Table of Contents

ToggleWhat is a Large Cap Mutual Fund?

Large Cap Mutual Funds are Equity Mutual funds that invest in Large Cap Stocks (companies) and other securities like bonds, fixed-income assets, etc. Large Cap companies are categorized as India’s leading 100 companies as per Market Capitalization.

On average, these 100 companies will have a stable business, revenue, profit, and market capital of more than 20,000 crores. So, these Large-cap companies provide a consistent share price (capital gain) return.

Many investors tend to choose Large-cap stocks over mid or small-cap companies. At the same time, indices like SENSEX, Nifty 50, Nifty Next 50, Nifty 100 hold these top 100 stocks. It provides a 12–16% nominal return, depending on the performance. Still, if you invest in Large Cap Mutual funds, then you should at least (minimum) hold your investments for 5 years.

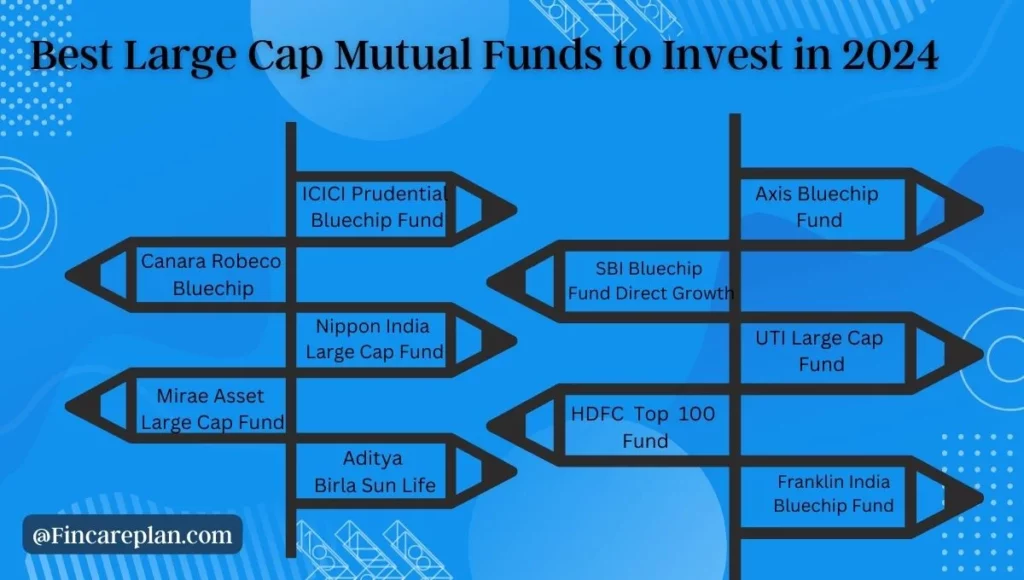

Here is the complete listing of the 10 best Large Cap Mutual Funds in India in 2024. We draft this list by posting multiple analyses on the following parameters:

- AUM (Asset Under Management)

- 5 Years Performance.

- Performance since Inception

- Volatility against Index

- Expense Ratio

- Percentage of equity holdings.

What are the Best Large Cap Mutual Funds in India in 2024?

1. ICICI Prudential Bluechip Fund Direct Plan Growth

The ICICI Prudential Bluechip Fund Direct Growth is one of India’s best large-cap mutual funds to invest in 2024, as the fund has completed 10 years. The fund was started in January 2013, and since its inception, it has yielded a CAGR of 16.44%. The benchmark index for the fund is S&P BSE 100 India TRI

Here are the Stats, and why we ranked them as the best large-cap mutual funds to invest in 2024

- AUM (Asset Under Management – Rs. 47928.62 Crores

- Expense Ratio – 0.92%

- 5 Years Performance – 18.98%

- Percentage Since Inception – 16.44%

- Percentage of Equity Holding – 95.50%

- Risk vs Category – Low Risk

ICICI Bluechip Fund Direct Growth is managed by multiple fund managers Anish Tawakley (since Sep 2018), Vaibhav Dusad (since Jan 2021), and Sharmila D’mello (since July 2022). This fund has an asset allocation of Equity (95.5%), Debt (0.5%), and Cash (4.1%).

