Table of Contents

ToggleMany people question, what are the ways to invest in gold without any wastage of expenses. The government of India and the Reserve Bank of India (RBI) in collaboration had already released SOVEREIGN GOLD BOND in six series from April. Already 4 series issue’s date has expired and two more gold bond series are yet to be bought, which might be issued during August and September. There are four ways through which we can invest in gold. They are,

- Physical Gold or Ornaments.

- Gold Mutual Funds.

- Gold ETF.

- Sovereign Gold Bond (SGB).

Before going into the brief discussion on the above four ways, we have to understand that, more than gold as an investment, most people consider it as material that can be pledged in emergencies as currency. When it comes to gold as an investment, the main thing we should have in mind is,

- Faster Liquidity.

- Safety.

- Less or No Wastage and GST charges.

- Can we take a loan during an emergency?

Sovereign Gold Bond:

SGB was first introduced in the year 2015, with the first issuance of 9.14 lakh units of gold for Rs. 245 Crores. SGB is a proactive scheme provided by the Government of India through which our Government collects funds from people for the development of the nation, in return they provide us an interest rate of 2.5% per annum. The interest rate is paid out every 6 months.

SGB can be purchased online, with a Demat account, and a bank account. When SGB is purchased online, it has a discount of Rs. 50 per gram of gold.

SGB can be bought based on a minimum of 1 gram to 4 kg of gold.

Advantages Of Sovereign Gold Bond:

· It’s not physical gold, so the safety and expenses related to wastage and GST are NIL.

· Since, it has been provided by the Government of India with the collaboration of RBI, our capital and interest are safe

· It can be pledged to avail of a gold loan, at the time of emergency.

· Apart from 2.5% interest provided by the government annually, the price appreciation will also provide us benefits. The price appreciation is not in our hands and we can’t decide.

· The amount that you don’t require for the next 8 years can be invested in a gold bond. It will yield good returns when compared to physical gold or ornaments.

· The income tax on capital gain is exempted by Income Tax Act 43, 1961.

Disadvantages Of Sovereign Gold Bond:

· There is no chance of liquidity when it is required.

· Very frequently, we can’t determine the price of gold in favor of us, because the gold price appreciates once in 10 years. If already gold price is already at its peak, we can expect only appreciation to Rs. 5500 – 6000.

· Only after 5 years of holding, we be given a chance to sell the SGB, that too, in a secondary market; in which you will not get the desired amount that you need.

Gold ETF vs Gold Fund:

Gold ETF:

· It is the traded gold through the Demat account in the Commodity market.

· For every transaction (buy or sell), we have to pay broker commission which is decided by the T&C of your brokers.

· Liquidity is not as same as dealing with physical gold or gold funds, since there should be a buyer as you sell.

· There is tax associated with GOLD ETF when the interest earned is more than 1 lakhs.

Check out our article comparing the Gold BeES and Gold ETF.

Gold Fund:

· Gold fund is what we buy from mutual funds, managed by Asset management companies.

· There is an expense ratio associated with Gold Funds since it is professionally managed by the Fund manager and his technical team.

· There are no entry fees, but exit load is associated if the fund is redeemed within a year.

· Liquidity is very fast when compared to all types of gold investments.

· Taxation is the same as the Gold ETF.

When compared to all the four types of Investments in Gold, a Sovereign gold bond will be the most suitable one as it provides,

· Rs. 50 per discount while procuring online.

· Adding to the price appreciation of gold, the Government provides an additional 2.5% interest per annum.

The only disadvantage of SGB is liquidity and a long holding period of 8 years.

You can check the complete difference between Sovereign Gold Bond and Gold ETFs here.

Myths Of Gold Price – Learn From History:

While we were going through many promotional channels of Sovereign gold bond, we found that they have a target of the gold price to be at Rs. 8000 per gram, without knowing the performance of gold in history.

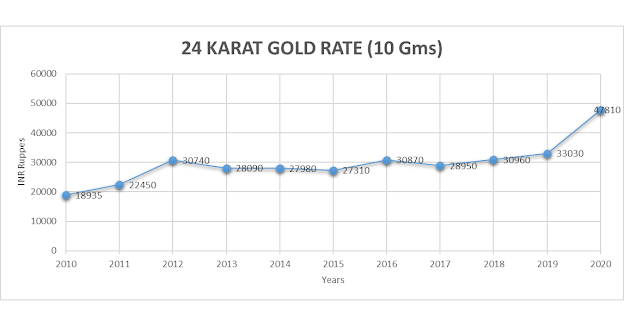

Please find the picture above, this picture has already been used in one of our topics “IS GOLD AN INVESTMENT”. Please have a look at that topic for more knowledge on gold as an investment.

· From here, we have understood that gold price increases only once in a decade.

· The growth accounts for more than 45-60% in a single year, after that, there will be a flat track record in the gold price for the next 6-8 years.

· Gold price is already in its high value and this price increase is due to corona pandemic and the market crash in March 2020.

· In the same way, after a market crash in 2008, the gold price had a 45% growth during 2010-2011.

· As we all know, Gold price is inversely proportional to market growth.

· We may expect another crash (maybe or not) if it happens the gold price may move towards 5500 – 6000. This will be the price range for the next 8 years.

· So, as per historical records, we may expect a 6-8% growth in gold price every year and add the government’s 2.5%. The return on SGB may yield 8.5-10% per annum.

· Don’t be trapped by non-analytical promotional channels promoting the gold rate to be Rs. 8000 in 8 years, as gold has already grown to its height.

Conclusion:

· When it comes to Gold as an investment, SGB will be the best investment way when compared to other investment ways.

· As there is no fast liquidity, you have to park the amount that you don’t require for the next 8 years.

· Be specific in investing by analyzing history and don’t be greedy in the return.

· Generally, we don’t promote gold as an investment, rather if it is an emergency fund.

· Sovereign Gold Bond is the only investment way for Gold. Even while discussing mutual funds, we say don’t invest in a single sectoral or thematic.

· Expect a return of 8.5-10% per annum which will be a good return for gold for the next 8 years.