Table of Contents

Toggle

Recently, we wrote an article on Qualitative Fundamental Analysis of Indusind Bank Share. Here, we are continuing the article on Quantitative fundamental analysis of Indusind Bank Shares.

The share has grown at a CAGR of 18.59% from inception. This means a long term investor of IndusInd would be earned 42.54 times only in the share price. There are many other benefits that a long-term investor would have received.

Our readers will understand the fact, of why we only write about fundamental analysis and long term benefits. Yes, share market investments are the best wealth creation platform only if the business is held for a long time.

In this article, you will learn about,

- Financial Performace

- Valuation Ratios of Fundamental Analysis

- Intrinsic Value Calculation

- Insights to Investors

Kindly have a look at our article on HDFC Bank Shares

Financial Performance of IndusInd Bank Shares:

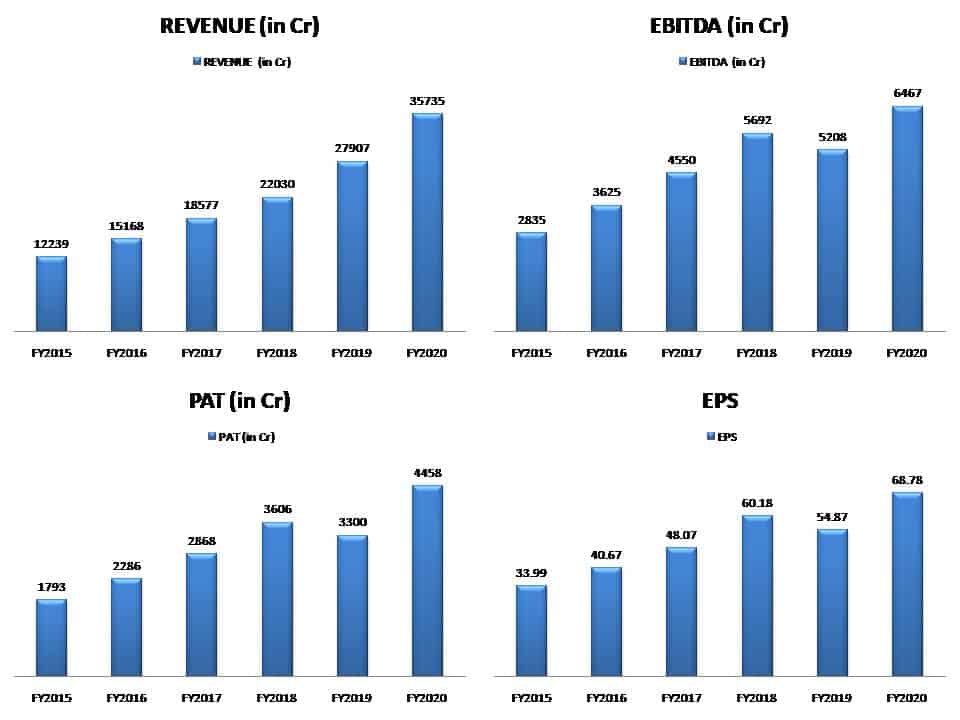

The above image is a short glimpse of the financial performance of the company over the last 5 years. Here we have discussed the performance of Revenue, EBITDA, PAT, and EPS

- Revenue has grown at a CAGR of 23.9% in the last 5 years. It is higher than the growth of the industry average of 16%.

- EBITDA has grown at a CAGR of 17.93% in the last 5 years.

- PAT (Profit after Tax) has a growth of 19.97% (CAGR) over the last 5 years. The growth is higher than the industry average of -1.75%

- Earnings Per Share (EPS) has a growth of 13.66% in the last 5 years.

- In the last 5 years, the market share of IndusInd Bank has extended to 5.88% from 4.25%.

When we compare this with 5 years growth of in Share price. The share price has grown by only 0.15% in the last 5 years.

The bank has performed very strongly in terms of Net Profit of 30% growth in Q2’2020-21 compared to the previous quarter.

Fundamental Analysis – IndusInd Bank Share:

Market Capital – Rs. 65178 Cr.

Number of Shares – 69.98 Crore Shares

Valuation Ratios:

The basis of fundamental analysis starts with understanding and calculating the values of the business

Book Value – Rs. 491 per Share

Price to Book Value (P/B) – 1.91 (Ideally, P/B should be less than 1)

Cash Adequacy Ratio (CAR) – 16.55% (14.7% – Last Year)

Non Performing Assets – 0.52 (1.12 in Q2’2019-20)

Earnings Per Share (TTM) – Rs. 39.57/Share

Price to Earnings (P/E) – 23.75

Borrowings to Net Worth Ratio – 1.78

Loan to Deposit Ratio – 102.35

Return on Equity – 13.09%

Net Profit Margin – 12.48%

Shareholding Pattern:

- Promoters – 14.68%

- FII – 51.81%

- DII’s – 17.24%

- Retail Investors – 16.27%

Intrinsic Value Calculation of Indusind Bank Shares:

As a Value Investor, it is a must to understand and calculate the intrinsic value of a share to set our investments.

Let us try to calculate the value,

EPS (TTM) – 39.57

5 Years EPS growth – 13.66%

Let us consider the same growth to be expected in coming years with a 10% margin of safety. So, the Intrinsic value of IndusInd Bank shares is 750.

The current share price is 23.9% overvalued.

Hence, it is a bank stock. We should primarily focus on Book Value. The ideal P/B should be 1. So, in this parameter, the share price should be Rs. 491.

Insights to Investor:

- The Bank has shown consistent growth in terms of Revenue, Profit, and Earnings per Share.

- They have focused a lot on reducing Net NPA %

- Increasing Capital Adequacy Ratio, Loan to Deposits Ratios. These parameters ensure a healthy business for the bank.

- Still, the 5 years share performance may not be satisfying investors as Indusind Bank has slipped from an all-time high.

- Anyhow, long term investors of more than 20 years are benefited by the shares. It has provided a return of a CAGR of 24%.

- The current price is slightly higher than the Intrinsic Value.