The equity portfolio consists of various sectors like Financial (22.9%), Technology (10.3%), Energy (15.7%), Construction (15.0%), Automobile (11.1%), Healthcare (5.8%), Consumer Staples (5.3%), Others (14.0%).

Here is the Risk Ratio of the Fund:

- Standard Deviation – 12.08 vs 13.66 (Index)

- Sharpe Ratio – 1.37 vs 1.13 (Index)

- Alpha – 4.65 vs 14.81 (Index)

- Beta – 0.88 vs 0.44(Index)

- R2 – 93.87 vs 21.65 (Index)

Other Details of the Fund:

Check out our article for a better understanding of the Risk ratios of a mutual fund.

- P/E – 21.23

- P/B – 3.25

- Top 5 Equities hold 33% of AUM

- Top 20 Equities hold 67% of AUM

- Exit Load – 1 %if redeemed within 1 year

- Stamp Duty – 0.005%

- Minimum SIP (Systematic Investment Plan) – Rs. 100 per month

Check out our article comparing the Axis Bluechip fund and ICICI Bluechip fund.

- 5 Years Performance is higher than the category average.

- 15.65% returns since Inception

- The expense ratio is 0.92%, which is relatively Low Risk compared to the category.

- Last 1 Year returns were low compared to the category average.

2. Canara Robeco Bluechip Equity Fund – Direct Plan – Growth

Canara Robeco Bluechip Equity Fund Direct-Growth is one of the top pick funds in India to invest in 2024, as the fund has completed 10 years in the market. The fund was started in January 2013, and since its inception, it has yielded a CAGR of 15.36%. The benchmark index for the fund is S&P BSE 100 India TRI

Here are the Stats, and why we ranked them as the best large-cap mutual funds to invest in 2024

- AUM (Asset Under Management – Rs. 11639.09 Crores

- Expense Ratio – 0.51%

- 5 Years Performance – 18.54%

- Percentage Since Inception – 15.36%

- Percentage of Equity Holding – 95.70%

- Risk vs Category – Low Risk

Canara Robeco Bluechip Equity Fund Direct Growth is managed by highly experienced fund managers Vishal Mishra (Since Jun 2021), and Shri Datta Bhandwaldar (Since July 2016). This fund has an asset allocation of Equity (95.7%), and Cash (4.3%).

The equity portfolio consists of various sectors like Financial (31.8%), Technology (11.6%), Energy (9.2%), Construction (8.2%), Healthcare (6.5%), Automobiles (7.8%), and Others (16.7%).

Here is the Risk Ratio of the Fund:

- Standard Deviation – 12.04 vs 13.66 (Index)

- Sharpe Ratio – 1.03 vs 1.13 (Index)

- Alpha – 0.32 vs 14.81 (Index)

- Beta – 0.89 vs 0.44 (Index)

- R2 – 96.55 vs 21.65 (Index)

Other Details of the Fund:

- P/E – 24.37

- P/B – 3.93

- Top 5 Equities hold 33% of AUM

- Top 20 Equities hold 24.37% of AUM

- Exit Load – 1% if redeemed within 1 year

- Stamp Duty – 0.005%

- Minimum SIP (Systematic Investment Plan) – Rs. 100 per month.

- 5 Years Performance is higher than the category average.

- 15.36% returns since Inception

- The expense ratio is 0.51%, which is relatively Low risk compared to the Category

- Last 1 Year returns were low compared to the category average.

3. Nippon India Large Cap Fund – Direct Plan – Growth

Nippon India Large Cap Fund Direct-Growth is one of the top pick funds in India to invest in 2024, as the fund completed 10 years in the market. The fund was started in January 2013, and since its inception, it has yielded a CAGR of 16.78%. The benchmark index for the fund is S&P BSE 100 India TRI

Here are the Stats, and why we ranked them as the best large cap mutual funds to invest in 2024

- AUM (Asset Under Management – Rs. 20217.64 Crores

- Expense Ratio – 0.82%

- 5 Years Performance – 18.72%

- Percentage Since Inception – 16.78%

- Percentage of Equity Holding – 98.40%

- Risk vs Category – Moderately High Risk

Nippon India Large Cap Fund Direct Growth is managed by highly experienced fund managers Sailesh Raj Bhan Jain (since Jan 2013), Ashutosh Bhargava (since Sep 2021), and Akshay Sharma (since Dec 2022). This fund has an asset allocation of Equity (98.9%) and Cash (1.6%).

