Table of Contents

Toggle

This article is completely on the fundamental analysis of Airtel’s share price to the value of the company. In the last year, the company hit a huge loss and still trading at nearly an all-time high. The telecom giant has crossed 25 years of serving people across the globe.

You will understand the qualitative fundamental analysis of the company shares. This will be an eye-opener in considering the key parameters before investing.

This equity share holds a market share of Rs. 275178.3 Cr and groups under Large Cap Stock. The company has provided many benefits to long term investors.

Let us have a detailed analysis of the company by,

- History of the company

- Business Overview

- Telecom Industry Overview

Kindly have a look at our article on Grey Market Premium in IPO.

History of Airtel Share Price:

- In the year 1986, the company was formed under the name of Bharti Cellular Limited, which was founded by Sunil Bharti Mittal.

- They were the first enterprise to launch a Fax machine in India in 1990.

- Around 1995, they got permission to operate Cellular services in Delhi, under the brand name Airtel.

- Later in 1996, they extended the service to Himachal Pradesh. During 1998, the service reached major parts of Madhya Pradesh. In the same period, they acquired JT mobiles in Karnataka, Andhra Pradesh, and Punjab.

- In the same year, Bharti Telcom formed a joint venture with British Telecom on an equity ratio of 51%:49%.

- The next year (1999), New York Life Insurance Fund acquired 3% of the stakes from Bharti cellular.

- In the year 2002, they got approval to provide cellular services across 8 other new cities/circles.

- They established their footprints in Mumbai, Maharastra, Tamil Nadu, Kerala, Uttar Pradesh, Haryana, and Gujarat during 2002-03

- Currently, they have a presence in 17 countries in Asia and Africa.

Finally, the company entered as a public company through an IPO on the stock market in the year 2002. The total shares were 18.53 Cr with an issue price of Rs. 45 per share. The total fund raised was about Rs. 834 Cr for the stock exchanges.

Henceforth, let us have a deep look at the business overview of the company.

Business Overview of Airtel Share Price:

Bharthi, with an ambitious focus on predicting the future of the telecom industry, entered into cellular services. Currently, they are a pioneer in the telecom industry with the highest number of subscriber base in India.

They are one of the early entrants in this industry alongside the Government-owned BSNL (Bharath Sanjar Nigam Limited). With sustained and trusted subscribers, they are the one largest telecom service provider still has had more than 25 years of strong market share growth.

The company has an active subscriber base of almost 320 million with 32% of the total share in subscriber base.

Products and Offers by Airtel:

- In 2004, Launched the first-ever easy recharge prepaid option for Rs. 50 per month. In addition, launched the lifetime prepaid for Rs. 999 in 2005, Hello Tunes, and mobile money in 2011.

- They launched instant music on mobile in the brand “SongCatcher” in the year 2006.

- Partnered with Apple in the launch of iPhone 3G, which helped Airtel to reach subscribers with the Airtel 3g network in 2008.

- Introduced Wync music in the year 2014 with a package of 1.8 million songs across many regional languages of India. It was the first telecom operator to introduce an OTT (Over-the-top) platform.

- In the year 2014, launched the One Touch Internet facility. In the consecutive year, they applied for a payment bank license with Kotak by acquiring a 19.9% stake.

- The first-ever private telecom company to launch 4G (LTE advanced Carrier) in India in the year 2016. In the same year, they launched Airtel V-Fiber.

- Airtel Payments Bank became the first payment bank in the country to go LIVE in the year 2017. In the same year, Airtel TV crossed 50 million Android downloads.

- In the year 2018, Airtel’s Wync music was awarded as the “Most Entertaining app of 2018“

- As per the Annual Report 2019-20, Airtel Broadband players entered almost 2.4+ million homes across 111 Cities in India.

- Airtel Digital TV is one of the leading DTH (Direct-To-Home) service providers in India with more than 16.6 million customers. They offer both standard and high-definition (HD) channels. This includes 645 Channels which HD channels are 85.

- In the year 2019 Launched Airtel Xstream, a converged digital entertainment application for mobile users, along with India’s first Android-based set-top box and OTT smart stick.

