Table of Contents

Toggle

TCS shares price has climbed almost 72% in the last 6 months post the COVID-19 crash. The Information technology giant is currently the No. 1 Indian Service-based IT company with a Market Capitalization of $144 Billion. Surpassed Accenture last week, Accenture has a market capitalization of $143 Billion.

Last Wednesday, the company announced its Q2’2020-21 financial results. Blocked a Net profit decline of 7.05% compared to the same quarter of last year. From Rs. 8073 Cr to Rs. 7475 Cr. Anyhow, the company has shown a growth in Revenue of 2.97% compared to Q2’2019-20. The company has an inventory on revenue of Rs. 40135 Cr as of Q2’2020-21.

After releasing the result, they shot two news to investors.

- Announced buyback shares at Rs. 3000 per share. Planning to buy about 5.33 Cr shares. The total amount the company invests in buying back the shares is just 1.55% of the Market capitalization

- Interim Dividend of Rs. 12 per share.

The dividend will be a happy factor for long term Investors. But, the Buyback of shares will be pleasing as per individual. If you ask us, as an investor you have to hold the shares. Since promoters invest their free float assets in back their shares, which provides investors another assurance of company performance.

Let us have a quick analysis of TCS as a company

TCS Shares Price – Business Overview:

A business overview is termed to be a qualitative analysis. TCS is a subsidiary company of TATA Sons, which is the only promoter holding 72% of shares.

The company majorly focuses on IT solutions, consulting, and business solutions. They are a pioneer in partnering with world-leading companies and segments. The company has a huge diversification in catering revenue sources globally,

- America – 52.2%

- Europe – 30.6%

- India – 5.7%

- Others – 11.5%

Europe has appointed them as the No.1 company in customer satisfaction for the last 7 years. Holds almost 5000+ IT business contracts in Europe alone. This shows how the company is steady in income flow

In Q2’2020-21, the company registered a revenue of 41,049 Cr, with a growth of 5.47% compared to Q1’2020-21. Also, they have registered revenue of 1,56,949 Cr in FY2019-20 with a growth of 7.2% over the previous year.

The company has constructed its business worldwide for the last 50 years in more than 45 countries. Adapting technology services to businesses all over the world.

More than consulting, the company is completely focused on future technologies like,

- Internet of Things (IoT)

- Cloud Infrastructure

- Blockchain Technology

- Artificial Intelligence and Analytics – Machine Learning & Data Science

- Big Data

- Cyber Security.

The Service industry has more competition and the CAGR growth for 2020-2015 is expected at 2.9% per annum. The company has invested all its time and energy in developing its talents ready for future technologies.

Revenue Split Up and Client Base:

There are 4 sectors the company has a key focus on providing solutions on technology and business. They account for the major revenue inflow, and the revenue categorizations are

- Banking Financial Services and Insurance – 38.9%

- Retail and Consumer Business – 16.7%

- Communication Media and Technology – 16.6%

- Manufacturing – 10.5%

- Others – 17.3%

TCS has increased its high volume client base from 2018-19 to 2019-20

- $50+ Million base clients – 105 vs 99 (Previous Year)

- $100+ Million base clients – 49 vs 44 (Previous Year)

Strategies Ahead of Industry:

- The IT service industry is expected to grow at a CAGR of 3.5% globally as the industry is expected to reach $1.5 Trillion as of 2023.

- As the world is transforming its business into a digital platform. Digital tools like DevOps, IoT, Artificial Intelligence, Machine Learning, and Analytics

- There is a huge demand globally for these digital tools and Software as a product.

As many startups and giant businesses are sparking on transforming the world, Information Technology has a major role in easily clustering the works.

As a company, it provides diversification in gender in both talent acquisition and Managerial development. The company has the highest record of women’s labor force of 35.3% among IT companies.

Many employees have given loyalty to work from home until 2025. They have reduced the electricity and rent expenses by up to 60% when compared to 2010.

The attrition rate is just 12.8% during FY2019-20, which is the lowest in the industry. The company invests more in employees. Almost 52% of their expenses are spent on employees.

Even employee satisfaction is high to work for the organization when compared with the employees of Infosys, Accenture, Cognizant, etc.

TCS Share Price – Financial Analysis:

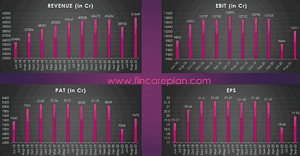

Here are some glimpses of financial performance in the quarter wise. In terms of quarterly performance, revenue and profits have strong impacts.