The equity portfolio consists of various sectors like Financial (35.5%), Technology (6.3%), Energy (13.9%), Services (11.1%), Automobiles (5.3%), Construction (5.3%), Consumer Staples (9.6%), Others (13.0%).

Here is the Risk Ratio of the Fund:

- Standard Deviation – 13.99 vs 13.66 (Index)

- Sharpe Ratio – 1.42 vs 1.13 (Index)

- Alpha – 6.15 vs 14.81 (Index)

- Beta – 1.01 vs 0.44 (Index)

- R2 – 92.54 vs 21.65 (Index)

Other Details of the Fund:

- P/E – 22.70

- P/B – 3.44

- Top 5 Equities hold 33% of AUM

- Top 20 Equities hold 73% of AUM

- Exit Load – 1% if redeemed within 7 days

- Stamp Duty – 0.005%

- Minimum SIP (Systematic Investment Plan) – Rs. 100 per month.

- 5 Years Performance is higher than the category average.

- 16.78% returns since Inception

- The same fund manager has managed the fund since its inception.

- Last 1 Year returns were low compared to the category average.

- Moderately High Risk Compared to Category

- The expense ratio is 0.82%, which is Moderately High Risk compared to the Category

4. Mirae Asset Large Cap Fund Direct Plan Growth

Mirae Asset Large Cap Fund Direct Growth is another top pick as the best large cap mutual fund, as the fund has completed 10 years. The fund was started in January 2013, and since its inception, it has yielded a CAGR of 16.79%. The benchmark index for the fund is S&P BSE 100 India TR

Here are the Stats, and why we ranked them as the best large cap mutual funds to invest in 2024

- AUM (Asset Under Management – Rs. 37969.17 Crores

- Expense Ratio – 0.54%

- 5 Years Performance – 15.58%

- Percentage Since Inception – 16.79%

- Percentage of Equity Holding – 96.50%

- Risk vs Category – Low Risk

Mirae Asset Large Cap Fund Direct Growth is managed by the most experienced fund managers, Gaurav Misra (since Jan 2019) and Gaurav Khandelwal (since Oct 2021). This fund has an asset allocation of Equity (96.5%) and Cash (3.5%).

The equity portfolio consists of various sectors like Financial (34.9%), Technology (12.6%), Energy (9.2%), Construction (6.8%), Automobiles (6.4%), Consumer Staples (6.6%), Others (23.6%).

Here is the Risk Ratio of the Fund:https://fincareplan.com/uti-large-cap-fund-direct-growth-review/

- Standard Deviation – 12.08 vs 13.66 (Index)

- Sharpe Ratio – 0.96 vs 1.13 (Index)

- Alpha – (-)0.51 vs 14.81 (Index)

- Beta – 0.89 vs 0.44 (Index)

- R2 – 96.18 vs 21.65 (Index)

Other Details of the Fund:

- P/E – 24.51

- P/B – 3.61

- Top 5 Equities hold 39% of AUM

- Top 20 Equities hold 73% of AUM

- Exit Load – 1% if redeemed within 1 year

- Stamp Duty – 0.005%

- Minimum SIP (Systematic Investment Plan) – Rs. 500 per month

- 5 Years Performance is higher than the category average.

- 16.79% returns since Inception

- Expense Ratio is 0.54%, which is relatively low

- Low Risk compared to Category

- Last 1 Year returns were low compared to the category average.

