get better long-term gains rather than bidding for a few thousand dollars every day.

- Investors must be aware that, in a volatile market where earnings depreciate, we must stop investing when P/E crosses 20-22.

- In a perfect economic condition, we can invest as earnings grow, if not, it’s better to stay out.

- Market beginners should not stay out. Keep watching the market, its performance, and what we can learn from the present condition.

- You can buy until you find your stock at a fair or attractive price.

- It’s time to redeem all your actively managed mutual funds.

- Stop both SIP and Lumpsum from investing in Index mutual funds.

- When the market corrects itself, or earnings move in the forward direction rather than the market’s price, you can continue investing.

If not Equity, where to invest:

We should not stick ourselves to only one set of investment instruments.

We have to learn the concept of portfolio management.

As Graham says, invest 50% in equity and 50% in the bond market. It does not mandate that we should also follow the same, but we have to learn how to allocate our investment in different portfolios.

As we have learned, in the last three years, the Nifty 50 Index has yielded only 1.67% P.A. We have to think in alternative ways when the market will be overvalued.

In the last three years, the Debt or Bond market has shown consistent growth of 7.5 to 10%, which is phenomenal. These kinds of markets have maintained the same interest rate for almost decades. So, wisely plan to make your money grow. Equity is not the only place to grow your money all the time.

When the market is overvalued, we must take measurable steps to diversify our portfolios. Still, you can park the money you don’t require for the next 15-20 years in the equity market, but you have to be emotionally strong to withstand the market’s heavy fall and recovery.

Note: Debt funds, too, have some risk. Read all the documents and fact sheets before investing. Check the CRISIL rating of all the company bonds.

Conclusion:

- Always try to calculate the P/E of the Nifty 50 Index, which is the only way to acknowledge our market’s behavior.

- When the market P/E is above 21, kindly stop investing and preserve your capital. Instead, invest in any debt or bond market for low risk and average return.

- FII and DII have withdrawn over 7000 crores in the last 4 days.

- Stop all your SIP and lump sum investments in active mutual and index funds.

- Wait for the market to return to its fair price, where you can start your SIP and Lumpsum.

- Diversify your assets into various portfolios.

This subject is completely based on practical experience from most successful financial leaders and my mentors.

If you have any thoughts or comments, please share them with us. Also, please let us know if we need to cover any specific topic. We will work together to create valuable content to enhance your life.