Table of Contents

Toggle

Our last article was on Biocon share price qualitative analysis, and this is a continuation of the previous one. Here we will be touching upon the qualitative fundamental analysis of the company.

When you understand a company’s growth and long-term vision of changing the lives of patients through biologics and biosimilars. The next phase of our analysis should be to understand the value of a single share and comparing with the current market price (CMP).

Let us continue the discussion forward from financial performance and other value calculations.

Financial Performance – Biocon Share Price:

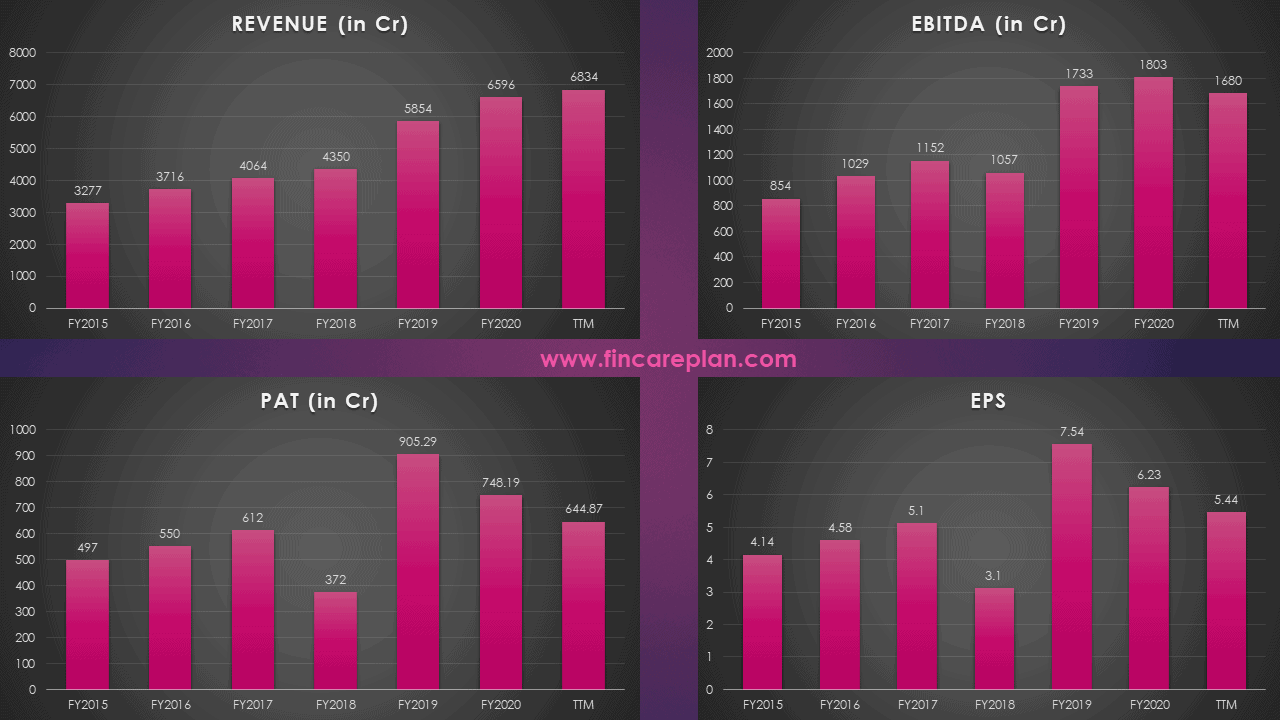

The above picture explains the last 5 year’s financial performance on the aspects of Revenue, EBITDA, PAT, and EPS.

- Revenue has grown at a CAGR of 15.01% in the last 5 years, whereas the industry average has grown at a CAGR of 12.49%

- EBITDA has grown at a CAGR of 16.12% in the last 5 years.

- The net profit has grown at a CAGR of 8.51% in the 5 years. This is higher than the industry average of 7.59%.

- Over the last 5 years, the company has increased its market share from 80.21% to 89.62% (as per tickertape.com)

The image clearly states the revenue has strongly in growth path year after year. But, when we consider net profit, there was continued fluctuation as the share price moves. There is no reason in terms of mismanagement. Here are a few reasons why the profits were volatile.

- In the last 3 years, the company has launched many biologics (Trastuzumab, Bevacizumab, insulin Glargine, Pegfilgrastim, etc.)

- In collaboration with BMS-Biocon research institute for bringing novel drugs to save mankind, they are investing huge.

- They have launched many molecules into business areas like the UK, Australia, USA, Canada, and even now in China. This requires a lot of investment in getting,

- Regulatory approval

- Marketing License

- Team expansions

- Investments in projects and marketing activities (promotional)

- So, these are the most important factor which has driven the profits in a zig-zag moment.