- Alpha is Negative

5. Aditya Birla Sun Life Frontline Equity Fund – Direct Plan – Growth

Aditya Birla Sun Life Frontline Equity Fund Direct-Growth is one of the top pick funds in India to invest in 2024, as the fund has completed 10 years in the market. The fund was started in January 2013, and since its inception, it has yielded a CAGR of 15.14%. The benchmark index for the fund is S&P BSE 100 India TRI

Here are the Stats, and why we ranked them as the best large cap mutual funds to invest in 2024

- AUM (Asset Under Management – Rs. 25898.36 Crores

- Expense Ratio – 1.01%

- 5 Years Performance – 16.33%

- Percentage Since Inception – 15.14%

- Percentage of Equity Holding – 98.60%

- Risk vs Category – Moderately Low Risk

Aditya Birla Frontline Equity Fund Direct Growth is managed by highly experienced fund managers Mahesh Patil (Since Jan 2013) and Dhaval Joshi (Since Nov 2022). This fund has an asset allocation of Equity (98.6%), Cash (1.1%), and Debt (0.40%).

The equity portfolio consists of various sectors like Financial (32.3%), Technology (9.5%), Energy (9.0%), Construction (10.1%), Healthcare (5.5%), Consumer Staples (7.7%), and Others (17.5%).

Here is the Risk Ratio of the Fund:

- Standard Deviation – 12.52 vs 13.66 (Index)

- Sharpe Ratio – 1.08 vs 1.13 (Index)

- Alpha – 1.02 vs 14.81 (Index)

- Beta – 0.93 vs 0.44 (Index)

- R2 – 97.09 vs 21.65 (Index)

Other Details of the Fund:

- P/E – 23.14

- P/B – 3.54

- Top 5 Equities hold 34% of AUM

- Top 20 Equities hold 68% of AUM

- Exit Load – 1% if redeemed within 90 days

- Stamp Duty – 0.005%

- Minimum SIP (Systematic Investment Plan) – Rs. 100 per month.

- 5 Years Performance is higher than the category average.

- 15.14% returns since Inception

- The expense ratio is 1.01%, which is relatively low

- Moderately Low Risk compared to Category

- The same fund manager has managed the fund since its inception.

- Last 1 Year returns were low compared to the category average.

6. Axis Bluechip Fund – Direct Plan – Growth

Axis Bluechip Fund is one of the top picks from our analysis, as the fund has completed 10 years. The fund was started in January 2013, and since its inception, it has yielded a CAGR of 15.14%. The benchmark index for the fund is S&P BSE 100 India TRI

Here are the Stats, and why we ranked them as the best large cap mutual funds to invest in 2024

- AUM (Asset Under Management – Rs. 33171.04 Crores

- Expense Ratio – 0.66%

- 5 Years Performance – 14.74%

- Percentage Since Inception – 15.14%

- Percentage of Equity Holding – 98.10%

- Risk vs Category – Moderately Low Risk

Axis Bluechip Fund Direct plan growth is managed by the most experienced fund managers Shreyash Devalkar (since Nov 2016), Vinayak Jayanath (since Jan 2023), and Ashish Naik (since Aug 2023). This fund has an asset allocation of Equity (98.1%), Debt (2.2%), and Cash (-0.3%).

The equity portfolio consists of various sectors like Financial (33.3%), Technology (10.4%), Services (11.2%), Energy (6.3%), Construction (10.2%), Automobiles (10.3%), Consumer Staples (5.0%), and Others (13.2%).

Here is the Risk Ratio of the Fund:

- Standard Deviation – 13.16 vs 13.66 (Index)

- Sharpe Ratio – 0.62 vs 1.13 (Index)

- Alpha – (-)4.63 vs 14.81 (Index)

- Beta – 0.95 vs 0.44 (Index)

- R2 – 91.59 vs 21.65 (Index)

Other Details of the Fund:

- P/E – 29.19

- P/B – 4.66

- Top 5 Equities hold 36% of AUM

- Top 20 Equities hold 81% of AUM

- Exit Load – 1 %if redeemed within 1 year

- Stamp Duty – 0.005%

- Minimum SIP (Systematic Investment Plan) – Rs. 100 per month

- 5 Years Performance is higher than the category average

- 15.14% returns since Inception

- The expense ratio is 0.66%, which is relatively low

- Moderately Low risk compared to the category.

