Table of Contents

ToggleThe ICICI Prudential Bluechip Fund Direct Growth is one of India’s best large-cap mutual funds to invest in 2024. This fund was established by ICICI Prudential Mutual Fund in January 2013 and since its inception, it has yielded a CAGR of 15.14%.

This fund is compared with the benchmark Nifty 100 Index TRI, and Nifty 50 Index TRI and holds the least risk and expense ratio among the categories.

Axis Blue Chip Fund has completed 11 years from inception and currently holds an AUM of Rs. 47928.62 crores.

If you had invested 1 lakh in 2013, your fund would have grown up to 4.5 lakhs in 2024.

Investing in this fund requires a minimum lump sum of Rs. 100 and a minimum monthly SIP of Rs. 100.

ICICI prudential bluechip fund comprises 4 plans:

- Direct Growth Plan (We speak about this plan in this article)

- Regular Growth

- Direct – IDCW (Dividend Plan)

- Regular – IDCW (Dividend Plan)

As a reader, you will find all the details about this fund that you need to know before investing.

ICICI Prudential Fund Direct Growth NAV:

The current NAV of ICICI Prudential Fund Direct Growth is 101.34 (as of February 2024).

The NAV of other plans of the same fund are,

- Regular Growth – 93.05

- IDCW – Regular Plan – 29.71

- IDCW – Direct Plan – 55.86

During the NFO period, all plans under the ICICI Blue Chip fund had an NAV of Rs. 10.

The Direct Growth plan has provided better returns and performance than the fund’s other plans. Choosing a direct fund is one of the best options if you can manage the risk appetite of the fund.

Regular plans are best if you need a professional to manage your fund.

ICICI Prudential Bluechip Fund Direct Growth Performance:

ICICI Prudential Bluechip Fund is an open-ended scheme that invests in large-cap companies (Top 100 companies in the Indian share market per share of market capital).

This fund’s objective was to outperform the benchmark (Nifty 100 TRI) with comparatively low risk.

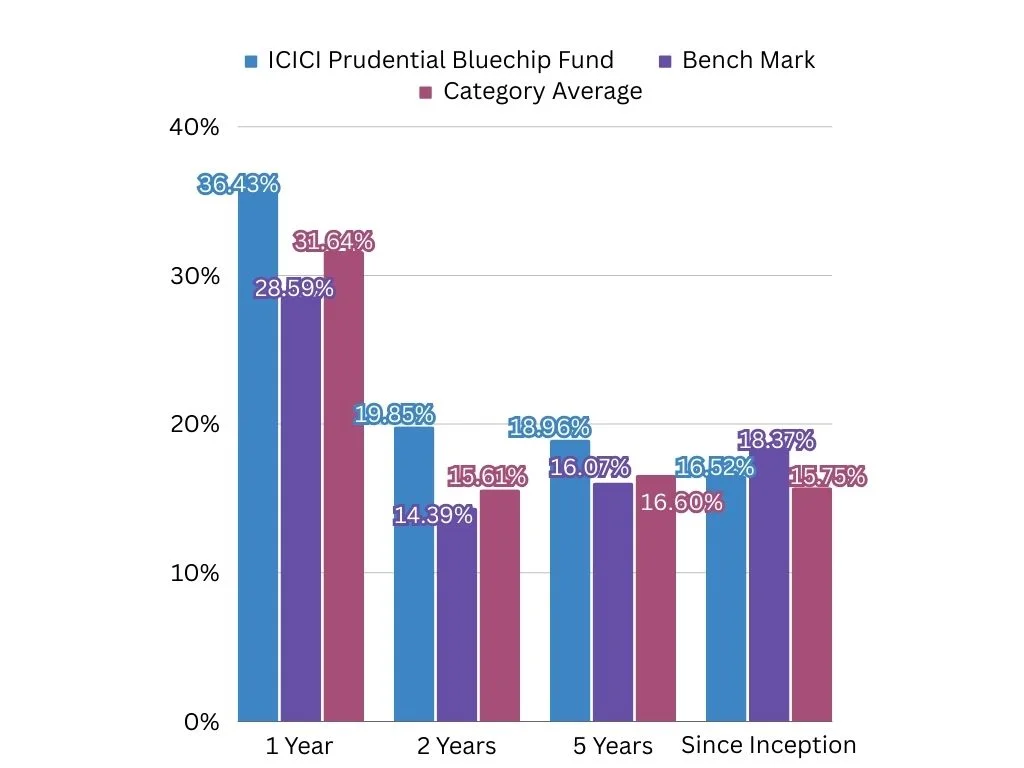

The fund has performed at a CAGR of 16.52% per annum since inception vs 18.37% to Nifty 100 TRI (benchmark). The category average has performed at a CAGR of 15.75%.

In the last 2 and 5 years of performance, the ICICI Bluechip Fund has outperformed its category average in all the available plan structures.

The performance of Nifty 100 TRI has over-performed the fund when analyzed since its inception

Even the fund has grown 66.7% higher than the Nifty 50 index and 40% compared to the Nifty 100 since its inception (January 2013).

Here is a quick snapshot of the fund’s performance compared with the benchmark and category average.

This fund is recommended for long-term outperformance if you want to outperform the category average or benchmark over the medium or long term.