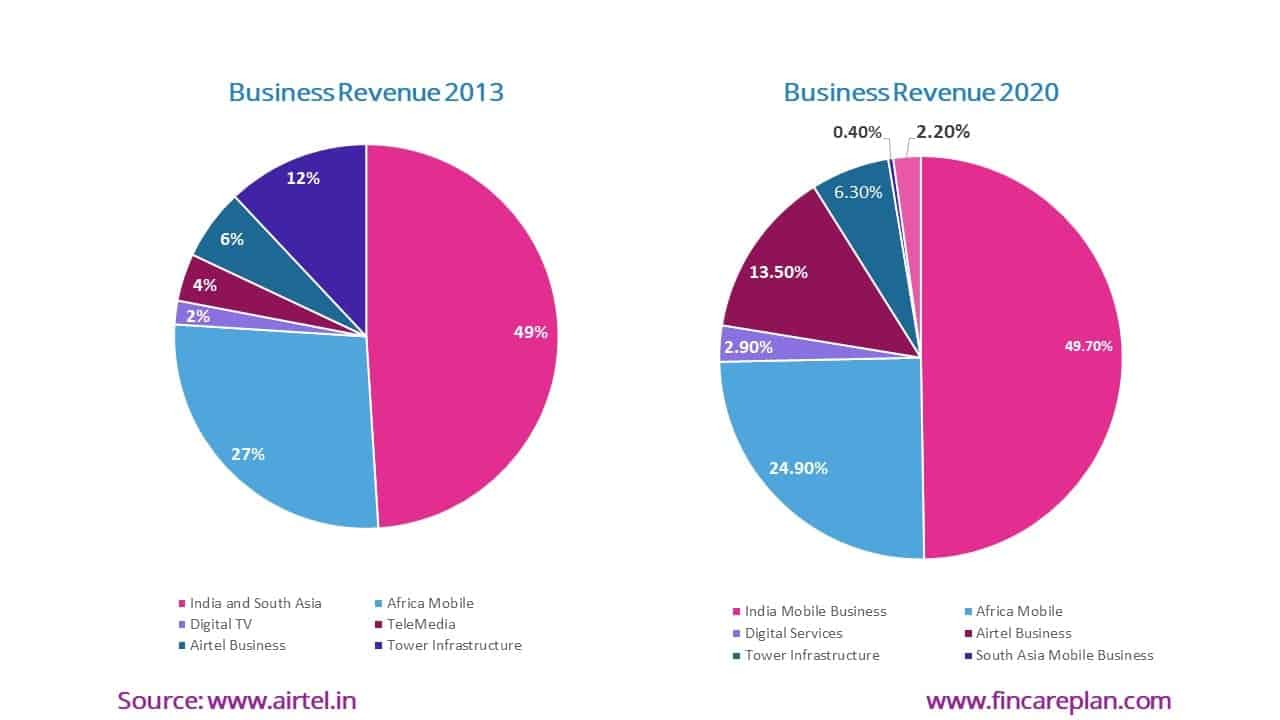

Business Revenue – Airtel Share Price:

The business revenue comes from 6 major components. They are as follows

- Mobile Services (India and South East Asia) – 48%

- Mobile Services (Africa) – 25%

- Home Services – 2%

- Digital TV Services – 3%

- Airtel Business – 14%

- Tower Infrastructure – 7%

Here are a few glimpses of revenue growth over the year.

- India and Southeast Asia revenue has grown by 11% compared to FY2018-19

- African mobile business revenue has grown by 13%.

- Tower Infrastructure business has declined by 1%.

- The Digital TV Services business has seen a deep shrink by 29%.

- Airtel Business has peaked up to 6%

- There was no difference in revenue in terms of Home Services.

Kindly look at our article on Asian Paints share price review.

Overview of the Telecom Industry:

Back in 2013, 10 players were occupying the telecom industry. From 2008 to 2012, known as the telecom boom, where many companies enrolled themselves as telecom service providers.

During this period, the TATA launched Docomo. They were the first player in India to introduce 1 paise per second. That was the period when mobile phones started entering every household in India. We all were the font of a mobile phone and that too with 2G Internet Services.

In the same period, many players like Uninor, MTS, Idea, etc started graving their market shares. Still, Airtel was the Leader and continues to be in the current.

The total Indian wireless market active subscriber base was around 723 million. The market was dominated by three players. Let us make you clear on the segregation of market share in terms of Subscribers.

- Airtel – 25%

- Vodafone – 20%

- Idea – 17%

- Reliance Communication – 15%

- BSNL+MTNL – 8%

- Tata Docomo – 6%

- Aircel – 5%

- Uninor – 3%

- MTS – 1%

- Others – 1%

The same situation before March 2016 was different with base subscribers of 936 million. The subscriber base has grown at a CAGR of 9% per annum in 3 years. This period was termed to be the saturation period for any players and by the end of 2016, many players started moving out of the competition.

During March 2016, the telecom industry was with only 8 players. The market segregation in terms of subscribers is,

- Airtel – 26%

- Vodafone – 20%

- Idea – 20%

- Reliance Communication – 10%

- Aircel – 7%

- BSNL+MTNL – 7%

- Tata – 5%

- Uninor – 4%

What happened after H2 of 2016:

Everyone would be aware, 2016 was the period when Airtel 1st launched the 4G network in India with big promotions and advertisements everywhere. The same period was termed as the “Start of Price War” in the telecom industry.

Reliance JIO entered the market as a Newbie and to capture the market. They played the best promotional methodology of offering free Call+4G Internet for every JIO subscriber for 6 months.

This brought a huge delegation in the telecom industry. The best part was, all the subscribers were very happy. The disappointment here was, JIO masterminded to capture the total market as a monopoly. Unfortunately, after the offer period was over, a maximum of subscribers still stayed with the existing network.

Anyhow, only strong players could hold the competition.

Kindly have a look at our article on Biocon Share Price Qualitative Fundamental Analysis.

Current Situation of the Telecom Industry:

- The current subscriber base is 962 million compared to 938 million subscribers in 2016. So, the subscriber base has grown at a CAGR of 0.63% per annum in the last 4 years.

- So, this has made us understand that the market has not grown in a higher way in terms of subscribers.

- There are only 4 players including BSNL. There was a 100% decline in players from March 2016. The players with segregation are,

- Airtel – 32%

- JIO – 31%

- Vodafone Idea – 30%

- Others – 7%

- The subscriber base has attained saturation, but in terms of Revenue, the industry is growing at a high peak in recent years. Especially in COVID and post-COVID situations.

Telecom Industry after 2020:

- As most of the work currently relies on the internet, a strong player like Airtel, JIO with its subscribers base across many digital and telecom products, the company revenue will grow strongly.

- Most of the business has transformed digitally. Especially when it comes to marketing and promotion.

- The internet usage in terms of bulk GB’s or pool GB has increased in the last 6 months up to 100%. Many corporate and small startup companies have undergone agreements with telecom players.

- Years to come will be a great opportunity for players in the telecom industry in terms of revenue and will taste some profits.

- At the same time, they have to focus on clubbing or launching products to support OTT platforms.

- As an investor, this is the right time to start accumulating in these businesses. Of course, you should understand the quantitative fundamental analysis of Airtel’s share price too.

- Reliance JIO is planning for a separate IPO launch in the Indian Stock market.