- Last 1 Year returns were low compared to the category average

- Alpha is Negative.

7. SBI Bluechip Fund Direct Growth

SBI Bluechip Fund Direct growth is one of the top picks from our analysis, as the fund has completed 10 years in the market. The fund was started in January 2013, and since its inception, it has yielded a CAGR of 15.70%. The benchmark index for the fund is S&P BSE 100 India TRI

Here are the Stats, and why we ranked them as the best large cap mutual funds to invest in 2024

- AUM (Asset Under Management – Rs. 43487.36 Crores

- Expense Ratio – 0.86%

- 5 Years Performance – 16.88%

- Percentage Since Inception – 15.70%

- Percentage of Equity Holding – 95.90%

- Risk vs Category – Moderately Low Risk

SBI Bluechip Fund Direct Growth is managed by the most experienced fund managers, Sohini Andani (since Jan 2013), Mohit Jain (since Nov 2017), and Pradeep Kesavan (since Dec 2023). This fund has an asset allocation of Equity (95.9%), Cash (3.9%), and Debt (0.1%).

The equity portfolio consists of various sectors like Financial (29.1%), Construction (12.3%), Automobiles (14.2%), Healthcare (7.3%), Consumer Staples (10.7%) and Others (26.4%).

Here is the Risk Ratio of the Fund:

- Standard Deviation – 12.59 vs 13.66 (Index)

- Sharpe Ratio – 1.02 vs 1.13 (Index)

- Alpha – 0.36 vs 14.81 (Index)

- Beta – 0.92 vs 0.44 (Index)

- R2 – 94.67 vs 21.65 (Index)

Other Details of the Fund:

- P/E – 27.83

- P/B – 4.42

- Top 5 Equities hold 33% of AUM

- Top 20 Equities hold 69% of AUM

- Exit Load – 1 %if redeemed within 1 year

- Stamp Duty – 0.005%

- Minimum SIP (Systematic Investment Plan) – Rs. 500 per month

- 5 Years Performance is higher than the category average.

- 15.70% returns since Inception

- Expense Ratio is 0.86%, which is relatively low.

- Moderately Low Risk compared to Category

- Last 1 Year returns were low compared to the category average.

8. UTI Large Cap Fund – Direct Plan – Growth

UTI Large Cap Fund (Formerly UTI Mastershare Unit Scheme) is one of the top-picked funds in India to invest in 2024, as the fund has completed 10 years in the market. The fund was started in January 2013, and since its inception, it has yielded a CAGR of 14.25%. The benchmark index for the fund is S&P BSE 100 India TRI

Here are the Stats, and why we ranked them as the best large cap mutual funds to invest in 2024

- AUM (Asset Under Management – Rs. 12230.07 Crores

- Expense Ratio – 0.81%

- 5 Years Performance – 16.08%

- Percentage Since Inception – 14.25%

- Percentage of Equity Holding – 99%

- Risk vs Category – Moderately Low Risk

UTI Large Cap Fund Direct Growth is managed by a highly experienced fund manager, Karthikraj Lakshmanan (Since Sep 2022). This fund has an asset allocation of Equity (98.9 %), Cash (0.6%) and Debt (0.5%)

The equity portfolio consists of various sectors like Financial (28.6%), Technology (15.7%), Energy (7.9%), Automobiles (8.7%), Services (8.7%), Construction (5.5%), and Others (25.0%).

Here is the Risk Ratio of the Fund:

- Standard Deviation – 12.48 vs 13.66 (Index)

- Sharpe Ratio – 0.93 vs 1.13 (Index)

- Alpha – (-)0.78 vs 14.81 (Index)

- Beta – 0.91 vs 0.44 (Index)

- R2 – 94.70 vs 21.65 (Index)

Other Details of the Fund:

- P/E – 27.73

- P/B – 4.27

- Top 5 Equities hold 32% of AUM

- Top 20 Equities hold 71% of AUM

- Exit Load – 1% if redeemed within 1 year

- Stamp Duty – 0.005%

- Minimum SIP (Systematic Investment Plan) – Rs. 100 per month.

- 5 Years Performance is higher than the category average.