Let us, deep-dive, into the last 5 years of financial growth.

- The 5 years of revenue growth is at a CAGR of 10.48%. It is higher than the industry average of 9.83%.

- Net worth (Profit) has grown at a CAGR of 10.25%, whereas the industry average growth is at 8.06%.

- In the last 5 years, the company has increased its market share from 30.87% to 32.06%.

- Over the 5 years of performance, they have increased their current ratio (Total Assets/Total Liabilities) to 4.3, when the industry average of the current ratio is at 2.8%.

- Free cash flow in the last 5 years is 12.14, which is less than the industry average of 14.08%.

- Continuous and sustainable growth in terms of revenue, which is fuel.

Fundamental Analysis – TCS Shares Price:

The Total Number of Equity Shares – 375.23 Cr Shares.

Valuation Ratios – TCS Shares Price:

- Market Capital: Rs. 10,62,375 Cr

- Book Value: Rs. 224.13 Cr

- Price to Book Value: 12.62; Industry Average P/B: 7.02

- Earnings per Share (TTM): 81.69

- Price to Earnings (P/E): 34.49 (Highly Over Value)

- Industry Average P/E: 27.75

- Return on Equity: 34.64%

- Debt to Equity (D/E): 0

- Interest Rate Coverage: 46.72

- Net Profit/Revenue: 19.87%

- Free Cash Flow (FY2019-20): Rs. 29281 Cr.

- EV/EBITDA – 23.33 (Very Expensive; EV/EBITDA should be less than 10)

P/E Ratio History Values:

P/E ratio is one of the fundamental analysis parameters to quickly check, whether the share price is under reasonable value.

Let us have a quick recap on P/E historical data,

- 10 years Average P/E – 25

- 5 years Average P/E – 23

- 3 Years Average P/E – 26

- 2 Year Average P/E – 25

- Current P/E – 34.49

Currently, the P/E is highly overvalued. At this time, as an investor, you should stay out of investments.

Shareholding Pattern:

- Promoters Holding – 72%

- Institutional Investors – 23.8%

- Retail Investors – 3.3%

- Others – 0.9%

Excess Liquid Cash Per Share:

Total Liquid Assets

- Fixed Assets:

-

- Investments: Rs. 216 Cr

- Other Financial Assets: Rs. 1184 Cr

-

- Currents Assets:

-

- Investments: Rs. 26140 Cr

- Cash & Cash Equivalent: Rs. 8646 Cr

- Bank Balances: Rs. 1020 Cr

- Other Financial Assets: Rs. 1473 Cr

-

- Total Liquid Assets: Rs. 38,679 Cr

- Total Liabilities: Rs. 36,150 Cr

- Excess Liquid Cash: Rs. 2529 Cr

Excess Liquid Cash per Share: Rs. 6.74 per share.

Fundamentally strong company, but the share price is damn high. As complete, the IT sector is at the boom. As an Investor, you should decide on,

- The company was still at a good growth as same as now. But, the P/E was at an average of 25-26.

- The perfect value in P/E will be around 16-20. So, the price of the share should be around 1376 to 1720.

Let me assure you once again with the Intrinsic Value calculation.

Intrinsic Value:

- EPS (TTM) – 81.69

- 5 years EPS Growth – 10.25%

- 1 Year EPS Growth – 3.8%

Volatility – The current share price is 1.17 times more volatile than the Nifty 50 Index. So, we should consider the margin of safety between 10% to 20%.

Considering all the parameters, The Intrinsic Value will be between 1132 to 1273.5. Even the Intrinsic value is lesser than the Fair P/E value.

Strengths:

- Strong business growth in Q2’2020-21 compared to the previous quarter.

- Strong Revenue and Net profit growth year on year.

- Buy-back of shares is positive for Long term Investors.

- High ROE.

- Increased client base and Volume of Business.

- Adapted and invested in digital technologies.

- Strong promoters holding with Zero pledge. Increasing market share year on year.

- Zero Debt.

Weakness:

- P/E is very high.

- P/B is 7 times the book value.

- The share price is trading at 130% higher than the Intrinsic value.

- EV/EBITDA is tremendously high

- Interest rate coverage has come down year on year, but more than the baseline.