- These investments will bear the right fruit in a few years or later.

Now, let us move towards growth of share price in the last 5 years,

20th November 2015 – Rs. 77.47

20th November 2020 – Rs. 419.55

In the last 5 years, the share price has grown at a CAGR of 40.19%. As per the investments made by the company and the profit growth of 8% per annum in the last 5 years. The share price has already grown to the value of the next 3 years.

But, in terms of operation and Revenue strength, the company is in a good position.

Kindly have a look at the Godrej consumer products share review.

Fundamental Analysis – Biocon Share Price:

Number of Shares – 120.11 Cr equity shares

Market Capital – Rs. 50394 Cr

Valuation Ratios:

- Book Value – Rs. 55.88 per Share

- Price to Book Value – 7.52 times

- Earnings per Share (TTM) – Rs. 5.44 per share

- Price to Earnings (P/E) – 77.12 (Highly overvalued)

- Industry P/E – 37.96

- Debt to Equity (D/E) – 0.37 (Considerably lowering year on year)

- Current Ratio – 1.33 (Minimum threshold is 2, and the Current ratio comes down Y-o-Y)

- Net profit Margin – 10.88%

- Average net profit margin – 13.63%

- Return on Equity – 11.66%

- Average Return on Equity – 12.45%

- Free Cash Flow – (Rs. 546.3 Cr) – Negative

Shareholding Pattern:

- Promoters – 60.67%

- FII – 16.9%

- Insurance Company – 1.66%

- Mutual Funds – 3.94%

- Other DII’s – 5.31%

- Retail Investors – 11.74%

Long Term Benefits – Biocon Share Price:

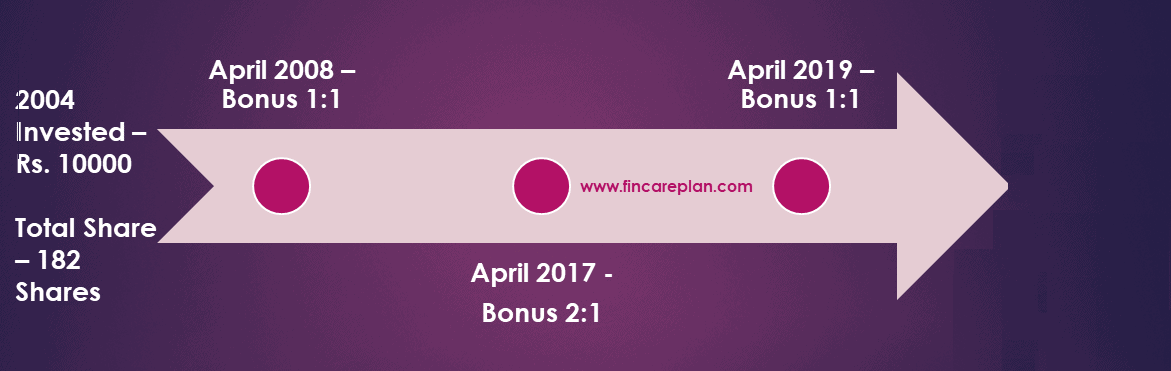

At the time of IPO, the share price was at Rs. 55 per share. If an Investor has invested Rs. 10000 to buy 182 shares as of 2004.

The company would have priced them with 3 fabulous bonuses.

April 2008 – Bonus 1:1 (The number of the shares would have doubled) – The Current Share would be 364 Shares

April 2017 – Bonus 2:1 (The number of shares would have tripled) – The current share would be 1092 shares

April 2019 – Bonus 1:1 (The number of shares would have doubled) – The current share will be 2184 Shares.

So, the amount Rs. 10000 invested in Biocon Shares in 2004, would be currently Rs. 9.16 Lakhs. The wealth would have grown by 91.6 times in the last 16 years at a CAGR of 38.08% per annum.

The company share price is expected to grow even further if you stay invested for another 10-20 years.

Insights to Investors:

- Strong Business plan and focus on 28 pipelines and other molecules. Strongly started domination in overseas.

- The growth rate is consistently on a positive note in terms of revenue, as they invest huge amounts in R&D and other regulatory affairs as extending the market focus overseas.

- The share price is trading higher than the intrinsic value. So. the current market price is not the perfect line to enter into an investment over the company.

- This is not a high dividend-paying company, hope they might support it with awesome bonuses.

- Investors should treat this company as a long-term investment material, this might grow 5-10 times of current market price in the next 10-20 years.

- In terms of negative – High P/E, High P/B, Negative Free cash flow, Current ratio, and High EV/EBITDA.