- 14.25% returns since Inception

- The Expense Ratio is 0.81%, which is relatively low.

- Moderately Low Risk compared to the Category

- The same fund manager has managed the fund since its inception.

- Last 1 Year returns were low compared to the category average.

- Alpha is Negative.

9. HDFC Top 100 Fund – Direct Plan – Growth

HDFC Top 100 Fund Direct-Growth is one of the top pick funds in India to invest in 2024, as the fund has completed 10 years in the market. The fund was started in January 2013, and since its inception, it has yielded a CAGR of 14.99%. The benchmark index for the fund is S&P BSE 100 India TRI

Here are the Stats, and why we ranked them as the best large cap mutual funds to invest in 2022

- AUM (Asset Under Management – Rs. 30261.72 Crores

- Expense Ratio – 1.08%

- 5 Years Performance – 17.27%

- Percentage Since Inception – 14.99%

- Percentage of Equity Holding – 98%

- Risk vs Category – Moderately High Risk

HDFC Top 100 Fund Direct Growth is managed by highly experienced fund managers Raghu Baijal (Since Jul 2022), Priya Ranjan (Since May 2021), and Dhruv Muchhal (since Jun 2023). This fund has an asset allocation of Equity (97.8%) and Cash (2.1%).

The equity portfolio consists of various sectors like Financial (35.3%), Energy (16.9%), Technology (9.9%), Healthcare (6.9%), Construction (6.5%), Consumer Staples (8.7%) and Others (15.9%).

Here is the Risk Ratio of the Fund:

- Standard Deviation – 13.91 vs 13.66 (Index)

- Sharpe Ratio – 1.27 vs 1.13 (Index)

- Alpha – 4.21 vs 14.81 (Index)

- Beta – 0.99 vs 0.44 (Index)

- R2 – 90.22 vs 21.65 (Index)

Other Details of the Fund:

- P/E – 18.95

- P/B – 3.08

- Top 5 Equities hold 36% of AUM

- Top 20 Equities hold 80% of AUM

- Exit Load – 1% if redeemed within 1 year

- Stamp Duty – 0.005%

- Minimum SIP (Systematic Investment Plan) – Rs. 100 per month.

- 5 Years Performance is higher than the category average.

- 14.99% returns since Inception

- The same fund manager has managed the fund since its inception.

- Last 1 Year returns were low compared to the category average.

- Moderately High Risk compared to Category

- The expense ratio is 1.08%, which is the second highest among the best Large Cap Mutual Funds.

10. Franklin India Bluechip Fund – Direct – Growth

Franklin India Bluechip Fund Direct-Growth is one of the top-picked funds in India to invest in 2024, as the fund has completed 10 years in the market. The fund was started in January 2013, and since its inception, it has yielded a CAGR of 13.13%. The benchmark index for the fund is S&P BSE 100 India TRI

Here are the Stats, and why we ranked them as the best large cap mutual funds to invest in 2022

- AUM (Asset Under Management – Rs. 7465.54 crore

- Expense Ratio – 1.12%

- 5 Years Performance – 15.11%

- Percentage Since Inception – 13.13%

- Percentage of Equity Holding – 97.70%

- Risk vs Category – Moderately Low Risk

Franklin India Bluechip Fund Direct-Growth is managed by highly experienced fund managers Anand Radhakrishnan (Since Jan 2013), Sandeep Manam (since Oct 2021), Venkatesh Sanjeev (since Oct 2021) and Ajay Argal (Dec 2023). This fund has an asset allocation of Equity (97.7%) and Cash (2.3%).

The equity portfolio consists of various sectors like Financial (36.0%), Technology (12.1%), Healthcare (7.0%), Automobiles (12.3%), Services (6.6%), Energy (7.4%), Consumer Staples (7.1%) and Others (11.5%).