The 2 years performance of the fund is 5.46% higher than the benchmark and 4.24% higher than the category average.

In 5 years of performance, the ICICI prudential bluechip fund direct growth plan has performed 2.89% higher than the benchmark and 2.36% higher than the category average.

In the last 11 years, the fund has performed 1.85% lower than the benchmark and 0.77% higher than the category average.

The same fund has outperformed the benchmark and category for the last 1 year.

Once again, the performance calibration proves that this fund should be invested if your goal is mid or long-term to outperform the category average or benchmark.

Fundamental Analysis Ratios:

P/B – 3.25

P/E – 21.23

ICICI Bluechip Fund Portfolio:

The portfolio of this scheme includes equity (92.66%), debt (0.45%), and others (6.89%).

Equity Holdings (92.6% of the total portfolio):

This fund holds 70 stocks, which are divided as follows

- Large Cap Investments – 83.44%

- Mid Cap Investments – 4.39%

- Small Cap Investments – 0.41%

- Others – 4.41%

Debt Holdings (0.45% of the total portfolio):

- Treasury Bills – 0.45%

Check out our article comparing the Equity vs Debt Mutual Fund

Fund Portfolio across Industries:

- Financial – 22.9%

- Technology – 10.3%

- Energy – 15.7%

- Construction – 15.0%

- Automobile – 11.1%

- Healthcare – 5.8%

- Consumer Staples – 5.3%

- Others – 14.0%

Top 20 Holdings:

- ICICI Bank Ltd – 8.43%

- Reliance Industries Ltd – 7.54%

- Larsen & Toubro Ltd. – 7.19%

- Infosys Ltd – 5.54%

- Axis Bank Ltd – 4.69%

- Ultratech Cement Ltd – 4.52%

- Maruti Suzuki India Ltd – 4.15%

- Bharti Airtel Ltd. – 3.74%

- HDFC Bank Ltd – 3.46%

- Sun Pharmaceutical Industries Ltd – 2.03%

- NTPC Ltd – 2.02%

- Hero MotoCorp Ltd – 1.86%

- ITC Limited – 1.81%

- Tech Mahindra Ltd – 1.72%

- HCL Technologies Limited – 1.66%

- Kotak Mahindra Bank Ltd – 1.47%

- Lupin – 1.39%

- SBI Life Insurance Company Ltd – 1.38%

- Hindalco Industries Ltd – 1.36%

- Bharat Petroleum Corp Ltd – 1.28%

33.4% of this scheme’s portfolio is made up of its Top 5 securities, and 65.85% is made up of its Top 20 securities.

Risk Ratios of ICICI Bluechip Fund:

Before investing in a mutual fund, it’s essential to analyze its risk ratio.

For predicting the volatility and risk of returns, we calculate a standard deviation, an alpha, a beta, and a Sharpe ratio.

Below are the details of the fund’s three-year risk factors compared to the category average over this period.

- Standard Deviation – 13.21 vs. 13.92

- Alpha – 4.22 vs (-) 0.26

- Beta – 0.9 vs 0.94

- Sharpe Ratio – 1.07 vs 0.75

The fund has low risk compared to the category average.

Compared to the category average, it also provides a better risk-adjusted return.

ICICI Bluechip Fund Direct Growth Expense Ratio:

Any mutual fund scheme’s expense ratio plays a crucial role and impacts its performance.

The expense ratio or TER of ICICI prudential blue chip fund direct growth is 0.93%.

The TER of the category average is 1.00%. This is one of the reasons the fund has performed better than the category average and benchmark in the long term (5+ years).

These are the expense ratio details for the same fund with different plans,

- Regular – Growth – 1.53%

- Regular – IDCW – 1.53%

- Direct – IDCW – 0.93%

This scheme’s direct growth plan is the best choice.

ICICI Prudential Bluechip Fund Managers:

The fund manager’s history is essential information for every mutual fund investor.

Three managers manage this fund. Anish Tawakley, Vaibhav Dusad, and Sharmila D’mello.

Anish Tawakley has been managing the fund since September 2018. He has about 24+ years of experience in the capital market.

Before joining ICICI AMC, he worked as an Equity Research and Credit Suisse India as an Equity research analyst at Barclays India. Apart from this fund, he manages nine more schemes at ICICI AMC.

Vaibhav Dusad has been managing the fund since January 2021. He is an Equity Research Analyst with over 11+ years of experience in the financial market.

Before joining ICICI AMC, he worked at Morgan Stanley, HSBC Global Banking and Markets, CRISIL, Zinnov Management Consulting, and Citibank Singapore. Apart from this fund, he manages six more schemes at ICICI AMC.

Sharmila D’mello has been managing the fund since July 2022. She joined ICICI Prudential AMC Limited in September 2016. Apart from this fund, he manages 42 more schemes at ICICI AMC.

Conclusion:

- The fund has consistently outperformed its benchmark and category average since inception.

- The expense ratio of this fund is less than the category average.

- This fund is one of India’s top picks in large-cap mutual funds.

- The ICICI Blue Chip Fund is designed for investors with long-term goals.

- Portfolios are well diversified within 70 equity securities and a few cash components.

- Hold low risk compared to the category average.

- The fund manager has an impressive track record.