Here is the Risk Ratio of the Fund:

- Standard Deviation – 13.02 vs 13.66 (Index)

- Sharpe Ratio – 0.90 vs 1.13 (Index)

- Alpha – (-)0.71 vs 14.81 (Index)

- Beta – 0.92 vs 0.44 (Index)

- R2 – 87.20 vs 21.65 (Index)

Other Details of the Fund:

- P/E – 22.59

- P/B – 3.36

- Top 5 Equities hold 34% of AUM

- Top 20 Equities hold 72% of AUM

- Exit Load – 1% if redeemed within 1 year

- Stamp Duty – 0.005%

- Minimum SIP (Systematic Investment Plan) – Rs. 500 per month.

- Moderately Low Risk compared to Category

- 13.13% returns since Inception

- The same fund manager has managed the Fund since its inception.

- Last 5 Years returns were low compared to the category average.

- The expense ratio is 1.12%, which is the highest among the best Large Cap Mutual Funds

- Alpha is in the negative.

Who Should Invest in Large Cap Mutual Funds?

The investments are made in top companies in India, which are stable and well-established. These companies produce a standard rate of return in terms of revenue, profit, and dividends to shareholders. So, investing in these companies produces a stable return for investors.

Large-cap mutual funds are suitable for investors who aspire to invest in the equity market with relatively low to moderate risk. As you have seen the 10 best large-cap mutual funds in India, the risk is between low to moderate in more than 50% of the funds.

At the same time, the average 10 years return as per CAGR is around 15%. Let us assume, that you invest Rs. 10,000 as SIP (systematic investment plan) in any of the above mutual funds. The return after 10 years will be 27.9 lakhs, and the wealth gain is 15.9 lakhs. This can’t be possible with fixed deposits or postal saving schemes.

The above 10 funds analysis would have made you understand, that even the worst performance, high-risk mutual funds have produced 12%-13% CAGR in the last 10 years.

The only thing, you should keep in mind is to be a stayed investor. Don’t care about market price fluctuations, or market news, and keep investing via SIP. If you can do this consistently with patients, large cap mutual funds should be a piece of your asset allocation.

Risk Involved in Large Cap Mutual Funds?

Even though the risk involved in large-cap funds is low to moderate, there is risk in the investments. Let’s brief in detail.

1. Equity Market Risk:

Stock markets are always prone to risk, fluctuation, bear, and Bull at any time. I mentioned Bull at last because, even after the market plunges to 30-50%, it rises more substantially like a bull to 100%.

2. Concentration Risk:

When a fund manager parks significant funds in a particular sector, you can make your investments at rest at any time. Few large cap mutual funds concentrate on one or two industries. When these two sectors plunge continuously, this risks the investors, and the fund may face a considerable sell-off.

3. Liquidity Risk:

There is no liquidity pressure in Mutual Funds, as you can redeem the funds as per your need. The amount will be transferred to your account within 2 working days.

When there is no buyer for the current market price for stocks in your portfolio, automatically, the price has to come down for liquidity. Every Mutual fund holds 1-5% of the total AUM as cash, and it was paid to you during redemption.

When more investors redeem, this cash holding will exhaust, and the fund manager has to sell the securities to pay you. This is why we suggest investing in mutual funds holding an AUM of more than 1000 crores.

4. Interest rate Risk:

Interest rates fluctuate depending on whether or not issuers have access to credit and whether or not there is demand in the market. Therefore, an increase in the interest rate may adversely affect the security’s price.

5. Credit Risk:

When the security issuer does not pay interest or return the principal at maturity, it creates a credit risk. As large cap funds hold some percentage of bonds or debt materials, this fund can be prone to credit risk.

Investing in large cap mutual funds: What should an investor consider?

1. Investment Objective:

Investment Goal is the primary focus of every large cap mutual fund while it launches and promotes. First, you should be clear on the benchmark index that your fund is competing. An investor must know the proportion of investment in securities and a portfolio of equities. This fundamental analysis provides you few lights on the expected performance of the fund.

2. History of the Fund:

One thing you should know is the history. When the fund opened, what is the performance to date from inception? Peeking at 1 year or 3 years performance is the not way to look at the history of the fund. Besides NFO, always check the funds that have completed 5 years in the market and yield more than the benchmark index.

3. Fund Manager’s Past Experience:

Fund Managers are the ones who are going to decide the performance of the fund you invest. So, it’s necessary to have a quick at the fund manager’s history.

What are the mutual funds they managed? How long are managing the current fund? What is the performance vs category of all the funds they managed?

These analyses will surely provide an exhibit of hope for them. It is an advantage if a fund manager is managing the fund you choose since inception.

4. Expense Ratio:

As per the above listing of best large cap mutual funds in India, you can find the funds with lower expense ratios have performed better. So, you have to choose the funds with low or moderately low expense ratios (especially when it comes to large cap funds)

5. AUM (Asset Under Management):

One of the important factors, that many investors forget to look at. When AUM is higher than 1000 Crores, the liquidity or NAV price risks come down. Be wise in picking the funds with higher AUM.

6. Direct or Regular Plan:

It has been seen from history that, Direct plan overperform Regular funds. From an investor’s standpoint, the major difference between direct and regular funds is the expense ratio. You will see, that the 10 best large cap mutual funds we have chosen are direct plans.

We have listed a few choosing factors, but you should know the complete checklists on how to choose a mutual fund in India.

Advantages of Large Cap Mutual Funds:

- The most significant advantage of investing in large cap funds is they provide a stable return.

- These companies have a solid track record in financial revenue flow and pay regular dividends to their shareholders.

- Large Cap Mutual Funds have low to moderate risk and are nullified if the investment is made for 15 to 20 years.

- Return on investment ranges between 13% to 16%, higher than fixed deposits, Life Insurance Endowment policies, and other saving schemes.

- Diversification of investment over the leading companies of India.

- High Liquidity is another advantage.

Disadvantages of Large Cap Mutual Funds:

- The returns are not as considerably high as other mutual funds (Mid Cap, Small Cap funds)

- Investments can be at risk if prior analyses are not done.

- We have only 10 years of data for the best large cap mutual funds in India.

- Decision on portfolio management is only with fund managers.

Conclusion:

In conclusion, investors should carefully consider important criteria including exit load, transaction fee, and cost ratio when thinking about the best large-cap mutual funds.

The transaction charge should be acceptable (between INR 100 and INR 150), the exit load should not be more than 1% of the total amount, and the appropriate expense ratio should be between INR 0.05% and INR 0.75%.

Investors can make informed selections and choose the best large cap mutual funds for their investing portfolio by paying attention to these factors.

Frequently Asked Questions about Best Large cap mutual funds:

Which Large Cap Mutual Fund is Best for 2024?

The Best Large Cap Mutual Funds in 2024 are ICICI Prudential Bluechip Fund, Canara Robeco Bluechip Equity Fund, Nippon India Large Cap Fund, Mirae Asset Large Cap Fund, and Aditya Birla Sun Life Frontline Equity Fund. All the above funds are direct plans. We have picked based on performance from inception, expense ratio, AUM, and risk compared to the benchmark.

Where do Large Cap Mutual Funds Invest?

Large-cap funds invest in the top 100 companies of India. The top 100 are chosen based on a market capitalization of more than 20,000 crores. As these companies are well-established and stable, the investment returns will also be durable.

Which Mutual Funds is Given the Highest Return?

From the list of the best large cap mutual funds, we picked the top 3 funds based on returns from inception. In this case, the mutual funds with the highest returns are the ICICI Prudential Bluechip Fund, Canara Robeco Bluechip Equity Fund, and Nippon India Large Cap Fund.

Are Large Cap Mutual Funds high risk?

On average, only a few funds among the picked large cap mutual funds are mapped under high risk. Major large-cap funds have risk meters ranging from low to moderate. Even, these risk meters can be nullified if you invest for the long term.

What Kind of Returns can I earn from Large Cap Funds?

The returns from Large Cap Funds are 2-3x times higher than the inflation of India. Here is the average return from the top 10 large cap mutual funds 16.82% (average) for the last 5 years and 15.37% (average) since inception.

Should I Invest in Large Cap Mutual Funds?

Yes, Large Cap funds should be a slice of your asset allocation. Investing in large-cap funds provides you with stable returns, with lower risk compared to other equity mutual funds. But, it is purely based on your investment goal and risk appetite.